Bitcoin experienced its usual price volatility on November 7th, with the price approaching $36,000 due to the squeeze on the price. However, the pressure on Bitcoin increased once again in the following hours, resulting in a drop. At the time of writing, Bitcoin is trading at $35,450.

Increase in Volatility Triggers Bitcoin Price

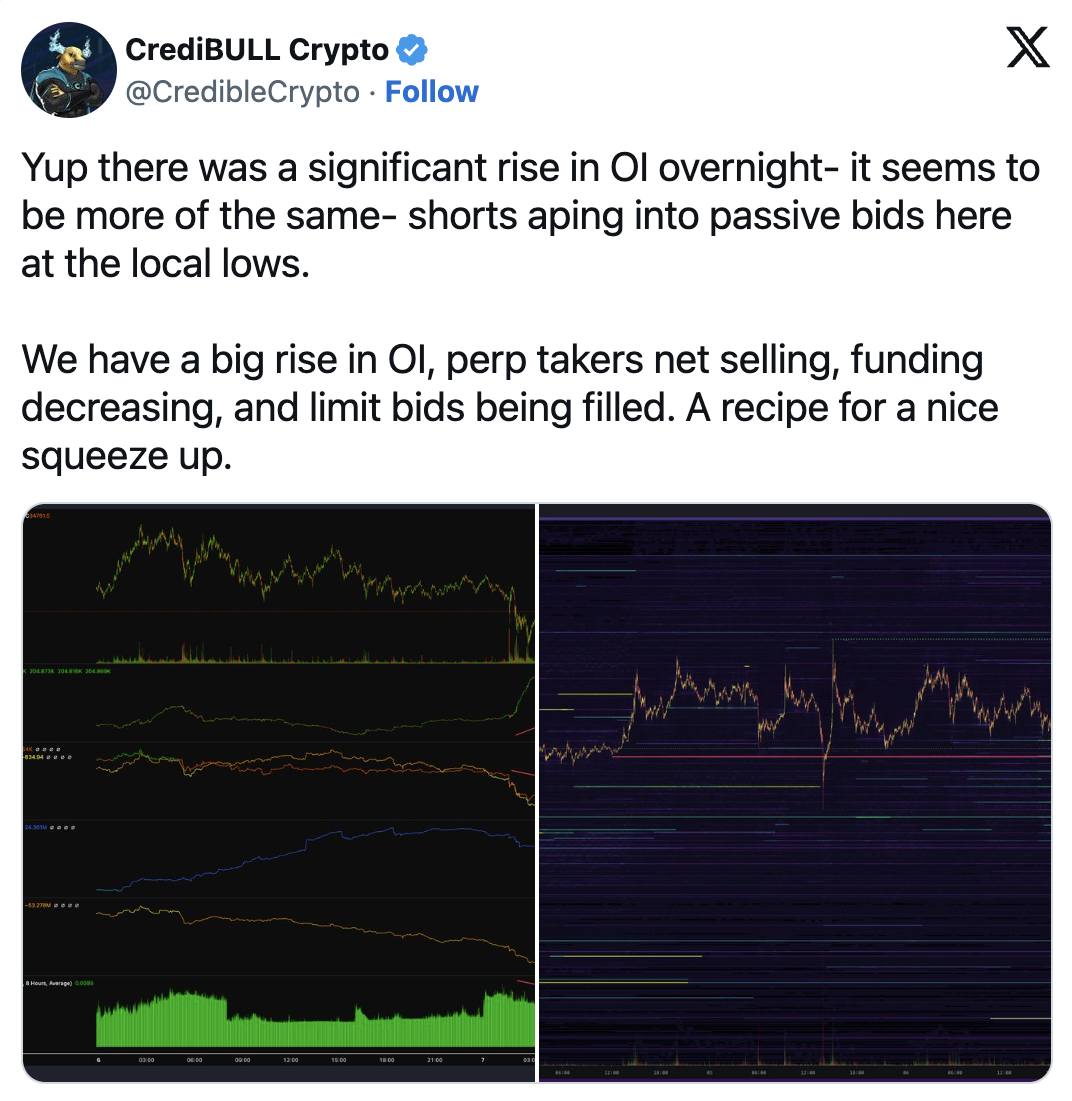

According to data from TradingView, the volatility level in the BTC/USD pair increased due to the high open interest (OI) in crypto exchanges. Many analysts had warned that the OI value of over $15 billion on November 7th could trigger a new volatility.

Additionally, some analysts were fearing a downward movement in Bitcoin price despite the uncertainty about its ultimate direction. During the process, as Bitcoin rapidly gained profits to reach just below $35,900, it tried to gain dominance in the futures market with short contracts.

