Bitcoin (BTC) quickly surpassed $60,000 due to delayed US payroll data but then fell back. As of writing, stock markets are positive, DXY is weak, and gold is strong. However, BTC remains weak. Those who opened short positions at higher levels profited again. So, when will this easy profit end?

Why Bitcoin Rose and Fell

There was a meaningless drop because the rumors were justified, and US officials revised employment growth downward as expected. The Fed has two main tasks: price stability and maintaining employment at a certain level. The Fed must balance both tasks. However, due to the highest inflation in 40 years, the price stability task has become a priority.

Powell and his team continued to pressure the employment market, saying that lowering interest rates could cause inflation to rise again. Today’s result was a downward revision of the Non-Farm Payroll estimate announced for March. Employment was revised down by 818,000 (or 0.5%) as of March 2024.

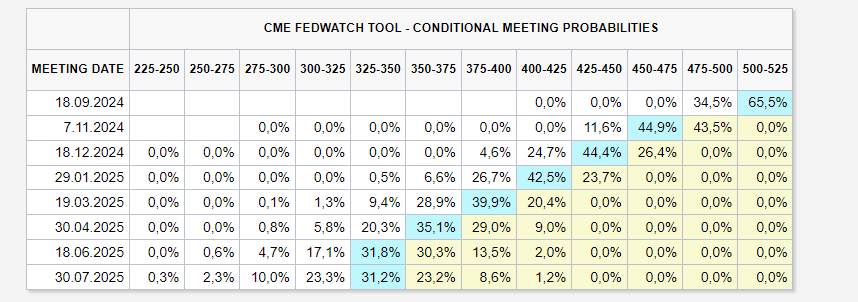

Despite this move, which means the Fed is pressured to cut interest rates, the BTC price drop is hard to fully explain. The market expects a 100bp rate cut this year. A 50bp cut is priced in for the November meeting. There are also expectations for two 25bp cuts.

QCP Analysts’ Market Commentary

Analysts also mentioned the rumors about the downward revision of payroll estimates and published their market evaluation before the data arrived. You can check the graph and the predictions below to see the success of the evaluation.

“Wall Street is abuzz with rumors that payroll growth will be revised down by at least 600,000. This would show that the US employment market was not as strong as the market expected last year.

The real question now is whether the Fed is behind the curve. The Fed delayed rate cuts due to a stronger-than-expected employment market and a robust economy.

We expect Powell to address this during the annual Jackson Hole event. However, since there is another month until the Fed’s September meeting, we believe Powell will not make a decision.

Banks have already started lowering Fixed Deposit rates based on expectations of a rate cut cycle. 12-month USD Fixed Deposits pay an annual interest of 3.5% – 4.0%. For the same term, you can lock in 9.5% annually in crypto cash and carry. This looks particularly attractive, especially if the Fed decides to enter a much more aggressive cut cycle.”

Türkçe

Türkçe Español

Español