Bitcoin tends to show resilience in July after its poor performance in June. Last week, BTC experienced a modest 3% increase and closed June with a 7% decline, showing overall volatility. The price movement in the first half of the year was full of fluctuations, and the BTC/USD pair dropped below the $60,000 level twice.

Reasons Behind Bitcoin’s Fluctuations

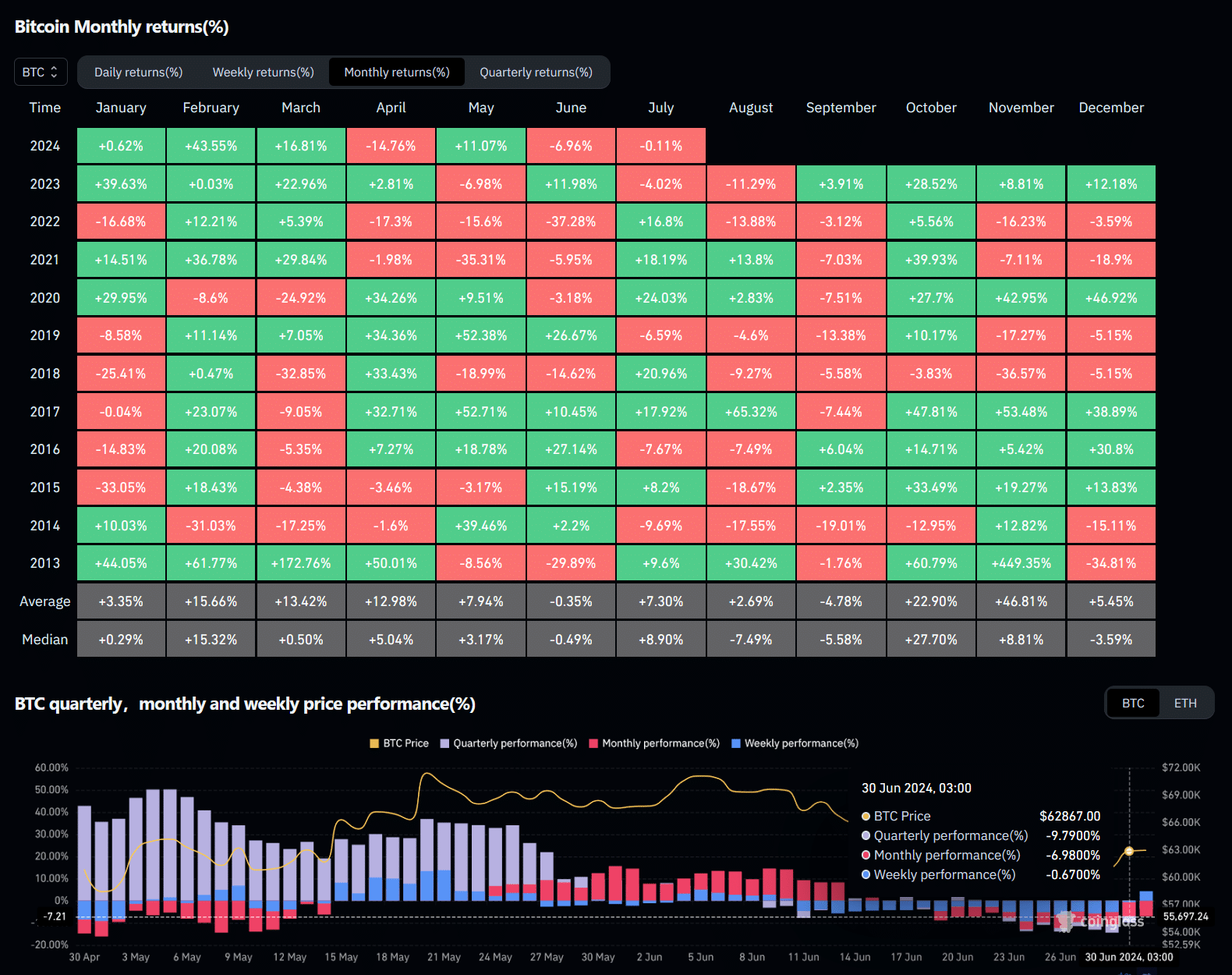

The market remains uneasy despite signs of potential improvement in the second half of the year. Historical data indicates that July generally marks a recovery month for Bitcoin, with an average return of 7.3% and a median return of 8.9%.

As the new month begins, the macroeconomic environment remains uncertain. This week, the release of US macroeconomic data and speeches by prominent figures like Fed Chairman Jerome Powell at the European Central Bank conference could affect Bitcoin’s price. Additionally, the release of the Fed’s previous meeting minutes and the June US employment report is expected to provide more information on the economic landscape.

Potential Interest Rate Cuts Will Be Positive for Bitcoin

Speculation continues about potential interest rate cuts by the US Federal Reserve that could affect Bitcoin’s price. The CME’s FedWatch tool shows that markets expect two 25 basis point rate cuts by the end of the year.

If these cuts occur, more investment in alternative assets like cryptocurrencies could be encouraged. However, the Bank of International Settlements (BIS) has warned against early easing of monetary policy, as it could reignite inflation and force a costly policy reversal.

The next Federal Open Market Committee (FOMC) meeting, scheduled for July 30-31, will be crucial for providing more clarity on the Fed’s policy direction. Market participants will closely watch for signals that could affect Bitcoin’s trajectory in the coming months.

What Are the Support Levels for BTC?

Bitcoin’s recent recovery to the $63,000 level is a positive sign, but concerns remain. BTC reached an intraday high of $63,700 on July 1 but continues to show weakness in the $58,500 to $72,000 range.

Investors need to pay attention to macroeconomic indicators and technical signals that could affect Bitcoin’s price in the short term. Upcoming economic data releases and the FOMC meeting will be important events to watch as they could further guide Bitcoin’s performance in the second half of the year.

Türkçe

Türkçe Español

Español