Bitcoin, following the daily close on March 29, surpassed the $70,000 level in the final hours of the last trading day of the first quarter due to strong buying pressure from traders.

Fed Chair Powell and His Views

The $69,000 level served as a temporary BTC support throughout the weekend. Later in the last trading day of the week, significant announcements also impacted Bitcoin‘s price. It was observed that, with the support of comments made by the Chairman of the Federal Reserve of the United States, Jerome Powell, there was an approximate $1,000 increase.

Speaking at the Macroeconomics and Monetary Policy Conference in San Francisco, California, Powell continued to maintain a cool-headed stance on both inflation and the economic outlook. Powell indicated that the Fed will not rush to implement interest rate cuts, which hold significant importance for risky assets.

“Growth is currently strong, the labor market is currently strong, and inflation is falling. We can be, and we will be, patient with this decision – because we can be.”

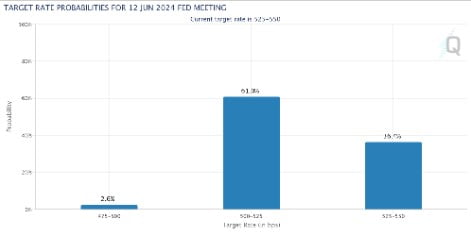

According to data from CME Group’s FedWatch tool, expectations for a 0.25% rate cut at the upcoming Federal Open Market Committee (FOMC) meeting reached a 61% probability. June is currently highlighted as the first month when a potential rate cut is being discussed in the markets.

BTC Price Analysis

When considering potential next BTC price levels and obstacles, attention is turned to weekly, monthly, and quarterly candlestick closings.

For popular crypto world trader and analyst Rekt Capital, the $69,000 level is as significant as ever. A close above this level would result in Bitcoin’s highest close to date.

In a price prediction shared by Rektcapital on platform X, the following statement was made:

“BTC will continue to whip and zig-zag within this Weekly Range until the Weekly Candle Close. A Weekly Candle Close above the All-Time High of ~$69,000 will bring Bitcoin closer to a breakout. Anything else is consolidation.”

Other analysts focused on positive on-chain data, and trader Kevin Svenson highlighted the Moving Average Convergence Divergence (MACD) oscillator on daily timeframes.

In a chart shared by Kevin on platform X, he described the MACD as “positioned for a cross” and noted that such an event could coincide with a potential BTC price breakout beyond the all-time high levels near $74,000.

Türkçe

Türkçe Español

Español