Bitcoin (BTC) investors have been unable to make a profit in the past few weeks as the leading cryptocurrency fell below $43,000. Moreover, BTC’s growth momentum has slowed down recently. According to experts, whales have been using this opportunity to accumulate more BTC. Will the actions of the whales be sufficient for BTC to regain its past glory?

Bitcoin Faces Selling Pressure

The slow price movement has led to a decline in market sentiment surrounding the cryptocurrency. According to data from CryptoQuant, the BTC Coinbase Premium index is trending downwards. This could indicate a dominant selling inclination among US investors at the time of writing. Crypto Tony, a popular cryptocurrency analyst, also mentioned in a tweet that despite BTC being in a positive trend, it has slowed down.

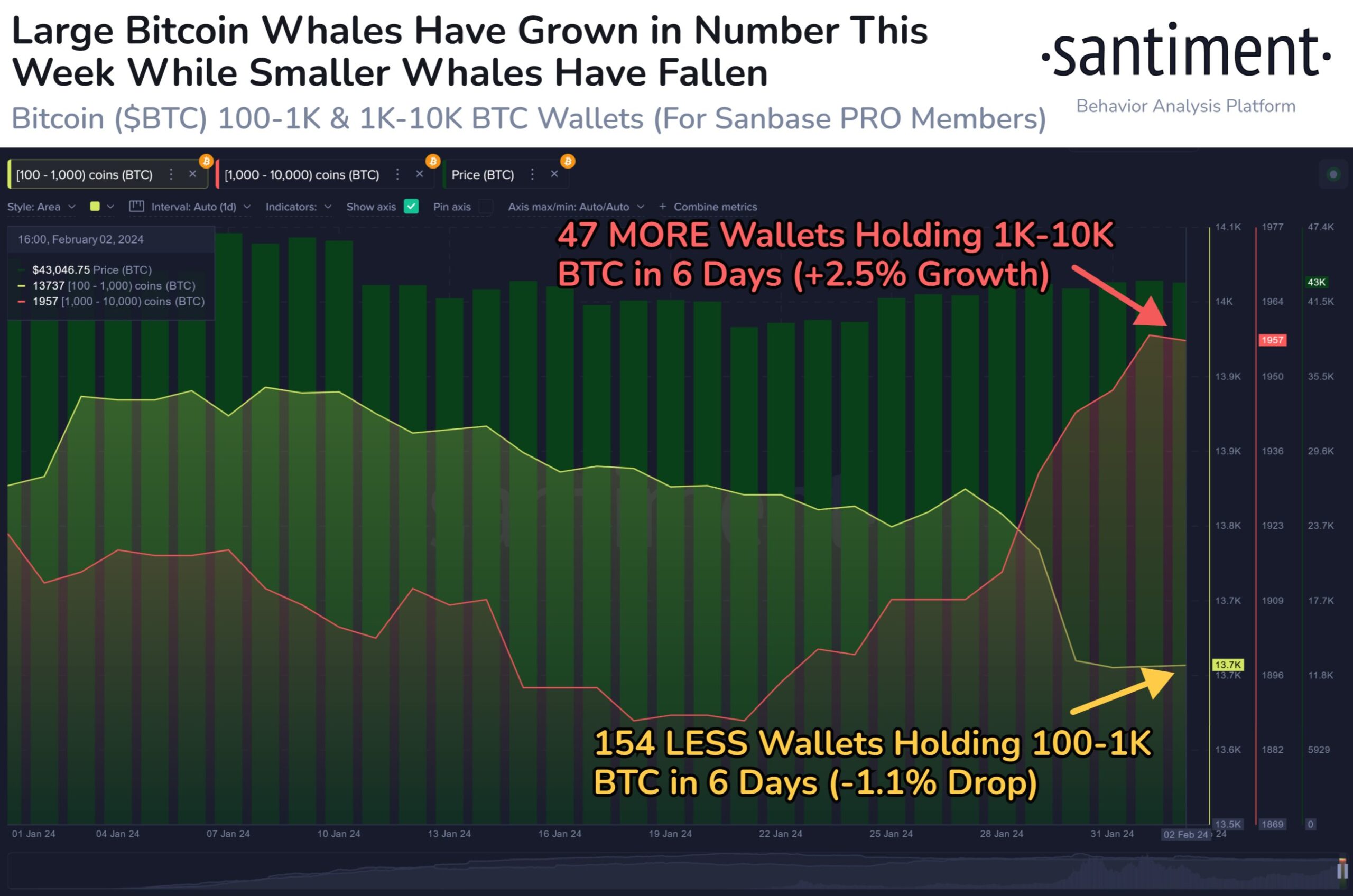

BTC’s fall below $43,000 may seem worrisome, but whales continued to accumulate more tokens. On February 3rd, Santiment tweeted highlighting such activity. According to the tweet, the number of wallets holding between 1,000 and 10,000 BTC increased by 2.5% in just the last six days. This was the highest increase since November 2022.

Decline in BTC Wallets

Conversely, wallets holding between 100 and 1,000 BTC have experienced a decline of over 1%. This marks the lowest level of retreat since November 2022. The mentioned data could indicate that major players in the cryptocurrency field trust BTC and are hoping for a recovery soon. While whales are accumulating BTC, it’s interesting to see miners offloading the cryptocurrency. It was previously reported that rapid selling by miners led to a significant decrease in reserves. Experts are examining the daily chart to see if the buying pressure from whales could be enough to alter BTC’s course.

Analyses suggest that both Bitcoin’s Relative Strength Index (RSI) and the Money Flow Index (MFI) are moving sideways. This could mean that the ongoing stagnant price movement might continue for a longer period, and investors may have to wait longer to see BTC reach new highs.