In the recent weeks, which have been bullish for cryptocurrencies, Bitcoin‘s breach of the $68,000 mark has shifted focus to the $69,000 level. At the time of writing, BTC‘s price hovers around $67,000, indicating the first negative outlook in days, albeit only a 2% decline. Amidst these developments, Binance made a move by announcing the addition of the meme coin PEPE, as 1000PEPE, and another altcoin to its Futures trading.

Binance Announcement

Binance has been at the center of investors’ attention with numerous listings, pair additions, and inclusion in futures trading. In an early announcement today, it was revealed that MYROUSDT and 1000PEPE would be added to Futures trading with up to 50x leverage. This operation will take place on Tuesday (today) at 11:30 Turkish time. The announcement was as follows:

Dear Binancians,

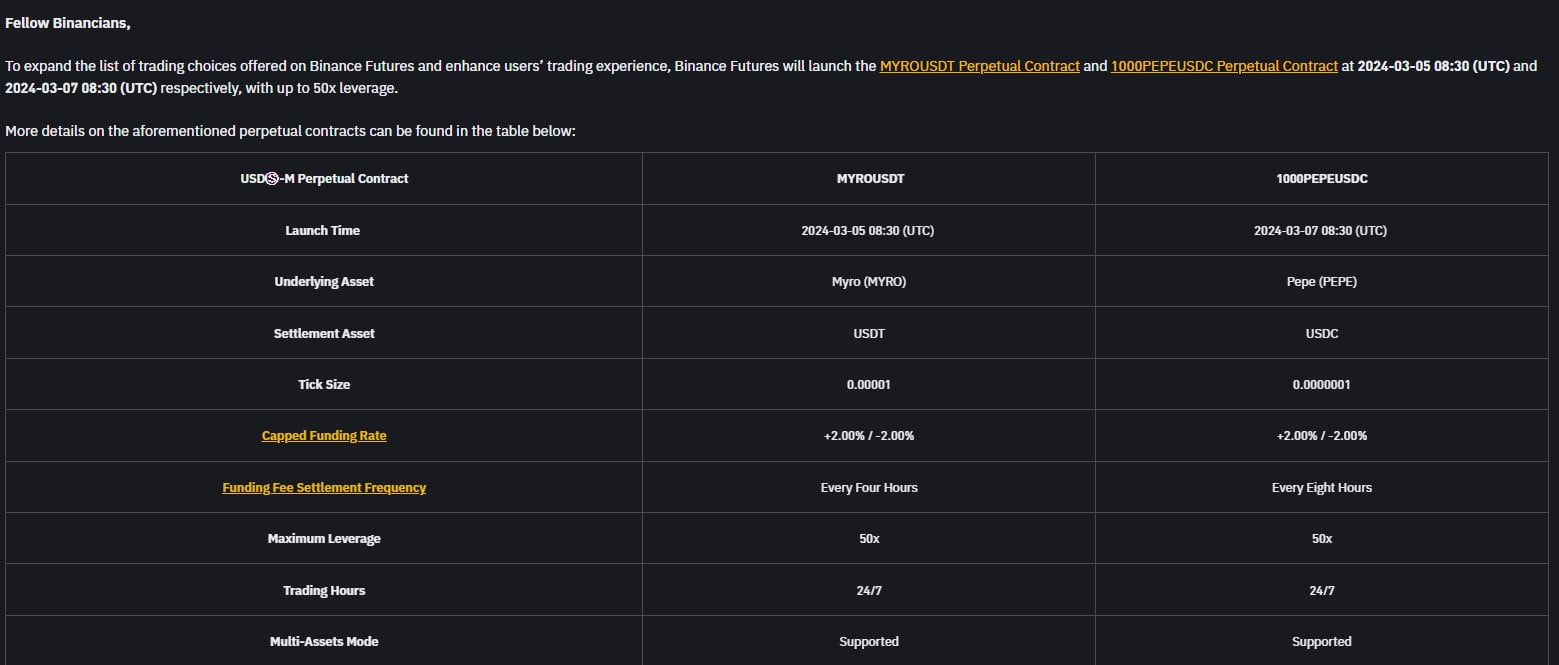

To expand the trading options available on Binance Futures and enhance the trading experience for our users, Binance Futures will launch the MYROUSDT Perpetual Contract and the 1000PEPEUSDC Perpetual Contract, respectively, on 2024-03-05 08:30 (UTC) and 2024-03-07 08:30 (UTC) with leverage of up to 50x.

More details regarding these perpetual contracts can be found in the table below:

PEPE and MYRO Price Outlook

PEPE’s price has been on the rise since last week, part of the meme coin frenzy in the market. As of this writing, PEPE’s upward trend continues. PEPE’s price has increased by 12% in the last 24 hours to $0.000007504.

PEPE’s 24-hour trading volume has also increased by 41%, surpassing $4 billion. Meanwhile, PEPE’s market cap has also jumped by 12%, crossing the significant milestone of $3 billion.

Following the Binance announcement, MYRO experienced a sharp increase, rising by 70% to trade at $0.286. MYRO’s market cap also saw a similar increase during this period, leaving $265 million behind. MYRO’s 24-hour trading volume also settled above $226 million with a 94% increase.

Binance Futures announcements are known to have significant impacts on cryptocurrencies. It will be beneficial for investors and their investments to be cautious during the times these operations are activated.