The world’s largest cryptocurrency, Bitcoin (BTC), surpassed $67,000 last week with double-digit gains, showcasing significant strength. Currently trading at $67,132 with a market value of $1.32 trillion, many analysts believe Bitcoin is in a consolidation phase, offering a final bargaining opportunity before continuing its rally post-block reward halving.

Last Bargaining Opportunity in Bitcoin

Popular cryptocurrency analyst Rekt Capital claims Bitcoin is in a post-halving pullback phase before continuing its upward trend. The 2024 block reward halving pullback reached -23.6%, marking the deepest pullback of the current cycle. This phase is seen as the last chance to buy Bitcoin at a favorable price post-block reward halving.

The block reward halving pullback set the stage for a consolidation range that starts a few weeks before the halving and ends with a breakout a few weeks after. This range fluctuates between approximately $60,000 and $70,000, occasionally extending beyond these limits. The consolidation phase can last from a few weeks to potentially up to 150 days before Bitcoin enters a parabolic upward trend and accelerated growth phase.

In 2020, Bitcoin experienced a -19% pullback post-block reward halving, followed by a 160-day consolidation period before entering a parabolic phase. Similarly, in 2024, Bitcoin saw about a -24% pullback post-block reward halving. If historical trends repeat, Bitcoin could consolidate for up to 160 days before entering a parabolic phase, indicating significant price increases. This cyclical behavior highlights the potential for substantial price rises following periods of stability.

Market Trend and Small Investors

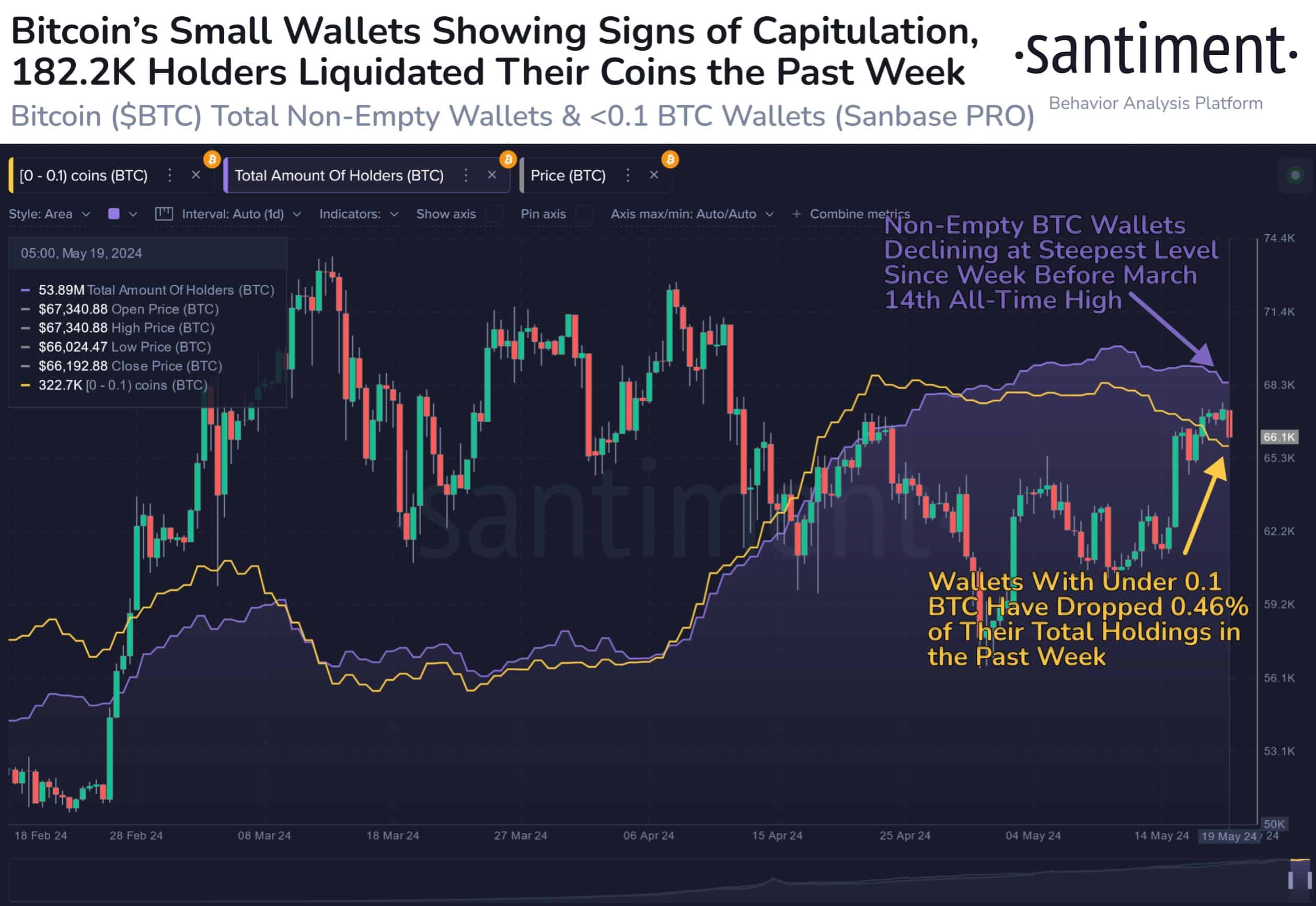

Despite the recent market recovery, Bitcoin remains just above $66,100 as small investors continue to liquidate their BTC. According to Santiment, the tendency of small wallets to sell their coins to larger wallets has historically been a bullish sign for Bitcoin, indicating strong market fundamentals and potential for future price increases.

Analysts like Rekt Capital emphasize that Bitcoin’s current phase offers a strategic buying opportunity for long-term investors. The consolidation range provides a stable foundation before Bitcoin potentially enters a parabolic upward trend driven by both historical patterns and current market dynamics.