Data indicates that the sentiment towards Bitcoin has now reached levels of extreme greed that are even higher than the all-time high (ATH) prices of November 2021. The Fear and Greed Index represents the average sentiment in the cryptocurrency world on a scale ranging from zero to one hundred. The index takes into account these five factors to calculate the score: Volatility, market momentum, social media sentiment, market dominance, and Google Trends.

What Does the Data Mean for Bitcoin?

When the indicator shows a value below 47, it implies fear sentiment in the industry. On the other hand, a value above 53 indicates the presence of greed among investors. Naturally, the region between these two extremes points to a neutral mindset.

In addition to these three main emotions, there are two “extreme” sentiments called extreme fear and extreme greed. The former occurs at values below 25, while the latter happens at values above 75.

As seen above, the current value of the Bitcoin Fear and Greed Index is 90. This indicates that investors have a strong sentiment of extreme greed. This latest value represents a significant jump from the previous day’s sentiment, which was around 82. The sharp increase in the indicator follows the cryptocurrency’s price surpassing its all-time high during the latest rally.

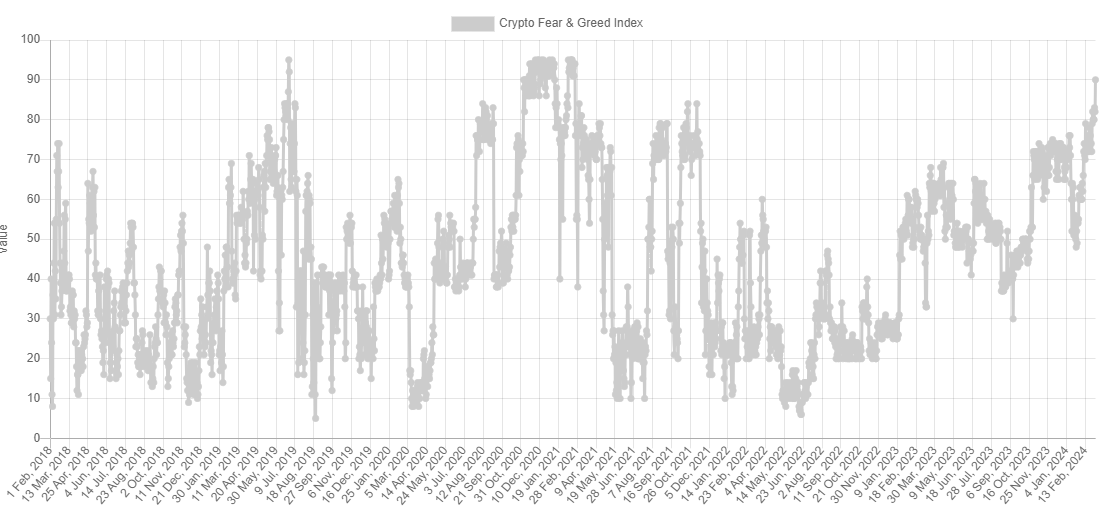

The current level of the Fear and Greed Index is high not only compared to the recent trend but also when considering historical data. The graph above shows how the value of the metric has fluctuated since its inception in 2018:

November 2021 Level Surpassed

As shown in the graph, the Bitcoin Fear and Greed Index is currently exceeding the level when prices reached their all-time high in November 2021 and is just below the values observed between the end of 2020 and the beginning of 2021.

Historically, Bitcoin tends to move contrary to the majority’s expectations. As the expectation leans more towards one side, the likelihood of such a reverse movement increases.

The peak of the 2019 rally and November 2021 are two examples where this pattern was in action. Therefore, the current extreme levels of the indicator could imply that the price is at risk of forming a peak at present.

Bitcoin reached $69,000 today but the BTC price subsequently fell below $65,000.