In the U.S., the long-awaited spot Bitcoin ETFs became available on January 10th, prompting some crypto whales to take profits. According to on-chain data, a Bitcoin whale made approximately $75 million in profit from a BTC sale in the early hours following the first trading day of the Bitcoin ETFs.

Bitcoin Whale’s Cost Basis Was $19,338

The U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs, and the ETFs were listed and began trading on January 11th, which led to action among crypto whales. Data shows that crypto whales, in particular, started to take profits in BTC.

According to data compiled by the on-chain data provider Spot On Chain, a crypto whale made a profit of $75 million from a Bitcoin sale overnight. This figure indicates a gain of approximately 41.5% on the whale’s investment.

Data indicates that the Bitcoin whale deposited and sold 2,742 BTC, valued at $127.7 million, on the Binance exchange when the price was at $46,570. When looking at the details of the Bitcoin whale’s wallet address, it is seen that they purchased $53 million worth of BTC in October 2022, with a cost basis of $19,338 per Bitcoin.

Spot Bitcoin ETFs’ Trading Volume Surpasses $4.5 Billion on First Trading Day

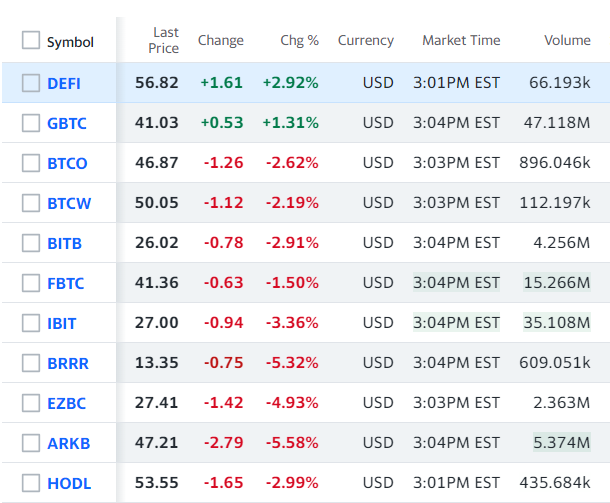

On the other hand, the U.S.’s first spot Bitcoin ETFs reached a trading volume that exceeded expectations on their first day of trading. Experts had predicted that the ETFs would reach a trading volume of $4 billion on their first day. According to Yahoo Finance’s data, the cumulative trading volume of spot Bitcoin ETFs on the first day exceeded $4.5 billion, outperforming expectations.

The spot Bitcoin ETF with the highest trading volume on the first day was Grayscale’s GBTC, which reached a trading volume of $47.11 million. It was followed by BlackRock’s IBIT with $35.1 million and Fidelity’s FBTC with $15.26 million.