Bitcoin (BTC)  $91,081 has recently halted its decline and is finally showing a steady course over the weekend. During this time, altcoins have begun to experience slight increases, albeit weakly. It has been a challenging three months since mid-December, and this period is not yet over. So, what is the current situation?

$91,081 has recently halted its decline and is finally showing a steady course over the weekend. During this time, altcoins have begun to experience slight increases, albeit weakly. It has been a challenging three months since mid-December, and this period is not yet over. So, what is the current situation?

Current Status of Cryptocurrencies

As of the time of writing, the total market capitalization of cryptocurrencies stands at $2.75 trillion. Daily volume has decreased by 37% from the previous day, dropping to $47.6 billion. The weekend’s lack of trading activity is palpable across the markets. Bitcoin’s dominance has slightly declined to 60.7%, while Ethereum  $3,094‘s (ETH) dominance remains weak.

$3,094‘s (ETH) dominance remains weak.

The fear index has slightly improved to 24, but Ether has been the week’s biggest loser with an 11.7% drop. Since ETH remains below the crucial $2,000 threshold, talking about a recovery in altcoins is challenging.

Bitcoin (BTC) Overview

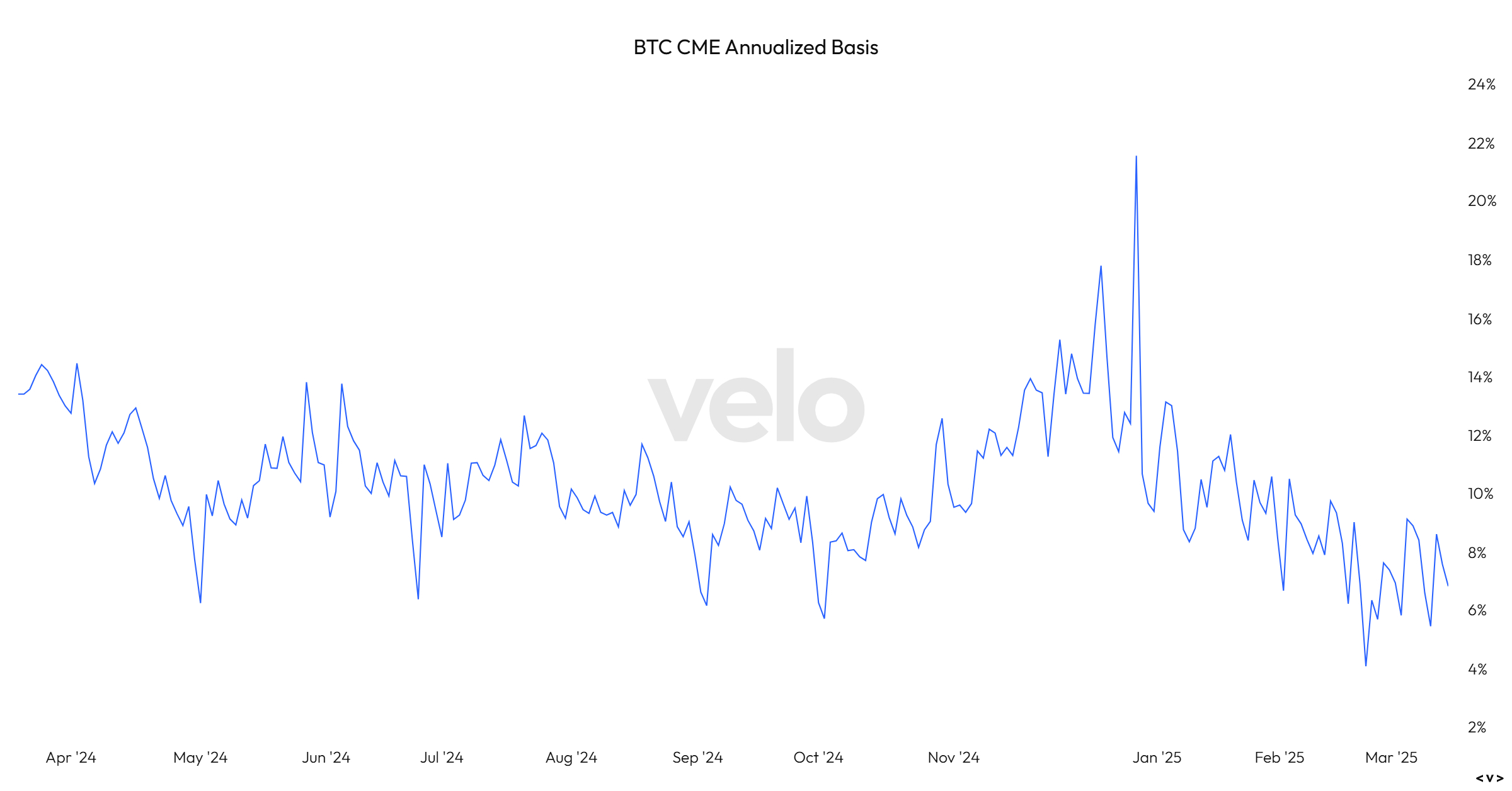

Recently, we’ve discussed that the allure of the BTC CME basis trade strategy is waning. The profits here have decreased to 6.82% as of Friday. While a temporary dip is not problematic, it is crucial to stay away from new selling waves, especially since it is far from the 4.08% region on February 24.

