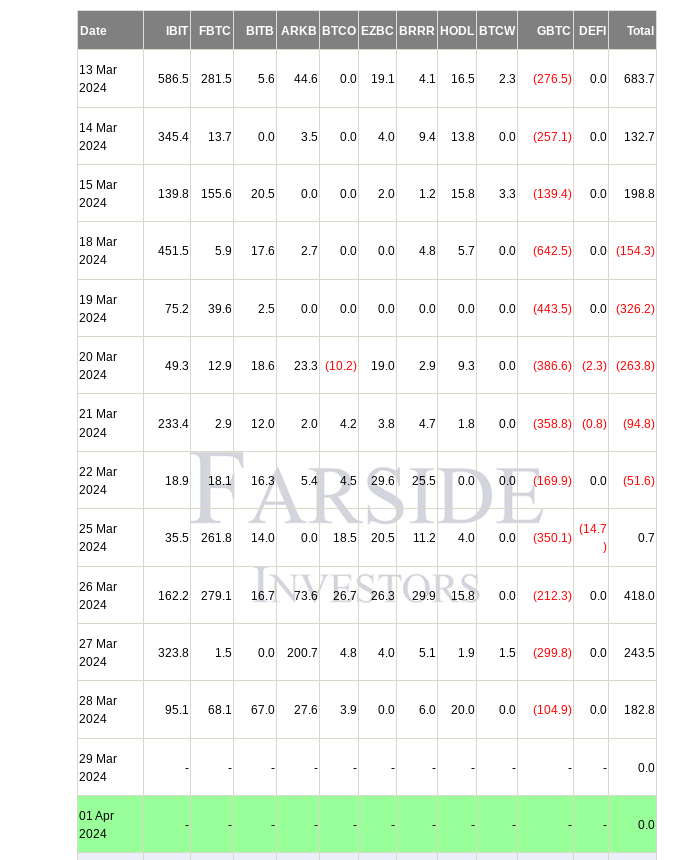

Bitcoin, tried to retest the $68,000 support on April 1st as the Wall Street opening led to weakness. Data from TradingView showed that Bitcoin price losses exceeded 4.5%, marking a troubled start to the second quarter of the year. Despite no outflows from the Grayscale Bitcoin Trust (GBTC), the return of institutional flows did not lead to further increases.

Prominent Investor Shares Downward Trend Analysis

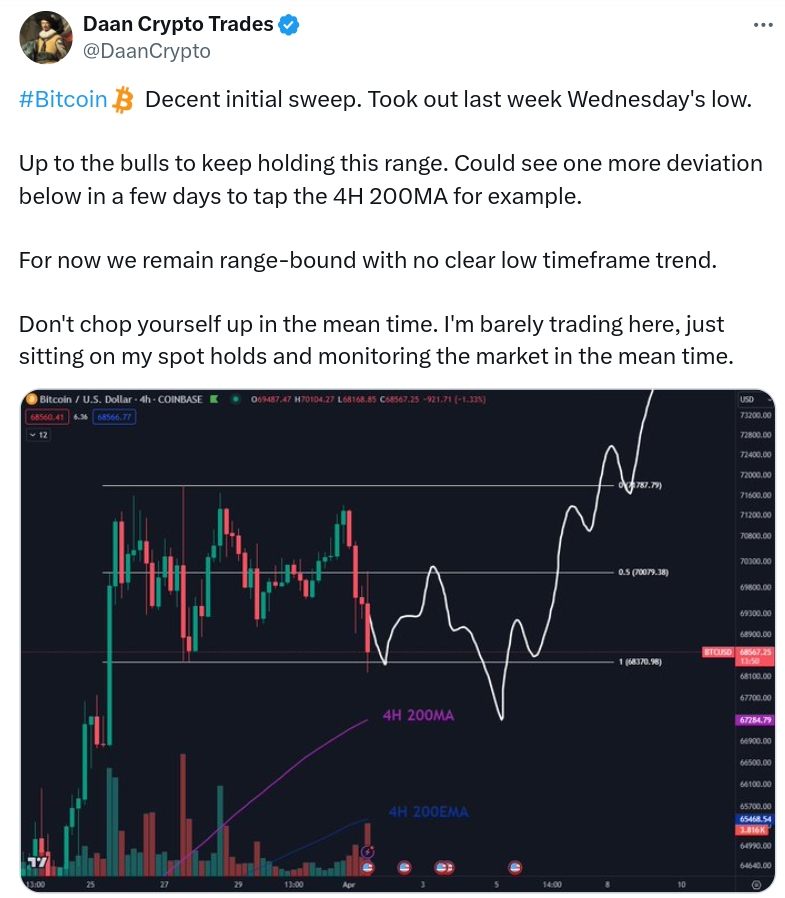

Commenting on this period for Bitcoin, the popular investor Daan Crypto Trades suggested that the Easter holiday period could be a factor. Along with data from crypto analytics firm Arkham, he shared the following comment with his followers on platform X:

“Grayscale, sent nothing significant other than some Ethereum and other cryptocurrencies. It’s probably related to the markets being closed for Easter. We expect the usual inflow/outflow data from tomorrow.”

