As the U.S. market opened, Bitcoin (BTC)  $91,967 experienced a rapid surge to $97,440, marking a day of renewed activity in the cryptocurrency sector. Many cryptocurrencies saw gains exceeding 5%, with BTC rising by 3% on the day. Those expecting a downturn may face disappointment as the market showcases a positive momentum.

$91,967 experienced a rapid surge to $97,440, marking a day of renewed activity in the cryptocurrency sector. Many cryptocurrencies saw gains exceeding 5%, with BTC rising by 3% on the day. Those expecting a downturn may face disappointment as the market showcases a positive momentum.

Insights on Bitcoin (BTC)

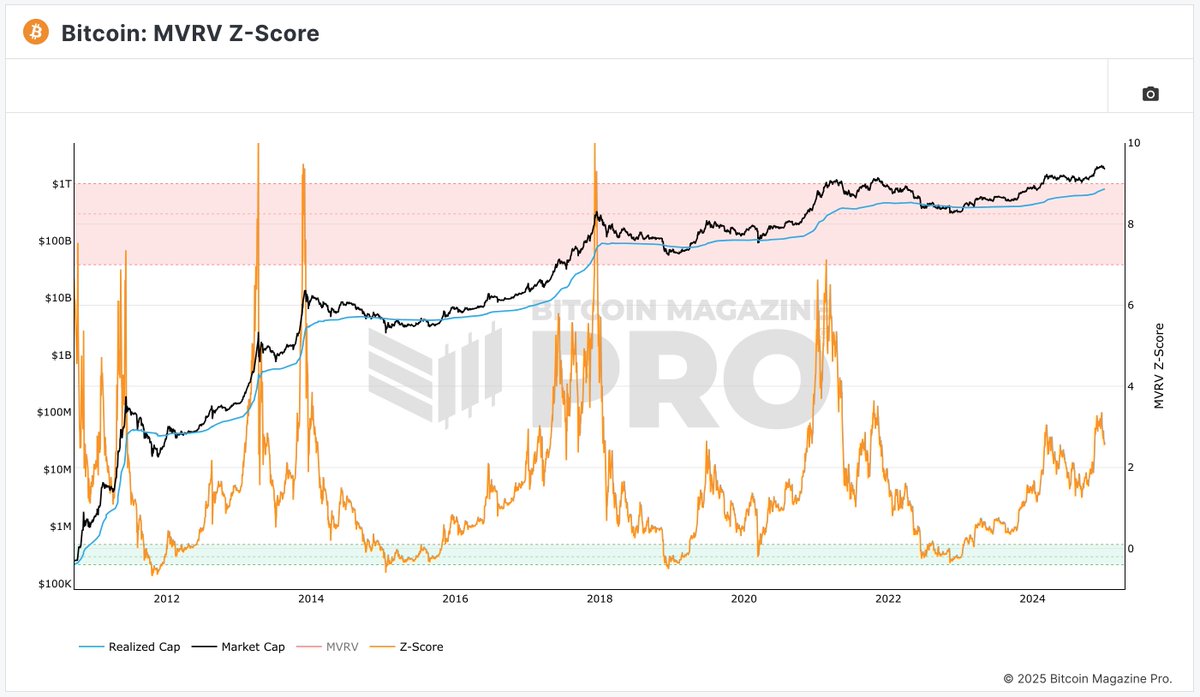

There are key indicators to monitor for the cryptocurrency peak. Current data suggests that BTC has not yet reached its cyclical peak. Popular crypto analyst Jelle recommends examining the MVRV-Z metric to assess BTC’s position in the market. The analysis indicates that there is still room for growth.

“The MVRV Z-Score has historically been an excellent indicator of market peaks. Currently, it indicates that Bitcoin is not overpriced.

Let’s aim higher.”

Negentropic believes that the recent decline may have ended. They shared a chart highlighting this perspective, suggesting potential market stabilization.

“As BTC stabilizes around $94K-$95K, profit-taking slows, making the region less attractive for investors. New liquidity and participant influx are crucial for upward momentum. The reopening of the market and portfolio adjustments could activate soon — likely before Trump’s inauguration.”

Looking Ahead to 2025 and Promising Cryptos

The previous year saw many categories outperforming the overall market. With BTC priced over $97,100, there are indications that 2021-like conditions might return this year. Particularly with Trump’s inauguration approaching, investors have ample reasons for optimism.

The shared chart illustrates which categories have performed better in recent years, suggesting this trend may continue. Staying aware of strong sectors during trading remains essential.

“The beginning of 2025 is progressing in line with themes from 2024.

Artificial Intelligence and Memes lead the charge, followed by other sectors. As always, I expect significant rotation this year. However, it’s beneficial to recognize strong sectors, especially when actively trading.”