The King of cryptocurrencies, Bitcoin, climbed above $30,150, and the RSI is heading towards the peaks of the overbought zone. Appetite for risk is increasing, as it would be foolish not to after several of the best possible events have occurred. Bitcoin’s price must pause at some point, but the bulls are not slowing down. In the last 24 hours, the price of BTC has increased by 11%. So, what’s the next target?

Could Bitcoin Hit $40,000?

Bitcoin (BTC) price is steadily increasing, trying to move beyond $30,200 after surpassing $29,000. Institutional investors, possibly anticipating Blackrock’s Bitcoin ETF approval, seem to be driving the ongoing rally.

An Exchange-Traded Fund (ETF) is a financial product that tracks the price of an asset, allowing investors to invest without owning the asset directly. Blackrock’s Bitcoin ETF, subject to approval, will allow BTC to be traded indirectly on traditional exchanges, similar to stocks and index funds, thereby opening Bitcoin and the cryptocurrency sector to a broader market.

The forthcoming Bitcoin ETF could push BTC prices up to $40,000 in the near future. The following figures make this a plausible scenario:

- The total market value of the US stock exchange is $40.5 trillion.

- This US stock market is 3,600% larger than the current global crypto market capitalization (TOTALCAP).

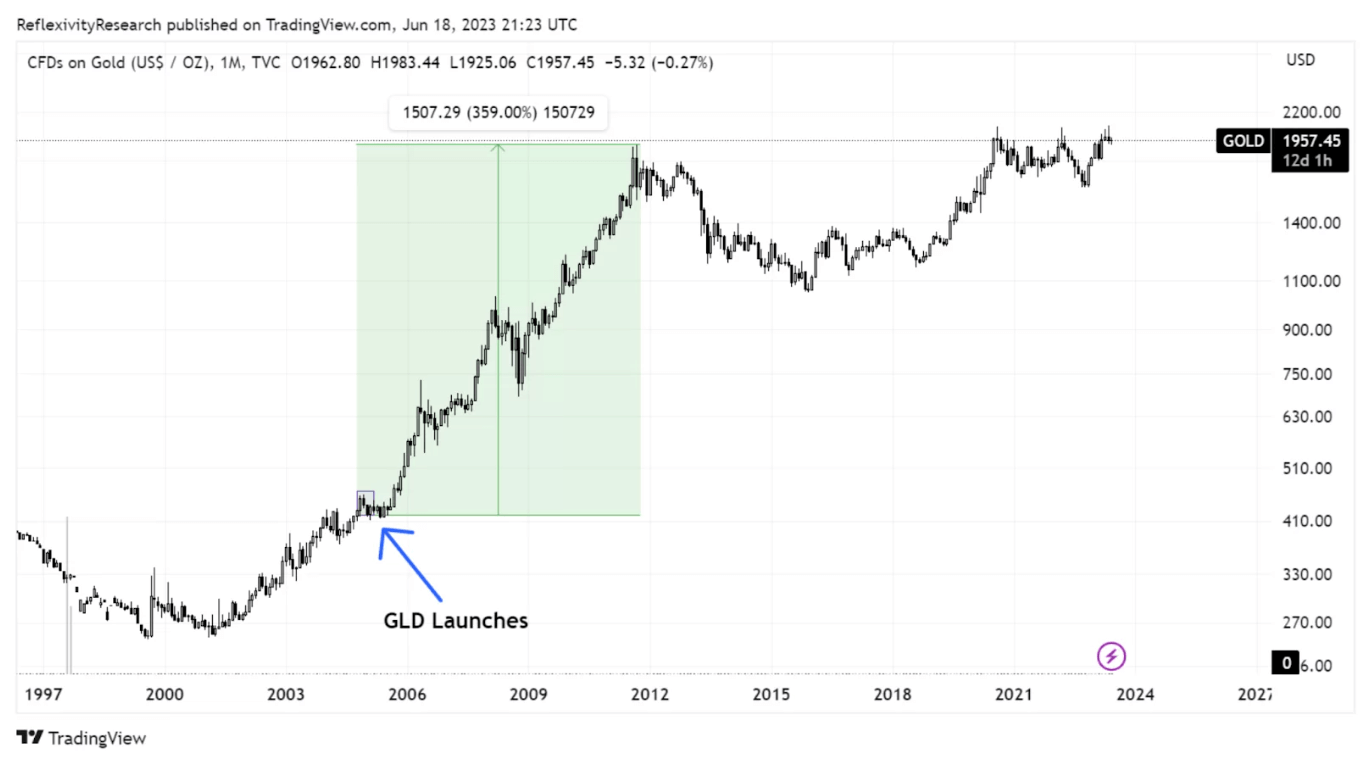

- When SPDR Gold Shares launched the first Gold ETF (GLD) in November 2004, the gold price was $700.

- By August 2011, the price of gold had reached its all-time high of $2,450, a 250% increase.

The chart above shows that the price of Gold was $699 when GLD was first introduced in 2004. Gold reached its all-time high of $2,450 within five years. On-chain data indicates that institutional investors began to take a bullish position in BTC as soon as Blackrock’s ETF application began to be discussed.

Bitcoin, Crypto Commentary

Particularly, IntoTheBlock’s data reveals that whale group investors increased their trading activities for 3 consecutive days. Large BTC transactions rose from 11,360 to 16,360 between the closing of June 17 and June 20, representing a significant 47% increase over just three business days.

Regulatory authorities potentially approving a Bitcoin ETF is a significant step towards mainstream acceptance and legitimacy of Bitcoin as an asset class. If things go as planned, Bitcoin investors can expect BTC to reclaim $40,000 in the near future.

Bitcoin may not face a serious obstacle until $33,000 if the current demand continues to increase. More importantly, the formation of a support above $31,000 could trigger FOMO.

This month saw the worst (SEC sued two major exchanges) and the best (entrance of trillion-dollar giants into Bitcoin) events. Therefore, investor motivation is increasing. As of 19:30, BTC also exceeded $30,700.