Bitcoin maximalists are currently divided. Is the capital inflow from the newly introduced ETFs or the anticipated supply shock from the halving event driving BTC to new heights? It’s difficult to provide a clear answer to this question. For investors, the primary concern is that the price of BTC should rise, regardless of which factor has an impact.

ETFs Bolster Bitcoin’s Rise

Bitcoin‘s surge to $73,777 from $38,500 in the first quarter of 2024, an increase of over 68%, is largely attributed to the emergence of new US spot BTC ETFs. During this period, these ETFs saw an inflow of $12 billion, pushing their total assets beyond $59 billion and elevating BTC’s market value above $1 trillion.

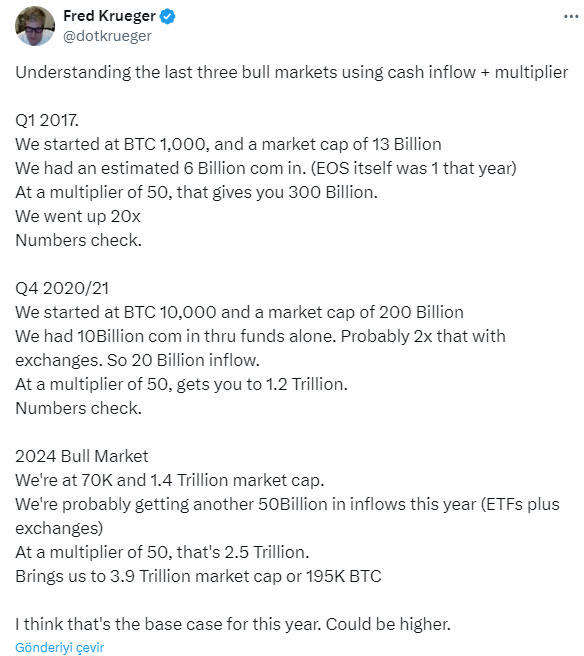

Fred Krueger, a Bitcoin maximalist and seasoned investor, crunched the numbers and predicted a bullish trajectory for BTC, expecting a price tag of $195,000 by the end of 2024. Sharing his views on platform X, Krueger emphasized the significant role of ETF inflows in driving the 2024 bull market cycle, stating:

“We are in the 2024 Bull Market at $70,000 and a market value of $1.4 trillion. We will probably secure another $50 billion inflow this year. Multiply that by 50, and you get $2.5 trillion. This puts us at a market value of $3.9 trillion or a BTC price tag of $195,000.”

Krueger anticipates that the driving force behind this surge, signaling a closer relationship between traditional finance systems and Bitcoin, will be traditional finance (TradFi) ETFs.

The Halving Event: A Catalyst or a Conundrum?

While ETF inflows dominate Krueger’s bullish forecast, he does not dismiss the impact of Bitcoin’s halving event. Although traditionally seen as a supply shock that could trigger price increases, Krueger believes its effect might be diminishing.

Krueger suggests that the halving could soften price declines but may have a limited effect in sparking a significant rally, commenting, “I think the halving opens the way for the rally.”

With Bitcoin trading below $70,000, recent market movements have sent mixed signals. BTC briefly tested the $68,000 range before recovering to $69,000 after a dip below $70,000.

Rekt Capital, a respected crypto market analyst, remarks on Bitcoin’s weekly candlestick closing above $71,200. The analyst views this move as a breakout, following the previous cycle’s all-time high of $69,000.

Türkçe

Türkçe Español

Español