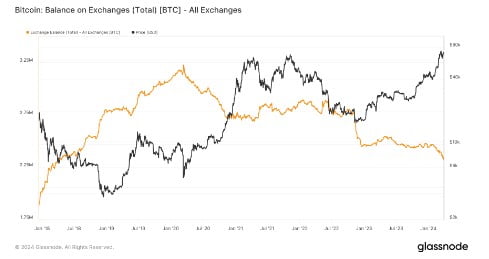

Since the approval and commencement of spot exchange-traded funds (ETFs) in the US, approximately $10 billion worth of Bitcoin has been withdrawn from crypto exchanges. Data provided by the on-chain analysis firm Glassnode shows that since January 11, there has been a decline of over 136,000 BTC in exchange reserves.

Current Status of BTC and Exchanges

The fundamentals of Bitcoin supply indicate that profitability continues to shift in favor of the bulls due to mass withdrawal transactions on exchanges this quarter. US spot Bitcoin ETFs have been trading for less than approximately 3 months. Nevertheless, during this period, there was an outflow of BTC valued at about $9.5 billion from major exchanges.

As of March 28, according to data provided by Coinbase, there were 2,320,458 BTC on exchanges, which is the lowest balance since April 2018.

Moreover, there is no sign of a slowdown in this trend. Data from Glassnode reveals that on March 27 alone, withdrawal transactions exceeded 22,000 BTC (worth $1.54 billion), marking the third-largest daily transaction of the year.

Meanwhile, J.A. Maartunn, a contributor to the on-chain analysis platform CryptoQuant, highlighted a massive USDC transfer to Coinbase, the largest crypto exchange in the US. The notable figure stated that the transaction was one of the largest in history.

1.4 billion USDC was just moved to Coinbase. Is strong buying pressure coming?

Bitcoin Halving Approaches

The long-term impact of ETFs on BTC supply and price remains a hotly debated topic among market watchers. Many sources believe that a significant “squeeze” in supply is expected in the coming period. This effect is anticipated to be felt within the next six to twelve months.

ETF purchases alone represent a much larger amount of buying than the “new” BTC mined every day by miners.

After the halving event in mid-April, the BTC supply is expected to increase by only 3,125 BTC per newly mined block, which suggests an even greater rate of increase.

Charles Edwards, founder of the quantitative Bitcoin and digital asset fund Capriole Investments, mentioned in a part of his latest market commentary:

The biggest Bitcoin halving in history is just a few days away. For the first time, Bitcoin will become harder than gold due to a halving of its supply growth rate. Increase institutional demand through ETFs, a programmatic supply squeeze from the Halving, and Bitcoin earns the title of the world’s hardest asset. There’s a lot to look forward to in April.

Türkçe

Türkçe Español

Español