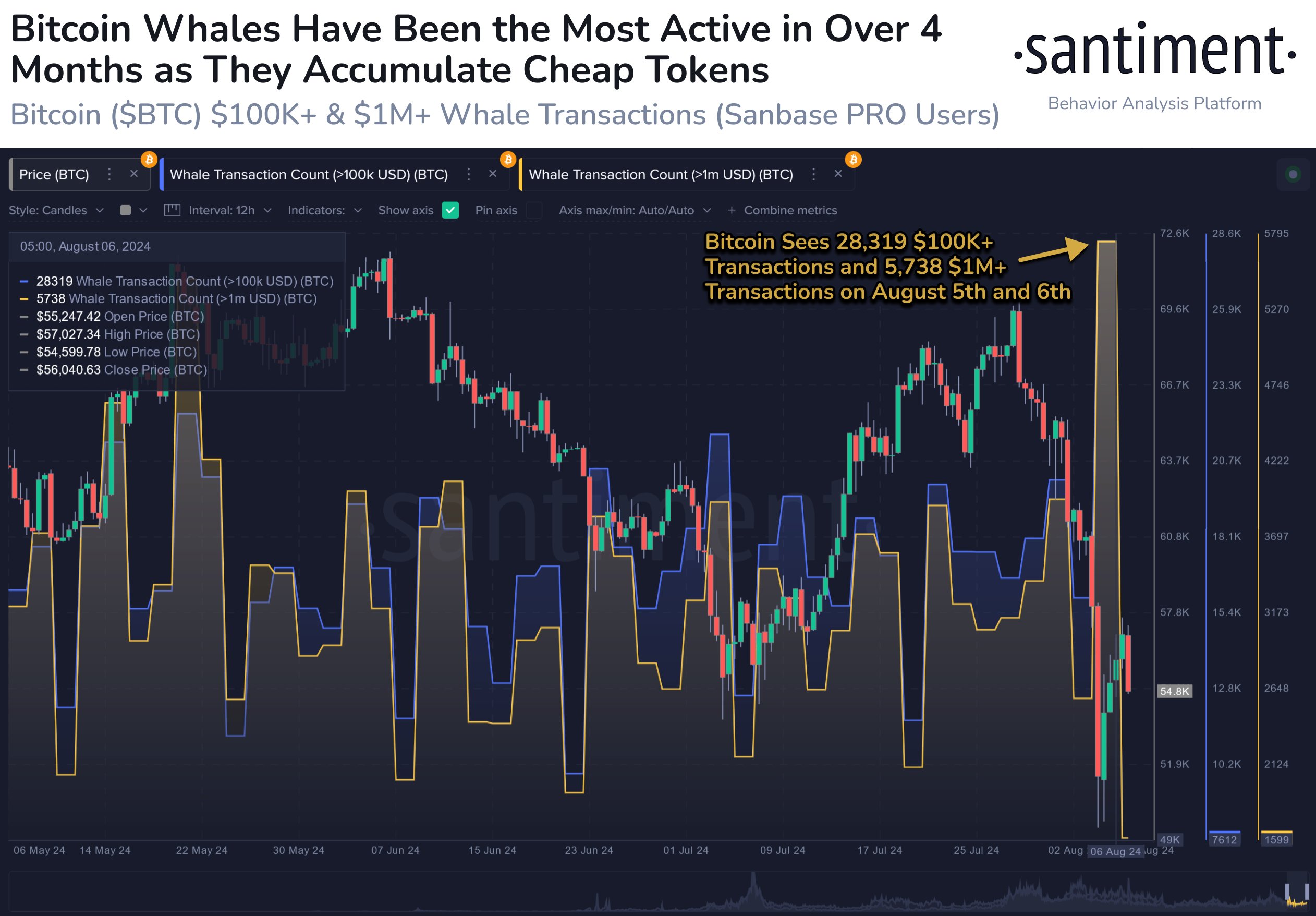

According to on-chain data, Bitcoin whale transactions reached their highest levels since April during a major crypto market crash on August 5 and 6. On August 8, blockchain data analysis platform Santiment revealed in a post that wallets holding between 10 and 1,000 Bitcoin rapidly accumulated during the price drop that caused the most important asset in crypto to fall below $50,000.

What’s Happening on the Bitcoin Front?

Santiment data shows that as crypto prices fell on those two dates, there were 28,319 Bitcoin transactions worth over $100,000 and 5,738 transactions worth over $1 million. Bitcoin lost about 18% of its value on August 5, dropping from just over $60,000 to below $50,000 in less than a day. However, it has since slightly recovered to reclaim the $57,000 level following dip purchases.

Experts reported on August 7 that Bitcoin whales accumulated assets worth approximately $23 billion in the last 30 days, with activity peaking during the market crash. CryptoQuant founder and CEO Ki Young Ju reported that over 400,000 Bitcoin have been moved to permanent holder addresses since the beginning of July, clearly indicating an accumulation step.

Additionally, whales that have held Bitcoin for more than three years sold their assets to new whales between March and June, but there is currently no significant selling pressure from the old whales, he added.

Details on the Subject

A few days before the big drop, on August 3, experts reported that whales were withdrawing Bitcoin from exchanges at the highest rate in nine years. According to the report, Bitcoin whales with at least 1,000 tokens have withdrawn the most Bitcoin from exchanges since 2015.

However, the same cannot be said for investors in US-based spot Bitcoin exchange-traded funds, which saw a total outflow of $554 million between August 2 and 6, according to Farside Investors. Market research firm 10x Research shared the following statement on August 8:

“The lack of ETF buyers during this drop is concerning and raises concerns about the market’s direction.”

Türkçe

Türkçe Español

Español