The cryptocurrency market took a significant hit following U.S. President Donald Trump’s announcement of new tariff regulations. Bitcoin’s price plummeted to around 82,000 dollars, and although bulls attempted to maintain the 83,000-dollar threshold, their efforts were ultimately fruitless. Despite this abrupt decline, institutional interest in spot Bitcoin  $104,806 ETFs quickly rebounded, with a total of 220 million dollars entering these funds in just 24 hours.

$104,806 ETFs quickly rebounded, with a total of 220 million dollars entering these funds in just 24 hours.

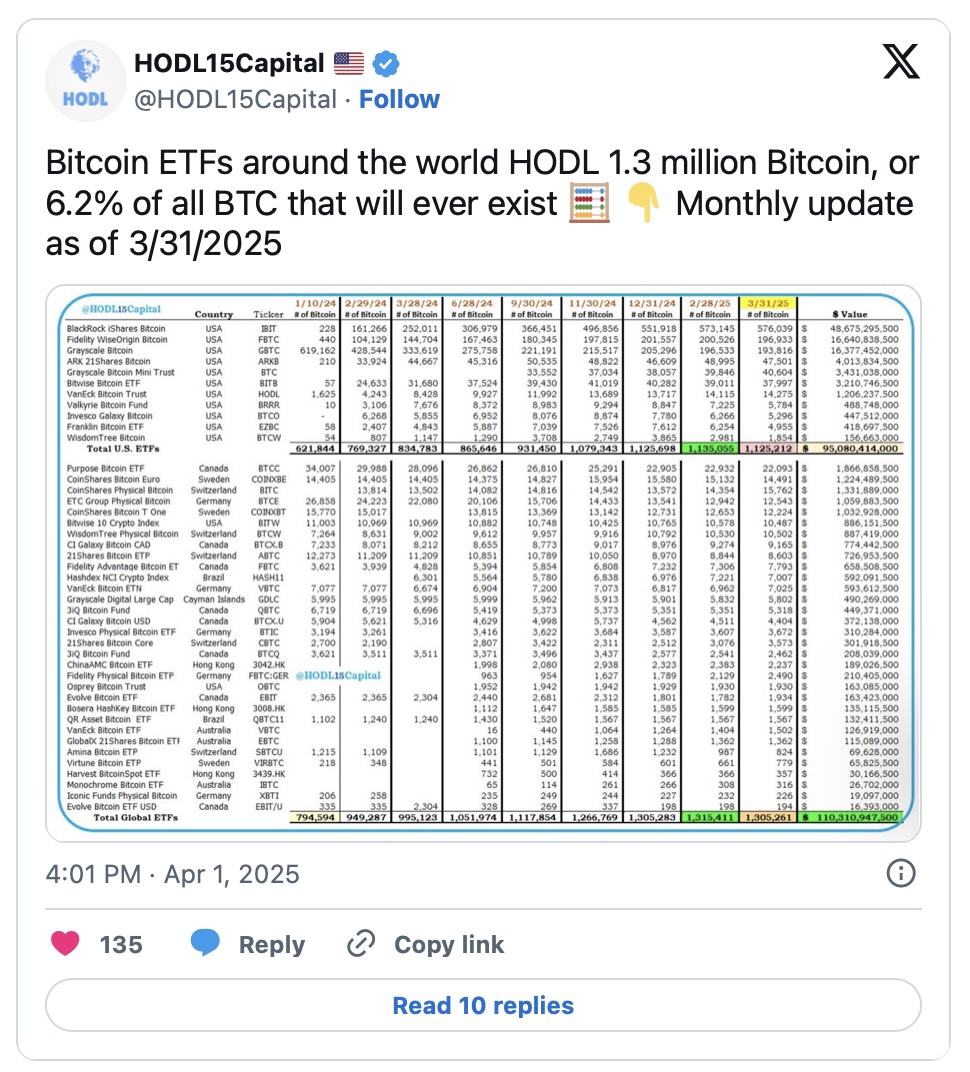

Strong Institutional Demand Returns for ETFs

Beginning the week on a weak note, ETFs swiftly recovered as of April 2. Fidelity’s FBTC product saw an influx of 119 million dollars, while Ark Invest’s ARK ETF gained 130 million dollars. However, BlackRock, one of the market’s largest players, experienced a 116 million dollar outflow from its IBIT product on the same day. Nonetheless, the overall picture indicates that large investors are viewing the price drop as a buying opportunity, disregarding short-term risks.

It’s clear that institutional interest is not limited to ETFs alone. The total amount of BTC held by publicly traded companies has reached 696,456 BTC. Just last week, eight different companies purchased a total of 26,303 BTC, demonstrating a sustained long-term belief in the leading cryptocurrency. Strategy and Japan-based Metaplanet are leading this acquisition trend.

Demand Remains Strong Despite Price Volatility

As Trump’s tariffs rattled the markets, Bitcoin’s price dropped from 88,000 dollars to 81,000 dollars. However, trading volume saw an impressive 85% increase, rising to 54 billion dollars. This suggests that investors are not entirely withdrawing from the market; rather, they are actively buying and selling. Currently, BTC is trading around 83,394 dollars, with a market capitalization of 1.65 trillion dollars.

Crypto analyst Ali Martinez highlighted the emergence of a critical trading range for Bitcoin. According to him, the range between 86,900 and 84,800 dollars is of great importance for short-term direction determination. Martinez noted that a break above or below this threshold could set the stage for the next major price movement. The buying activity from institutional investors strengthens the likelihood of an upward break.

Türkçe

Türkçe Español

Español