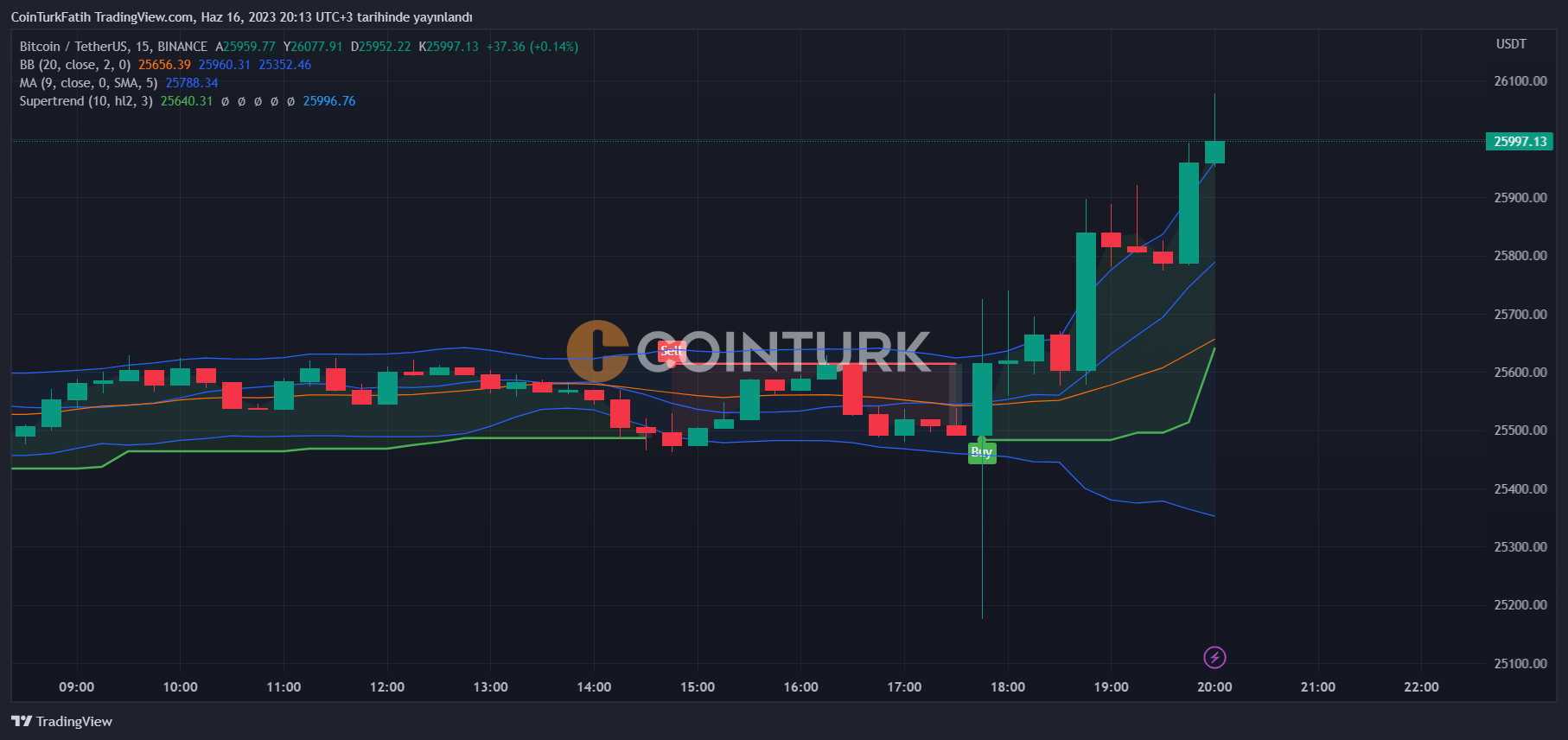

As the news is being written, Bitcoin price has again passed the $26,000 mark and continues to find buyers around this area. The rise in demand for Bitcoin at 19:00 came after the price dipped to $25,170. Following this significant volume of purchases, Bitcoin’s price once again exceeded the $26,000 threshold.

Why Are Cryptocurrencies Rising?

Late yesterday, BlackRock filed a Bitcoin ETF application, which has increased investors’ risk appetite. This is the primary reason for the rise. Despite having been rejected numerous times by the SEC, which is currently confronting the two biggest exchanges, BlackRock applied for a spot Bitcoin ETF. The bold move by the company, which has been rejected only once before, has excited investors. The SEC will respond to this application within a few months at the earliest.

The SEC, which has rejected all previous ETF applications, is currently involved in a lawsuit. Grayscale has filed a case claiming that the SEC has misused its powers and failed to approve applications it should have approved. It would be surprising if the regulator makes a decision against this while a lawsuit is ongoing. In order not to harm the process in the coming days, Grayscale may withdraw the lawsuit or they might settle with the SEC.

Bitcoin Price Prediction

For Bitcoin’s price to continue its upward trend in the short term, it needs to close above $25,800. If the $26,200 area becomes support in the coming hours, we can say that a clear turnaround has begun from the last decline. The exciting thing is that despite the fear of the SEC, Bitcoin investors are entering the weekend with high motivation.

The reasoning behind this rise is not insignificant. The recent announcement excited investors in a similar way to the PayPal news, which paved the way for the 2021 bull. The only problem is the damage that devastating bear markets inflict on the number of active investors. Perhaps we need to see a significant news like BlackRock ETF approval for the next influx of investors.

The CFTC already views Bitcoin as a commodity, and the SEC does not oppose this. However, regulatory pressure on altcoins will continue. We may enter a period where Bitcoin makes new peaks during the intermediate rising period, but altcoins give weak responses. It might be beneficial for investors to approach altcoins more cautiously due to the SEC lawsuits.