<a href="https://en.coin-turk.com/crypto-market-update-bitcoin-and-ethereum-analysis/”>Bitcoin, the world’s largest cryptocurrency by market value, has surpassed the $41,000 level for the first time since April 2022. This price increase has delighted cryptocurrency investors. According to 21 million.com, the value of BTC at the time of writing is $41,600. The price surge is thought to be potentially influenced by the approval of an ETF, among other scenarios considered.

Miners Celebrate in Bitcoin’s Upturn

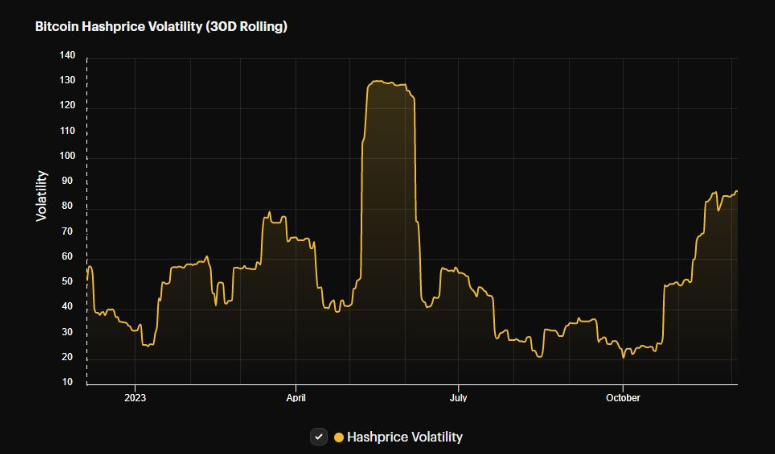

Not only investors, but Bitcoin miners are also enjoying a celebratory day. According to data provided by Hashrate Index, hashprice, known as a significant measure of miners’ profitability, has reached the highest level of the past six months at $87 per PetaHash per second (PH/s/day).

More importantly, at the time of writing, hashprice has experienced an increase of more than threefold since the beginning of the rally in mid-October.

To define hashprice, it can be described as a well-known mining metric that measures the earnings potential of a miner based on a certain rate of hash power. It is positively correlated with changes in the price of Bitcoin, which explains the significant jump in value.

The high returns from investments in expensive mining equipment highlight the sustainability in the mining sector. Such profits may attract investors, potentially leading to more players entering the industry.

Network Fees in Bitcoin Are on the Rise

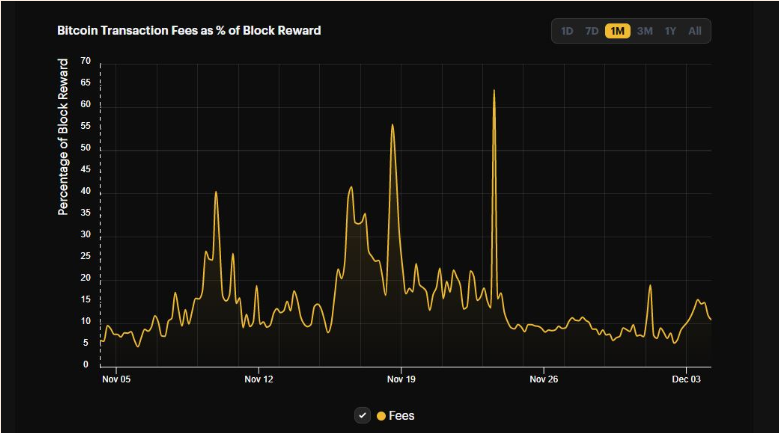

In addition to the price of Bitcoin, hashprice is also directly related to the transaction fees earned by miners. At the time of this writing, approximately 11% of mining rewards came from fees, indicating a significant increase in the past few days.

While Bitcoin block rewards decrease following the halving event every four years, miners’ dependency on fees is expected to rise. In light of this, the increase in fees can be seen as a positive development.

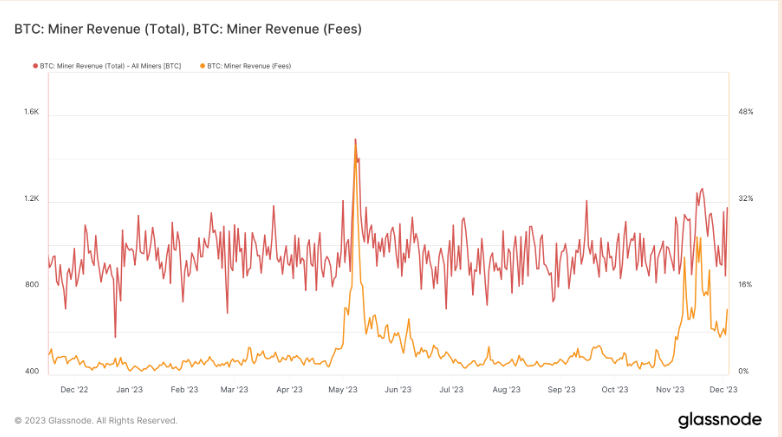

Glassnode’s data offered a more detailed examination of this situation. According to the graph below, except for the sudden spikes due to the rise of Ordinals, fees have been trending lower for most of 2023. This increase could have led to an overall rise in miners’ earnings.

Looking ahead, periods of high on-chain traffic and consequently high fees may help offset the adverse effects of diminishing rewards.

Türkçe

Türkçe Español

Español