Bitcoin (BTC) on May 15 experienced its most significant single-day rise in nearly two months, surging over 7.5% to reach $66,250. This increase came as weak US economic data raised the likelihood of the Federal Reserve (Fed) cutting interest rates in September. Consequently, lower borrowing costs for fiat currencies tend to increase the appeal of alternative investment vehicles like altcoins, leading to a significant rise in Bitcoin alongside other risk assets.

Fed Expected to Cut Interest Rates by 25 Basis Points

The US Department of Labor released data on May 15 showing that the consumer price index (CPI) increased less than expected in April. This indicates a downward shift in living costs in the US, with the headline CPI rising by 0.3% in April compared to 0.4% in March and February. The core CPI, which excludes volatile food and energy prices, also rose by 0.3% in April compared to a 0.4% increase in March. These figures suggest that inflationary pressures may be easing.

In addition to the CPI data, US retail sales figures for April also disappointed. Headline retail sales growth stalled, and the “control group” category used in GDP calculations saw a monthly decline of 0.3%. These weak economic indicators significantly shifted market expectations towards a Fed rate cut. Investors now expect the Fed to cut interest rates by 25 basis points in September, coinciding with the summer period from June 20 to September 22. The Fed also signaled a slowdown in quantitative tightening measures, which will further ease liquidity constraints starting in June.

Other Central Banks Also Preparing for Rate Cuts

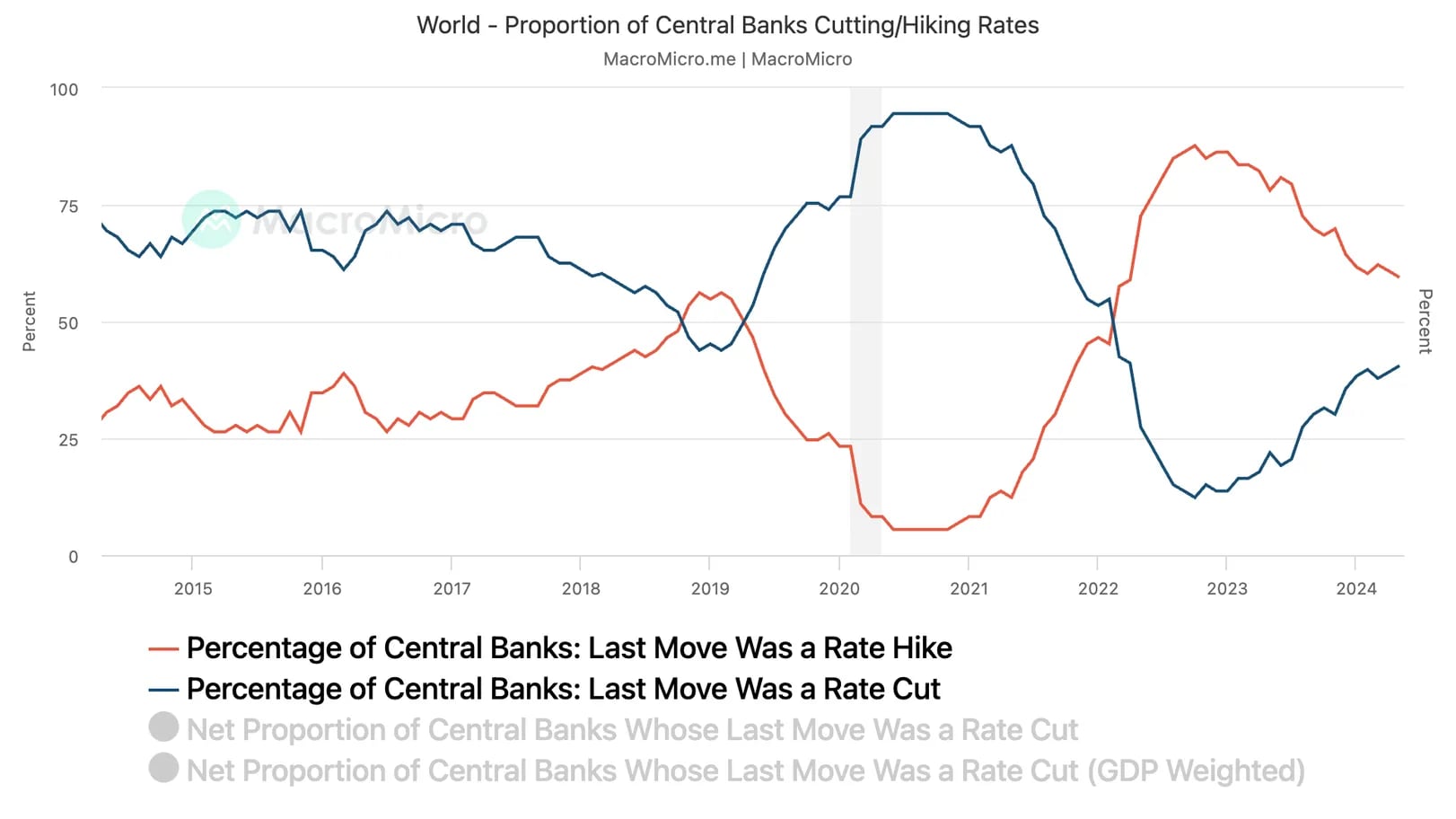

The expectation of rate cuts is not limited to the Fed. Market participants also expect the Bank of England (BOE) and the European Central Bank (ECB) to lower interest rates in June. Meanwhile, the Swiss National Bank (SNB) and Sweden’s Riksbank have already reduced their benchmark borrowing costs. This global shift towards monetary easing is beneficial for risk assets, including Bitcoin and altcoins, as it increases market liquidity.

Data from MacroMicro, a website that tracks market data, confirms this trend. The percentage of global central banks raising interest rates has decreased, while the percentage lowering them has increased. This shift indicates that more central banks are now moving towards rate cuts, which could enhance market liquidity. According to MacroMicro, higher rates of interest rate cuts by central banks generally lead to improved market liquidity, while lower rates indicate tighter liquidity conditions.

Brokerage firm Pepperstone also supports this view, suggesting that the likelihood of increased liquidity over the summer will support equities. As expected, this will provide investors with more confidence to take on higher-risk investments, with Bitcoin and altcoins being the primary beneficiaries. The expectation of easier monetary policies from major central banks creates a favorable environment for Bitcoin and altcoins, reflecting the significant price increases observed on Wednesday.