The largest cryptocurrency, Bitcoin, has seen a significant price increase in the past few weeks, surpassing the $40,000 level and reaching its highest price level since April 2022. This upward momentum was fueled by increased demand from US investors, as evidenced by the positive Coinbase premium. Data reveals that the next target level for the largest cryptocurrency is above $50,000.

Bitcoin Targets $50,000 to $53,000

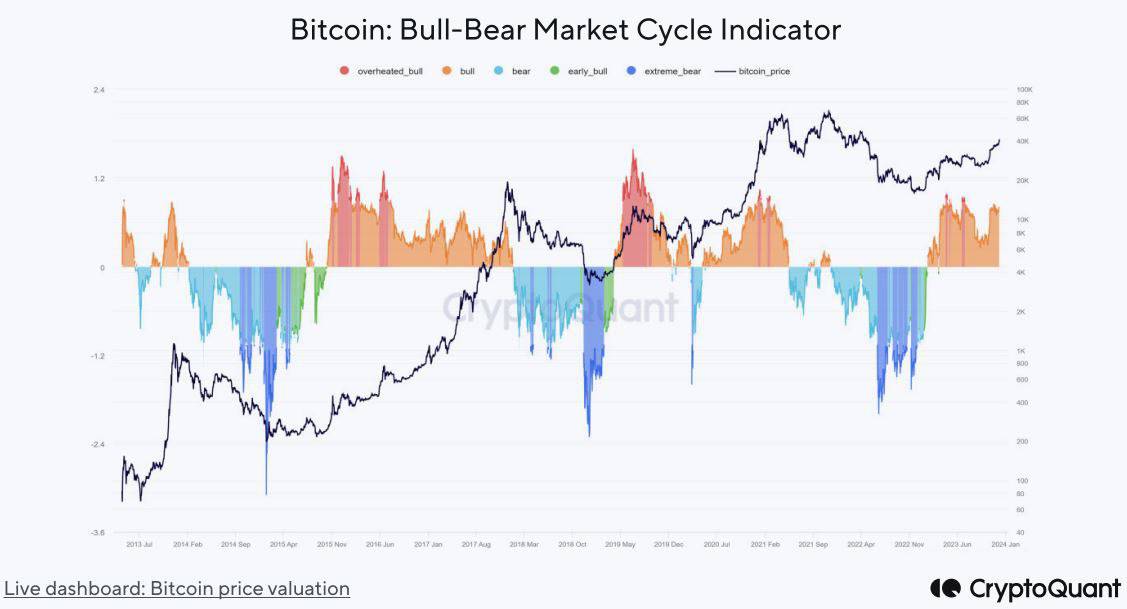

In light of the latest on-chain data provided by CryptoQuant, considering Bitcoin’s network activity and the price around $44,000, a potential target emerges between $50,000 and $53,000. From a long-term perspective, the on-chain data company’s Bitcoin Bull-Bear Market Cycle Indicator signals a bull market, indicating a rising market.

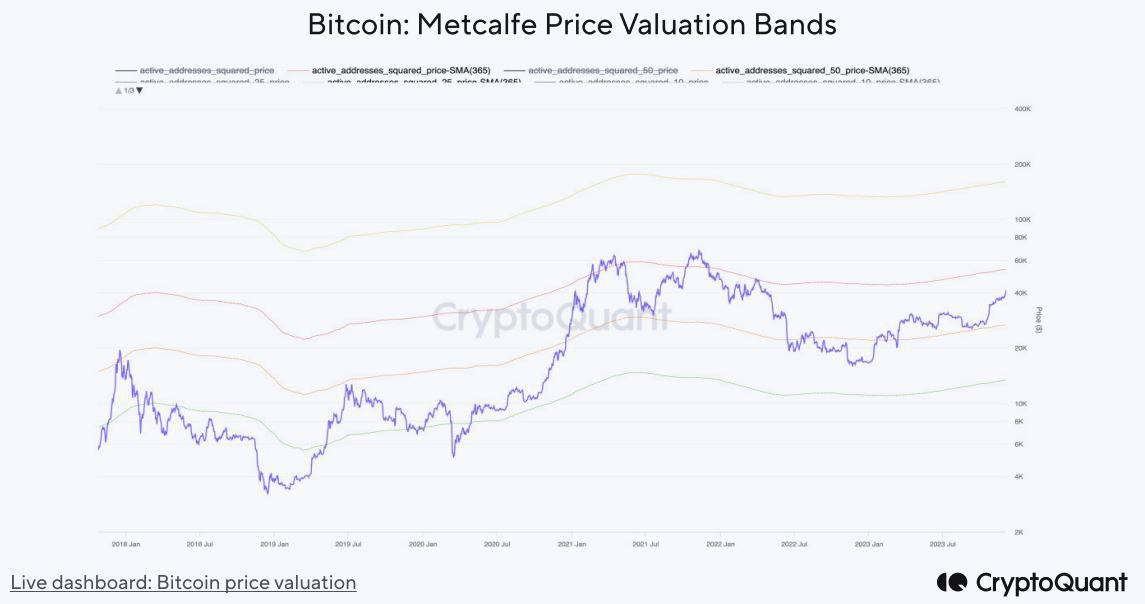

In addition, the optimistic outlook is reinforced by the fact that liquidity is not yet flowing from individual investors and the amount of BTC held in wallets for over a year has reached record levels. This suggests a positive trajectory for Bitcoin’s price movement in the foreseeable future. Especially CryptoQuant’s latest analysis reveals that Bitcoin, from a valuation perspective derived from network activity, could target the range between $50,000 and $53,000.

At the core of the potential price target is the red Metcalfe Price Valuation Band, which evaluates Bitcoin’s price in terms of user activity and particularly active wallet addresses. This band also acted as a strong resistance level for Bitcoin in April and November 2021 and April 2022, causing the price to come under pressure.

Bitcoin’s Bull Run Far From Peak

Considering the increasing funding rates and the fact that 86% of the circulating supply is currently profitable, the possibility of a short-term correction continues. Historically, these levels often correspond to levels seen at local peaks. While the short-term view suggests that investors should be cautious and vigilant under current conditions, the bullish signal from the Bitcoin Bull-Bear Market Cycle Indicator in the long-term view is noteworthy.

Attention should be paid to the indicator’s approach to the Overheated Bull Phase (red area), which is historically associated with a temporary pause or correction in the price rally.

CryptoQuant notes, considering the fact that there is not yet sufficient liquidity flow from individual investors and therefore whales are not expected to take profits, that the cryptocurrency market is far from reaching the peak of this bull run:

In general, the lack of liquidity from individual investors, combined with the all-time high level of BTCs that have not moved for over a year, points to an optimistic long-term view for Bitcoin’s price movement.

Türkçe

Türkçe Español

Español