The price of Bitcoin (BTC)  $103,047 rose to $98,865 after the recent inflation data was released. Although the data met expectations, it has not yet triggered the anticipated activity in cryptocurrencies. The current situation regarding ETFs raises questions about the market forecasts for DOGE, XRP, and ADA Coin.

$103,047 rose to $98,865 after the recent inflation data was released. Although the data met expectations, it has not yet triggered the anticipated activity in cryptocurrencies. The current situation regarding ETFs raises questions about the market forecasts for DOGE, XRP, and ADA Coin.

Bitcoin (BTC) and Dogecoin (DOGE)

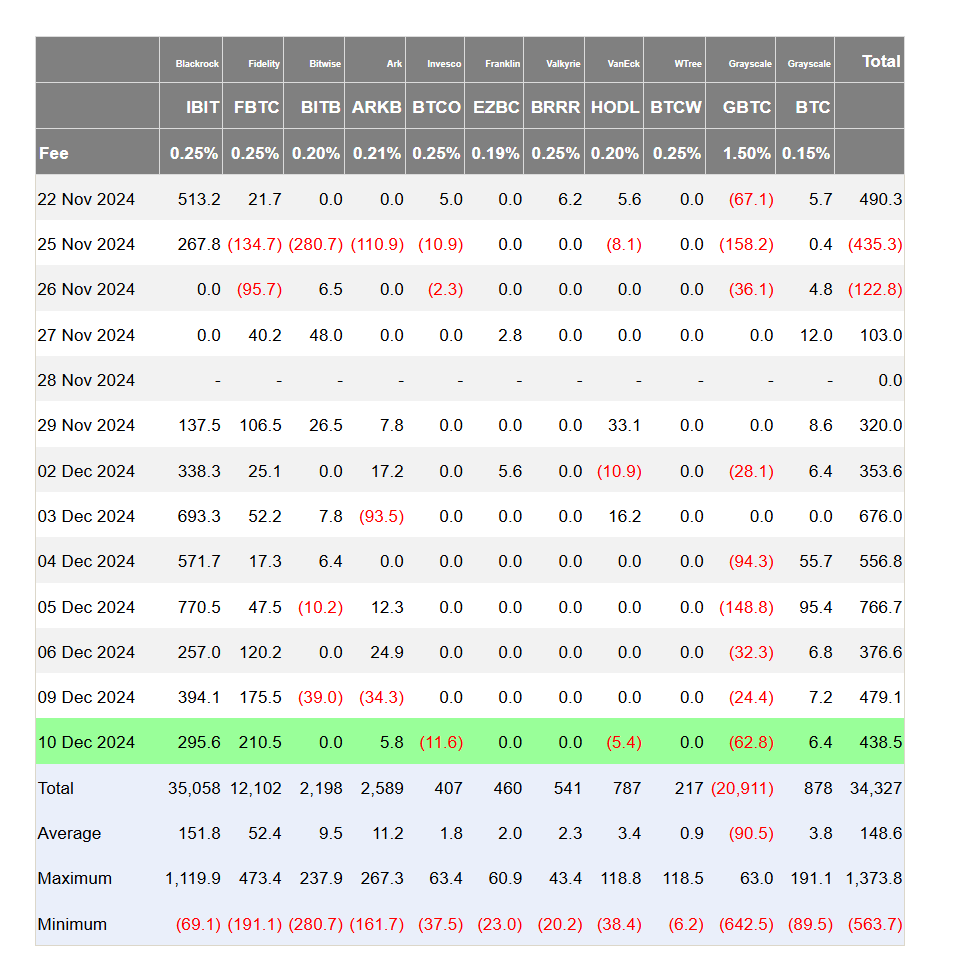

There was a notable inflow of $438.5 million into spot Bitcoin ETFs yesterday. BlackRock’s ETF saw an inflow of $295.6 million, while Fidelity remained at $210.5 million. The BTC price hovering above $97,500 and the ongoing demand indicate favorable conditions for further increases.

Moreover, Microstrategy has been making billion-dollar purchases consistently for weeks. With the company likely to be added to the Nasdaq index soon, we may see an increase in Bitcoin (BTC) purchases. The Nasdaq listing will enable the company to sell more shares, thus having more cash to acquire BTC.