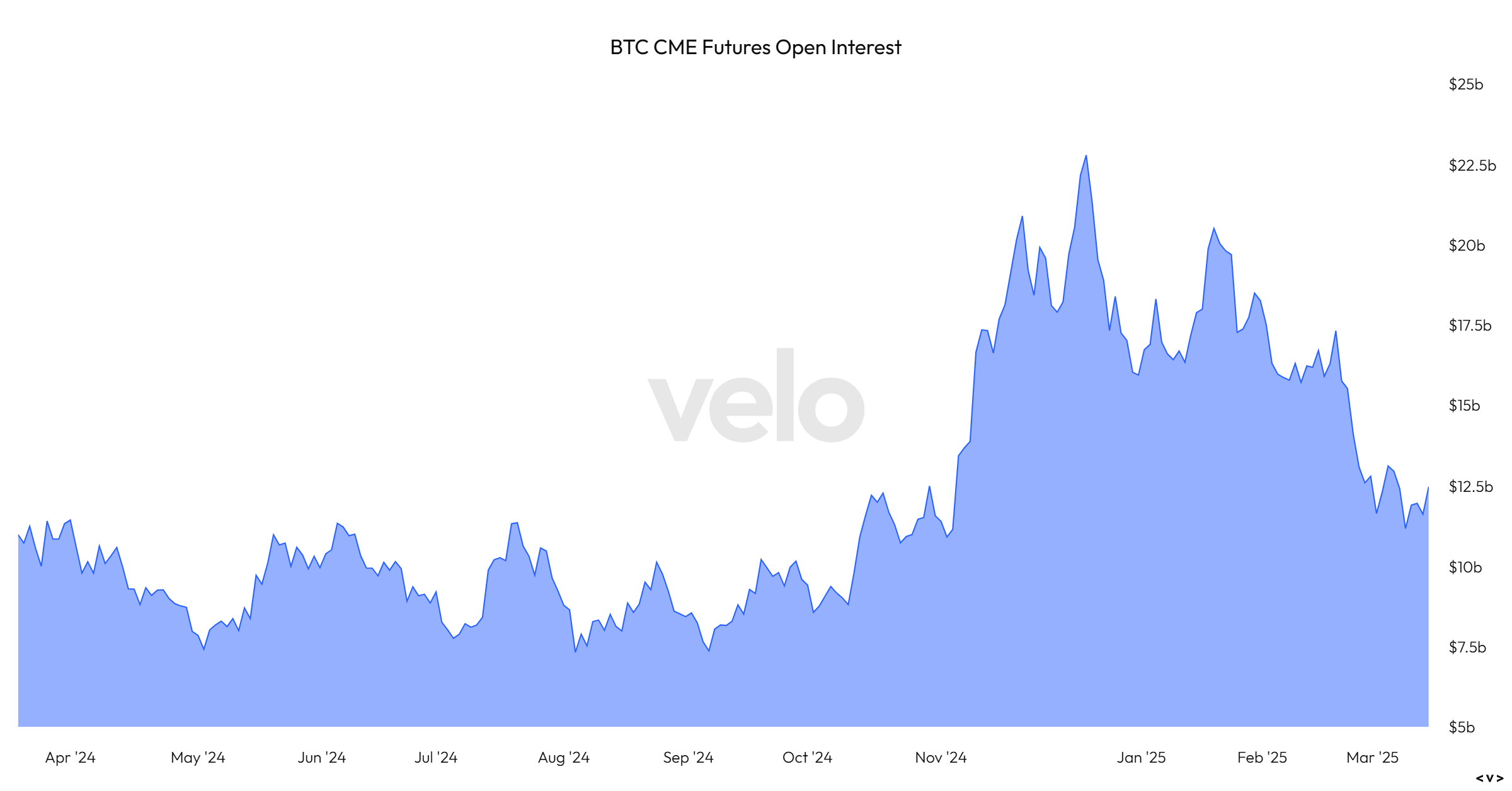

Option volume is normalizing. We previously stated that CME open positions needed to decline to $10 billion to prevent further spot declines. On March 10, open positions decreased significantly to $11.17 billion, indicating a normalization.

On Friday, this number gradually increased back to $12.48 billion. The opening of additional positions is supportive of a potential bottom reversal, and we will continue to monitor these developments in the coming days. Following this news, the next focus will be on significant developments expected within the next week, so keeping track of upcoming events may be beneficial for your short-term strategy.