Bitcoin (BTC), experienced a 13% drop in August, falling to $48,800 on August 5. Despite concerns about the Japanese yen carry trades and the US economy, market participants find hope in two key indicators based on Bitcoin options listed on the Deribit exchange.

Long-Term Option Curve Indicates Bullish Trend

Amberdata tracked data shows Bitcoin’s 180-day call-put curve remains above 3, indicating price strength. A call option gives the holder the right to buy the asset at a specific price in the future, indicating a bullish trend for the market. A put option represents a bearish trend. The option curve measures investors‘ willingness to pay for asymmetric bullish or bearish payouts. Positive values indicate stronger upward demand.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

This long-term bullish pricing aligns with some observers’ views that Bitcoin will recover after the initial shock of global market volatility dissipates. LondonCryptoClub founders stated, “The slowdown in the US economy is evident, and the Fed will have to cut rates more aggressively than anticipated. This will lead to a repricing of US Treasury yields and the dollar, which is very positive for Bitcoin. Additionally, with China increasing stimulus and liquidity injections, global liquidity conditions are expected to accelerate.”

CVD Indicates Bottom Buying in US Exchanges

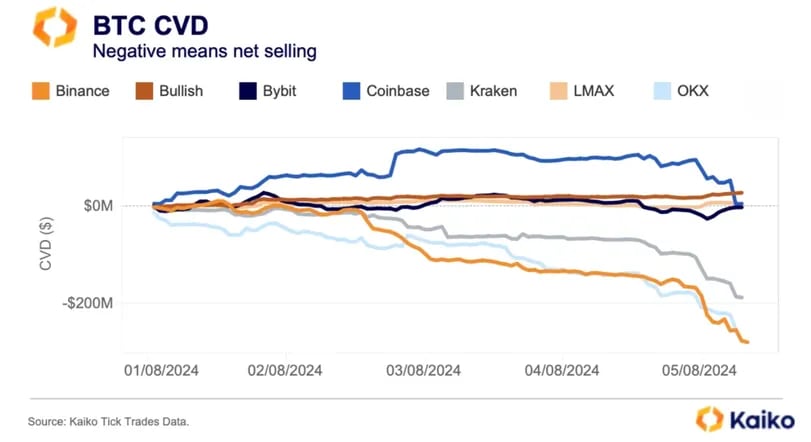

The rapid sell-off in the market was met with bottom buying on leading US crypto exchanges like Coinbase, Gemini, and Kraken. According to cumulative volume delta (CVD) data tracked by Paris-based Kaiko, net buying pressure on these exchanges has been positive since August 1.

CVD represents the total difference between transactions at the ask price (buy) and the bid price (sell) over a specific period. A positive and rising CVD indicates that buy volume exceeds sell volume, while a falling and negative CVD indicates the opposite.

Kaiko stated, “Interestingly, while strong sales were seen on overseas exchanges like Binance and OKX, the cumulative volume delta (CVD) of BTC remained positive on most US platforms, indicating that some investors were buying during the dip.”

Türkçe

Türkçe Español

Español