The world’s largest cryptocurrency, Bitcoin (BTC), made a strong rise as it entered the 4th quarter of 2023. In the early hours of the day, the price of BTC surpassed the $28,000 threshold with an increase of over 4%. With this rise, Bitcoin broke above its 200-day moving average and the next target stands at $31,000. The recent increase in Bitcoin’s price came at a time when the price of gold reached its lowest level in the last two months. The pressure on the price of gold came amid a strong rise in the US Dollar Index (DXY).

Gold and the Safe Haven Narrative

Despite the prevailing risks in global financial markets, gold has become an asset that investors avoid rather than being the preferred “safe haven”. The price of spot gold has fallen to its lowest level in the last two months and closed at $1,848 per ounce, dropping below the important support level of $1,880 per ounce.

The rise in the US Dollar Index (DXY) to its highest level in the last 10 months, due to concerns about the continuous increase in interest rates in the US, has created downward pressure on gold prices. The price of gold has even fallen below the critical support level of $1,880 per ounce. Surprisingly, gold is not experiencing safe haven demand even in an environment of risk aversion prevailing in financial markets.

Bitcoin Replaces Gold as a Safe Haven

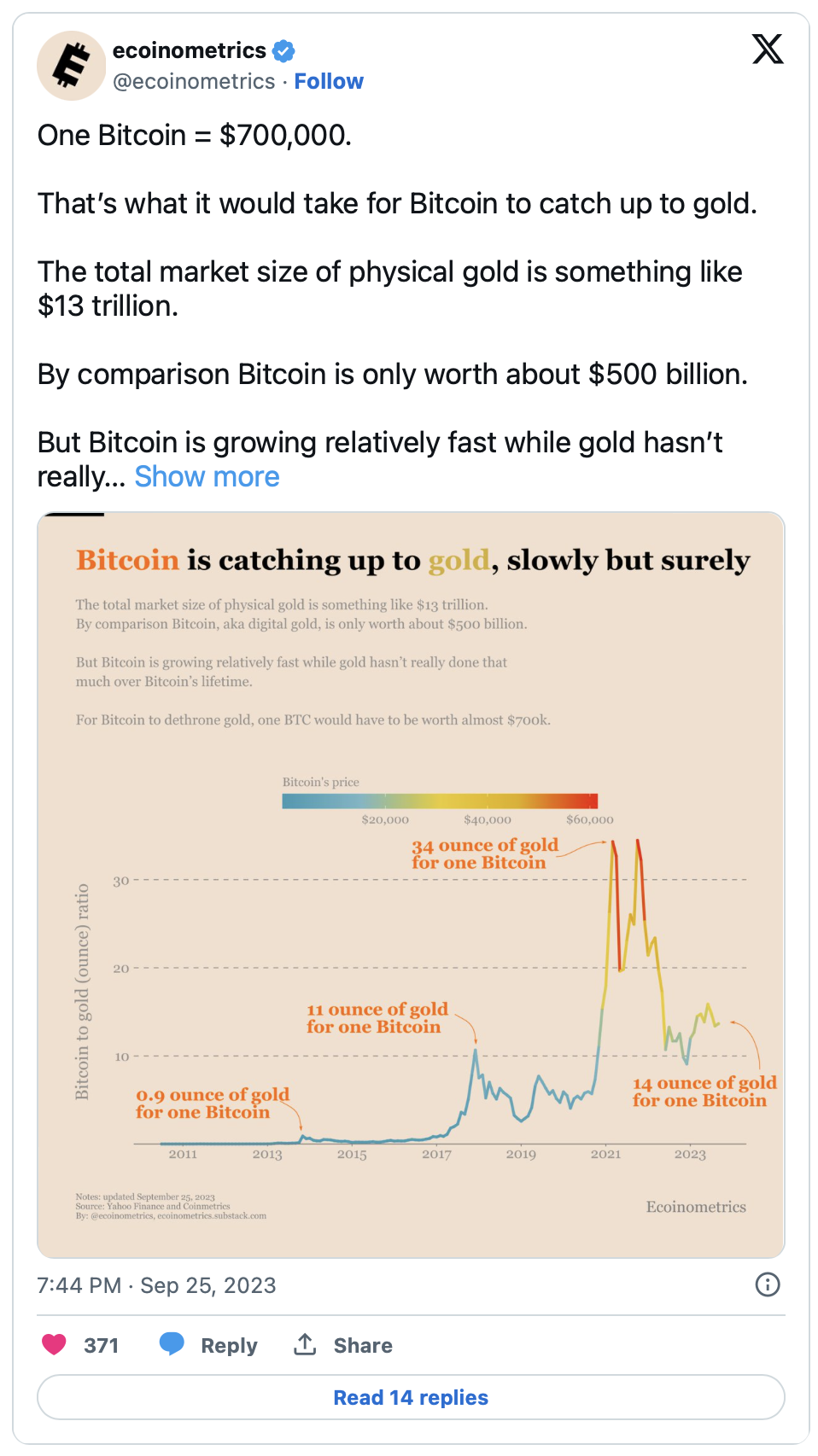

Recent developments show that Bitcoin once again emerges as a “safe haven” compared to gold. Over the past decade, Bitcoin has consistently caught up with gold. Additionally, Bitcoin’s price has increased more than 16 times compared to gold in the last 10 years.

However, while the market capitalization of gold is still $13 trillion, Bitcoin’s market capitalization is around $500 billion. Therefore, for Bitcoin to surpass gold, the price per BTC needs to exceed $700,000.

The biggest and most important question at this point is how long it will take for smart money to move into Bitcoin from gold. Interestingly, 2023 has proven to be a fairly good year for BTC so far. Experienced analyst ecoinometrics said the following about this:

In terms of BTC’s performance, 2023 stands out as the year with the least decline in the past ten years. The frequency of negative returns for Bitcoin has decreased day by day and week by week, making 2023 a year with relatively fewer significant drops. This trend emphasizes the market stability and notable volatility of the current year.

Türkçe

Türkçe Español

Español