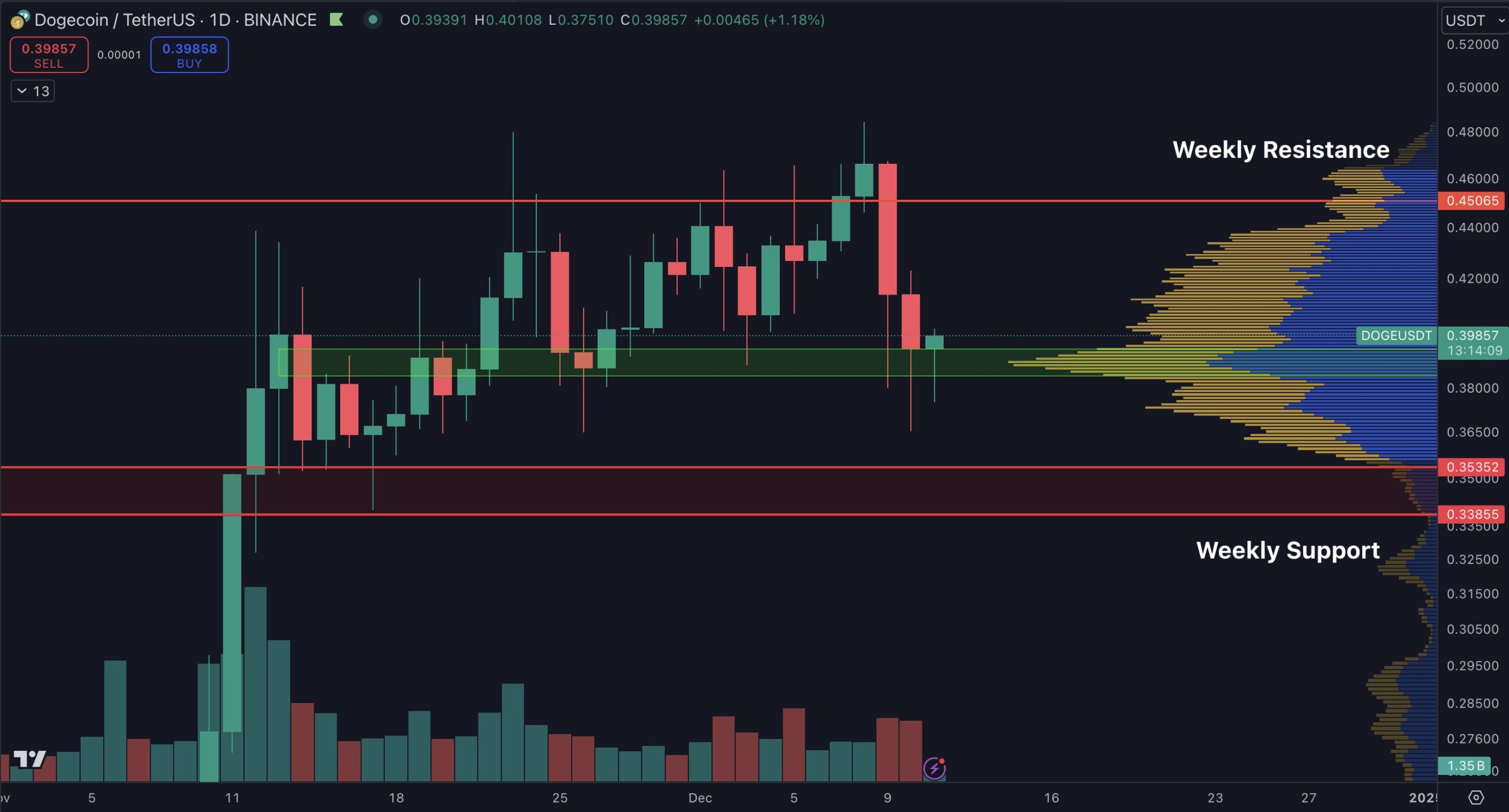

Daann Crypto Trades highlighted the current situation of Dogecoin  $0.179699 (DOGE), noting that it is trapped between two significant weekly price levels since the 2021 surge.

$0.179699 (DOGE), noting that it is trapped between two significant weekly price levels since the 2021 surge.

“DOGE is currently caught between two major weekly price levels since the 2021 rise. This range is critical to watch, from $0.35 to $0.45. Finding support above $0.38 is an encouraging sign, and I believe a test at $0.45 should lead to further upward movement.”

XRP and ADA Coin Insights

Following SEC Chairman Gensler’s announcement of his departure on January 20, the price of XRP Coin surged as anticipated. Although the price has not reached the previous all-time high of $3, it remains above $2.3. Significant events such as the approval of a new SEC Chairman, Trump’s potential return to power, and the conclusion of non-fraudulent crypto lawsuits could drive the price closer to $4.

XRP Coin investors might witness short-term fluctuations depending on the voting outcome for SEC Commissioner Crenshaw’s reappointment.

In terms of ADA Coin, the price increased by 7% to $1.07. With support at $0.914 holding, bulls are attempting to bounce back above $1, aiming for $1.15. If this level is reclaimed as support, targets of $1.24 and $1.32 could be revisited.

Türkçe

Türkçe Español

Español