Bitcoin started October with a rapid rise, but the failure to overcome the $28,000 level triggered increased selling. This, along with geopolitical issues, has caused fear and concern among investors. Despite this, an analyst made an intriguing prediction for Bitcoin.

US Data Causes Concern

According to data from TradingView, weakness in the price of BTC continues to increase, and the most critical level for analysts is currently observed at $27,000. At the time of writing, Bitcoin was trading at $26,661.

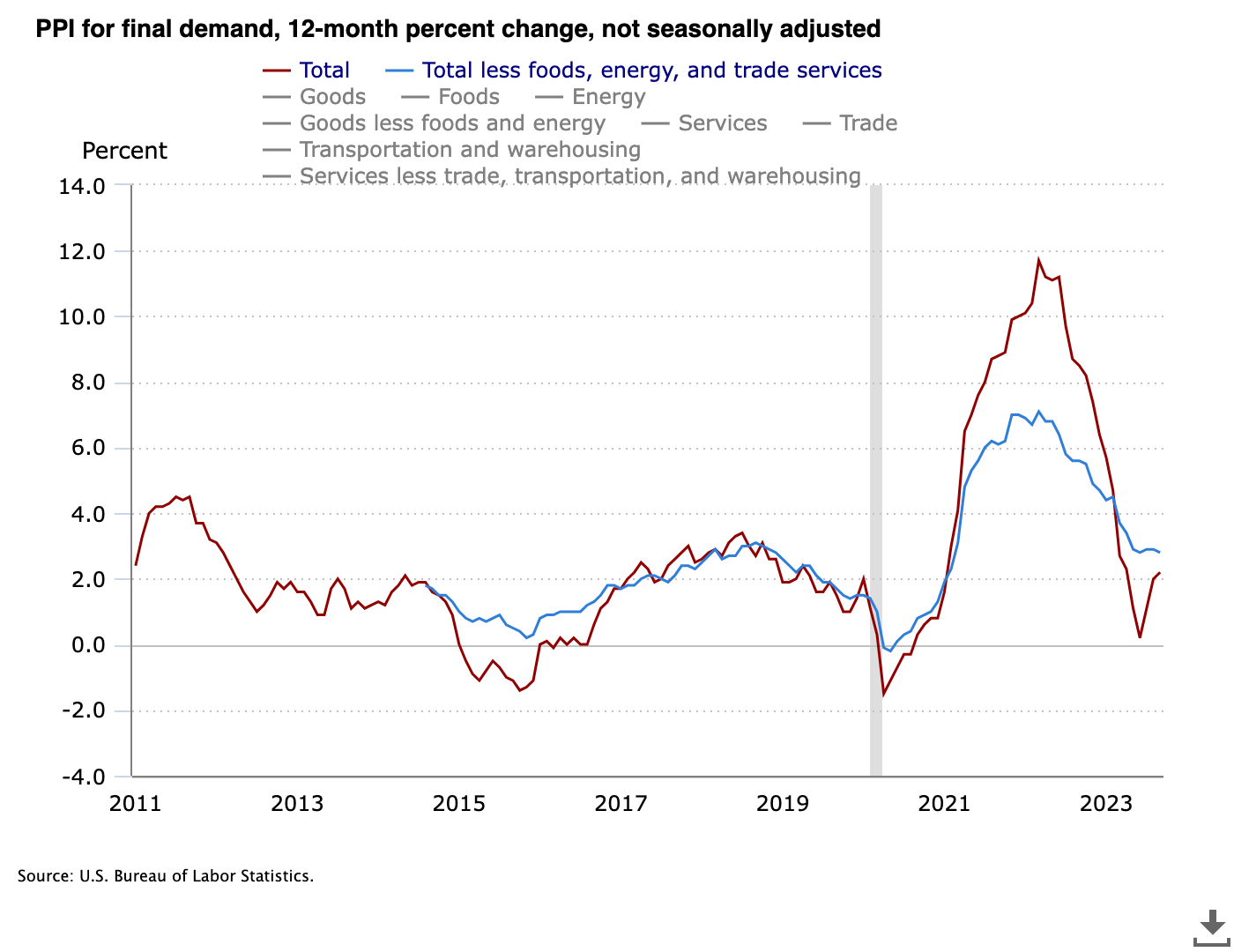

The movement in the price of BTC started with the Producer Price Index (PPI) coming in higher than expected, causing concerns about ongoing inflation pressures in the country. As a result, the US dollar continued to strengthen, and there were increased outflows from risky assets.

Bitcoin Analysis by Analysts

Michael van de Poppe, the founder and CEO of MN Trading and a renowned analyst, shared the following statement on the matter:

“The PPI is coming in hotter than expected, which means the dollar index (DXY) will likely make a upward jump, and Bitcoin will make some corrections.”

Bitcoin, which has lost nearly $1000 in value since the beginning of the week, has reached its lowest level since September 29. As a result, Bitcoin, which has reset its gains in October, has lost its “Uptober” characteristic for now. However, according to Van de Poppe, this drop is the final stage for the crypto market:

“This situation may reverse in October and we may enter an upward trend in November or reverse for a pre-halving or ETF rally in late December. Bitcoin has good days ahead.”

In line with all these developments, another popular analyst, Skew, drew attention to the $26,800 level for Bitcoin in a post. According to the analyst, this level is critical for Bitcoin. In the post, Skew made the following comment along with a four-hour chart:

“Bitcoin will wait for closure, but so far it looks like a rejection, and the $26,800 level is the last area for bulls to do something.”