BTC price hovers above $51,000, while Bitcoin whales’ activity hits a 20-month peak. According to recent data, Bitcoin whales have started accumulating, reaching the highest level of asset holdings in the last 20 months. Could this development lead to a price increase for BTC?

Bitcoin Whales Accumulate Billions in BTC in 2024

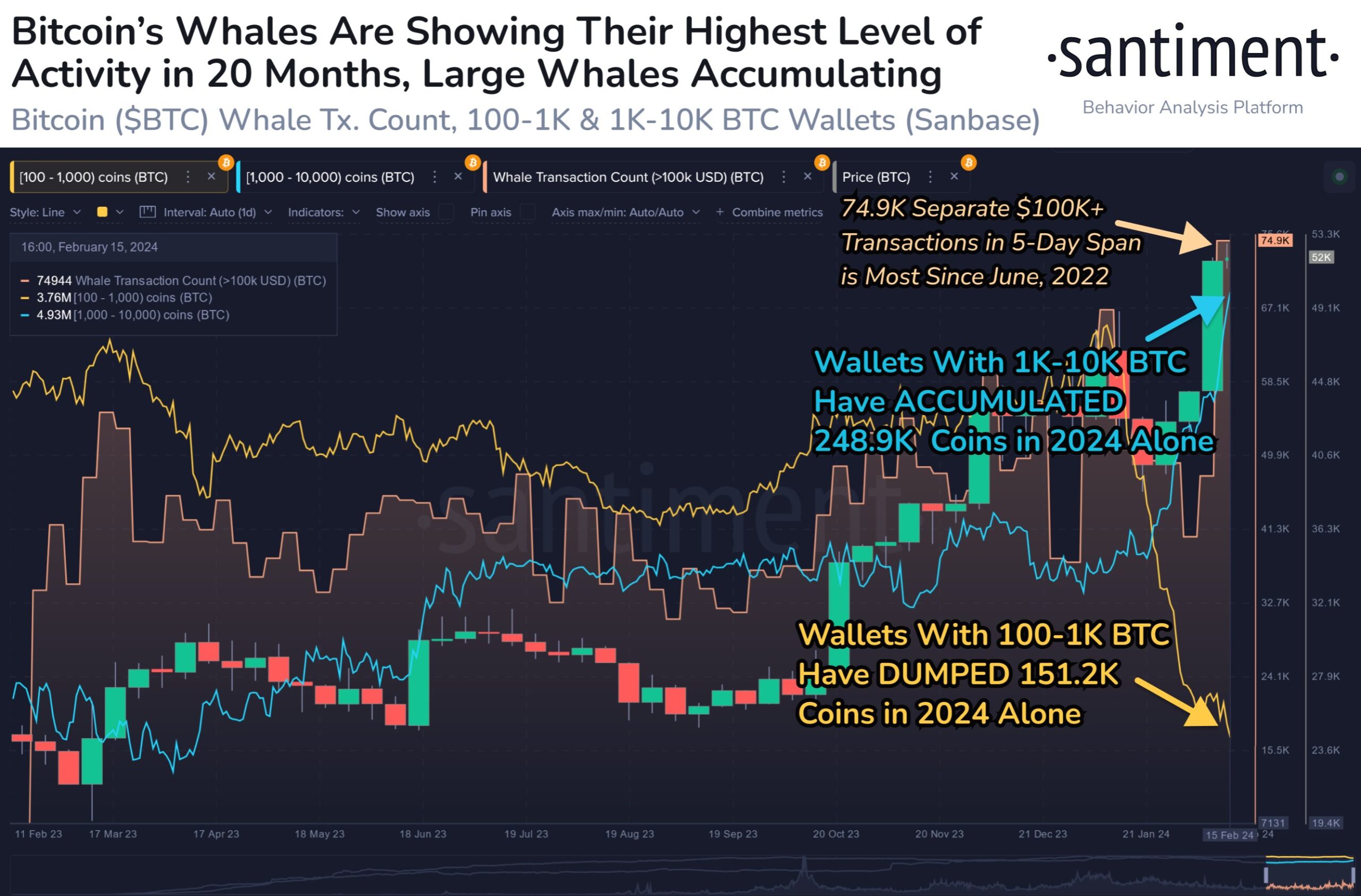

BTC price has managed to stay above the $51,000 level following a week-long rise. The rally in Bitcoin has catalyzed whale accumulation at different stages, supporting the gains in BTC price. Moreover, with Bitcoin surpassing the $52,000 level in the past five days, there has been an increase in whale transactions valued at over $100,000. This situation supports the thesis that Bitcoin’s price movement is attracting attention among market participants.

Data from on-chain intelligence tracker Santiment reveals that whales have been the most active in 20 months. Large wallet investors are acting independently of significant inflows into Bitcoin ETFs. Consequently, there has been a significant change in the Bitcoin supply held by different whale groups.

In particular, Bitcoin wallets holding between 1,000 and 10,000 BTC have added assets worth $12.95 billion in 2024. On the other hand, wallet owners holding between 100 and 1,000 BTC have reduced their assets by $7.89 billion. This indicates a significant shift in Bitcoin supply among different whale groups.

Bitcoin Whale Activity

With Bitcoin exceeding the $52,000 level in the last five days, there has been an increase in whale transactions valued at over $100,000, as seen in Santiment data. This metric has reached its highest level since June 2022. These measurements support the thesis that Bitcoin’s recent price movement has generated interest among market participants this week.

After a week-long rally, the Bitcoin price slightly retreated on Saturday. In the evening, BTC fell below $51,000. Subsequently, the BTC price continued to stay above the $51,000 level.

BTC is expected to move towards its previous all-time high of $69,000. However, the $53,000 level has formed a significant resistance. Spot Bitcoin ETFs are experiencing heavy inflows, and with the optimistic atmosphere building towards the BTC halving, an even greater impact on the BTC price is anticipated.