Bitcoin (BTC) price consistently traded in the $67,000 to $68,000 range for several days. What awaits the price of Bitcoin, the leading cryptocurrency, in the coming days? Let’s examine together. A decrease in volatility attributed to various factors in the cryptocurrency was observed.

BTC Activity Rate

The analyzed charts show Bitcoin’s activity rate and jump rate over time, along with its price in USD. The activity rate indicates how much Bitcoin is actively bought, sold, or moved by users, showing how frequently people use or transfer their BTC. Notable spikes and drops indicate periods of increased and decreased activity among Bitcoin holders. Significant volatility can be observed, especially during key price movements. There was an impressive drop in activity rate from 9% to -3%. This decrease in activity may indicate a trend towards long-term holding of Bitcoin.

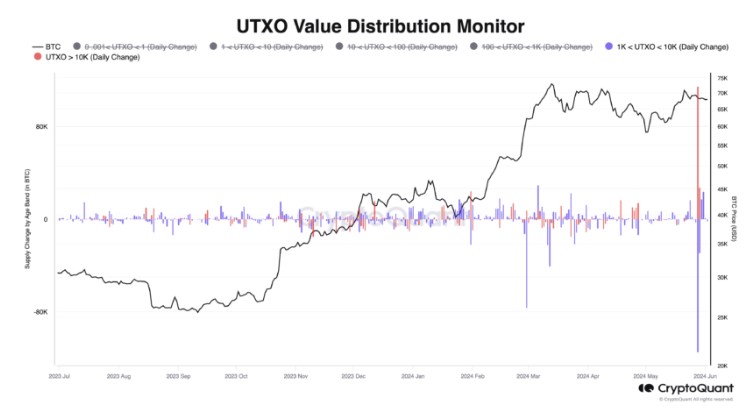

The vaulting rate shows how much Bitcoin is moved into long-term storage, keeping it secure for the future. Positive jump rates indicate that investors are moving more BTC into long-term storage. The chart shows periods of increased jump rates, potentially indicating holders’ confidence in the future value of the token. The UTXO (unspent transaction output) Value Distribution Monitor analyzes BTC transactions based on the value held in different wallets.

BTC Technical Data

UTXO stands for unspent transaction output. It refers to the amount of Bitcoin received after a transaction that can be used in future transactions. Essentially, UTXOs define where each blockchain transaction starts and ends. The UTXO value distribution monitor helps us understand the behavior of BTC holders, from small investors to large whales.

Positive changes mean more BTC remains within this value band. In summary, the price stability of Bitcoin in the $67,000 to $68,000 range and decreasing volatility indicate a maturing market. The drop in activity rate and increase in jump rate reflect growing confidence among large holders, indicating a shift towards long-term holding. The UTXO value distribution monitor supports this. While large investors accumulate BTC, middle-class investors are selling. These trends suggest a market where major players are optimistic about Bitcoin’s future and reinforce its long-term investment potential.

Türkçe

Türkçe Español

Español