As this article is being prepared, Bitcoin is struggling to maintain the $44,300 level, a scenario no one had anticipated. Experts predicting higher BTC prices on ETF approval day were shocked by the SEC account hack. What were the effects of the recent incident? What are the expectations now?

$230 Million in Liquidations

The king cryptocurrency continues its battle to maintain the $45,000 mark amidst a period of high volatility in the last 24 hours. About 17 hours ago, a security breach in the SEC’s X account led to the sharing of a false message related to the approval of a spot bitcoin ETF. Although the price climbed towards $48,000 following the post, the anomaly in the account’s likes section was noticed, and the subsequent hack announcement by the SEC Chairman sent the price rolling in the opposite direction.

The price fluctuation caused over $90 million in leveraged BTC positions to be liquidated. Those who opened highly leveraged positions when the ETF decision was announced became victims of their haste without understanding what was happening. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

According to Coinglass data, the total liquidation amount for all leveraged crypto positions was $230 million. The majority of these liquidations were long positions.

Cryptocurrencies in Turmoil

Most analysts were expecting an upward price movement with the ETF approval. This view still prevails, and of course, the first day volumes are critically important. A report published by CryptoQuant on Wednesday warns investors that sudden price corrections can still occur despite ETF approval.

This week we saw speculative large-volume sales swing the BTC price by $1500. The problem is that the absence of major market makers from the sector still causes shallow liquidity in order books. This shows that speculators have the power to move the price. Although the bubble here was significantly reduced with the closing of a massive futures position last week, the risk continues.

The CryptoQuant report stated:

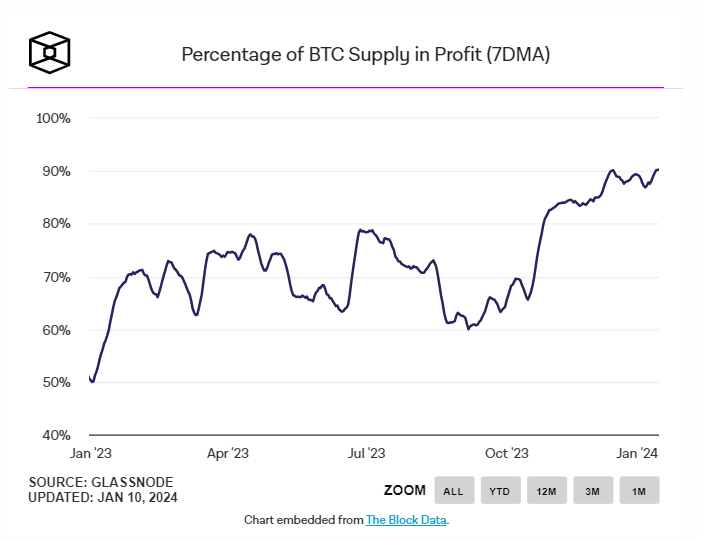

“Bitcoin demand will definitely increase after the approval of ETFs. However, due to high levels of unrealized profits among Bitcoin investors, several on-chain indicators are pointing to a price correction.”

The current circulating supply has reached the highest level in recent years at 90.23%, indicating the large number of investors who would make a profit if they sold.

Türkçe

Türkçe Español

Español