Bitcoin has been at the forefront of the financial world lately. BTC is preparing to take a significant step towards reclaiming its all-time high of $69,000. After a prolonged period of sideways movement, the leading cryptocurrency has signaled a recovery by exceeding $59,000 for the first time since December 2021. Currently, Bitcoin has risen to its intraday high of $59,487, marking a 4.27% increase.

Potential Selling Pressure on Bitcoin

It is important to note that Bitcoin is at a critical juncture in its recovery process. According to IntoTheBlock’s data, there are a total of 1.49 million significant addresses that have purchased approximately 433,000 Bitcoins at prices ranging from $56,961 to $67,413. This indicates that many Bitcoin holders are nearing a profit at the cryptocurrency’s current price, which could create potential selling pressure.

In the event of a potential correction in Bitcoin’s price, the next significant support level could be between $55,134 and $56,961. Within this price range, more than 991,000 addresses have purchased approximately 513,000 Bitcoin at an average price of $56,036.

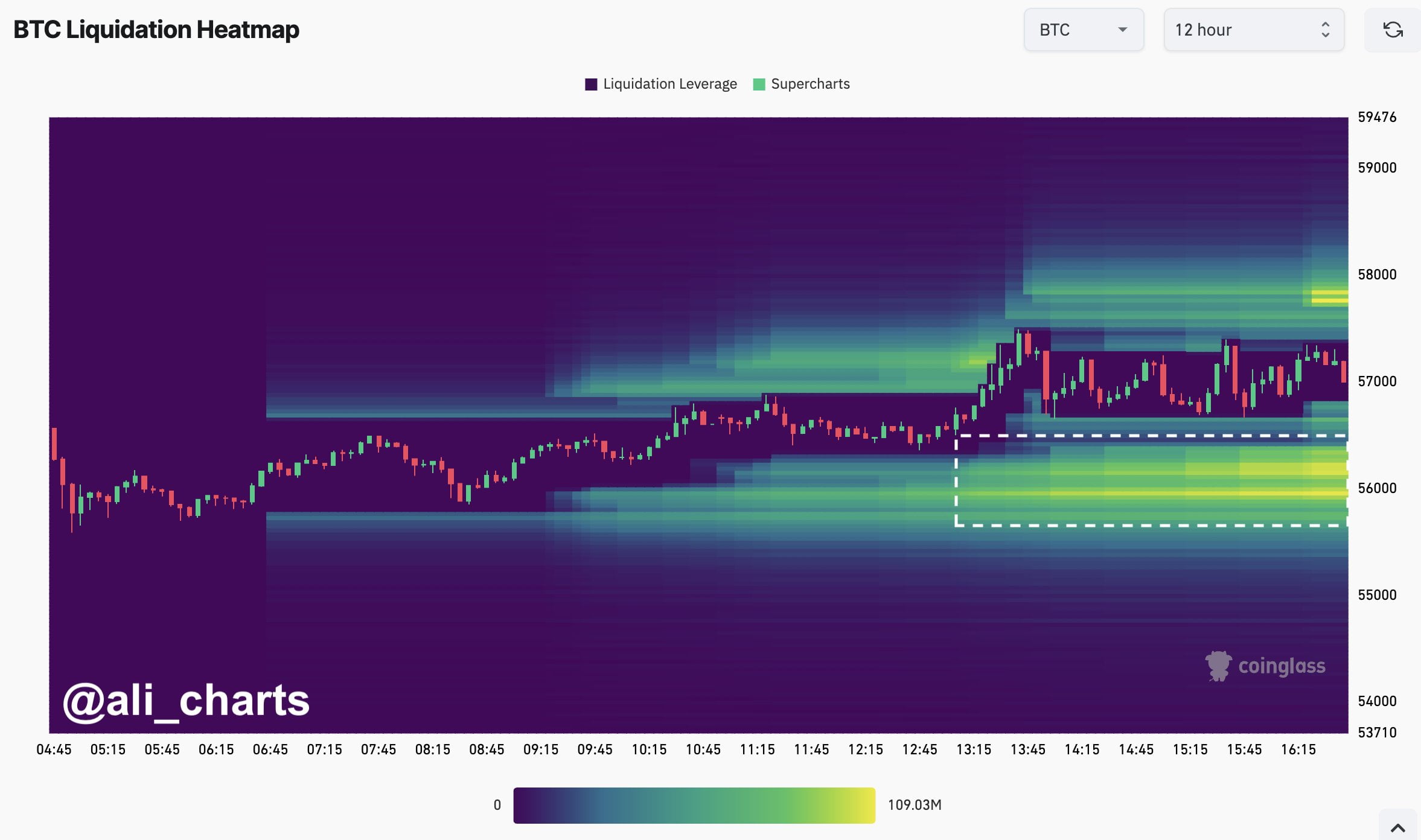

However, if Bitcoin fails to maintain the $56,000 level, there could be a significant risk of liquidation. Coinglass’s Bitcoin liquidation heat map indicates that approximately $300 million worth of long positions could be at risk of liquidation if Bitcoin drops to $55,900.

Bitcoin Still Below All-Time High Record

Bitcoin has shown significant resilience over the past year, adding $800 billion to its market value. Starting with an increase of approximately $320 billion in market value since January 1, 2023, Bitcoin has now reached a market cap of $1.13 trillion, solidifying its position as the world’s tenth-largest asset.

Nevertheless, Bitcoin is still below its all-time high and has a value less than 20% of its peak in November 2021. Investors remain optimistic about the future of Bitcoin, especially considering factors such as Exchange-Traded Funds (ETFs) and the upcoming block reward halving.

In the past, such events have led to significant increases in the price of the cryptocurrency Bitcoin and have fueled expectations for a new record in the near future. As a result, despite the pressure on Bitcoin’s price and potential volatility, the cryptocurrency continues its recovery process and remains under close watch by investors.