Daan Crypto Trades also added that GBTC outflows seem to be slowing down. On the last trading day of the first quarter, March 18, there was a significant decrease from the record level of $642 million to $104 million. Meanwhile, the BTC/USD pair, which has been at its lowest levels since March 25, has led investors to ponder. For Daan Crypto Trades, it was not about falling below the 200-period moving average in four-hour time frames and currently down to $67,330.

What to Expect on the Bitcoin Front?

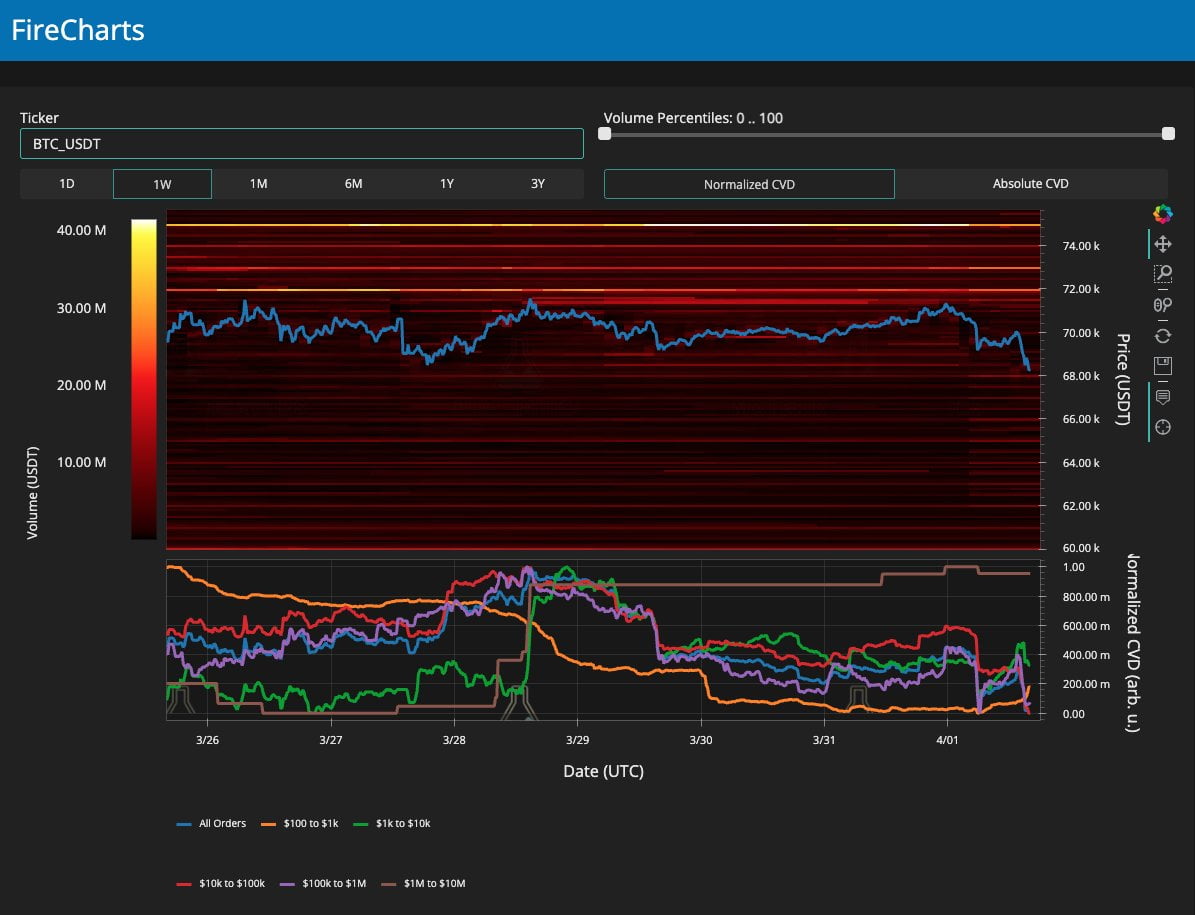

Trade source Material Indicators, which examines the liquidity of the exchange order book on the largest global trade platform Binance, painted a grim picture for Bitcoin price movement between now and the upcoming halving event. The firm, along with its co-founder Keith Alan, pointed to increasing bid liquidity towards $60,000 in a series of X posts and shared the following statements:

“Despite Bitcoin’s seventh consecutive green monthly close in history, there’s not just an upward trajectory for the halving event.”

Alan also added that Bitcoin’s movement in a relatively unexplored region could pose a problem for institutional buyers. However, he noted that the belief in reaching all-time highs remains firmly in place after the halving event:

“At least one institution believes it’s highly likely, as Bitcoin bids dropped to $62,000 after a brief dip below $69,000, exceeding $150 million.”

Türkçe

Türkçe Español

Español