Popular investor Skew and other analysts who analyzed the situation before the price movements had predicted this development. Skew argued that if Bitcoin returns to $34,800, momentum could rapidly increase:

“Open interest is still increasing, and it can be seen that short positions have a higher surface area in this OI accumulation. The $34,800 level could be a key price for a squeeze.”

What Can We Expect for Bitcoin?

On-chain and analysis platform Material Indicators reiterated its previous thought that $36,000 would not be surpassed this week. In an X post, an analyst commented:

“In this game, you can never say ‘Never,’ but based on the latest Trend Precognition signals, it would greatly surprise me to see Bitcoin surpass $36,000 before the weekly candle closes.”

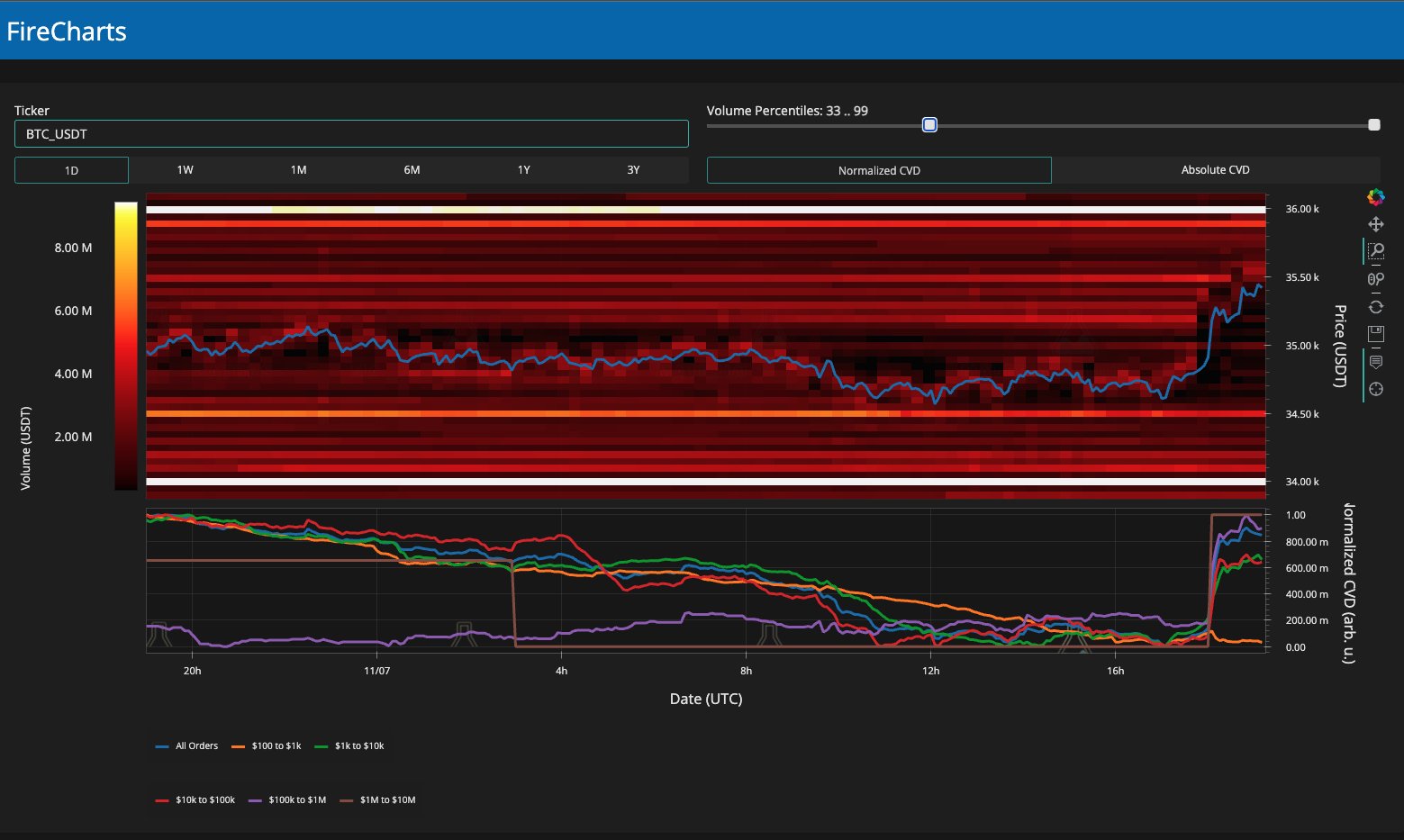

Popular trader Daan Crypto Trades summarized the situation, which he described as an interesting shift in the futures market. He stated that traders on the largest exchange, Binance, positioned themselves in a bearish trend compared to Bybit:

“Bybit consistently outperformed Binance. While Bybit had a clear interest on the long side, Binance was more short-focused in this range.”

A chart shared in the X post compared the continuous swap pairs of the two exchanges in the BTC/USDT pair, showing that Binance had lower trading volume after short liquidations.