In its latest reports, Santiment indicated that the price of Bitcoin (BTC) has strong reasons to climb to higher levels. According to the data, the rise that surpassed the $43,000 resistance on December 20th was an encouraging sign of bullish strength. It also highlighted that miner revenue was high and that increasing transaction fees contributed to this.

The Current Situation in Bitcoin

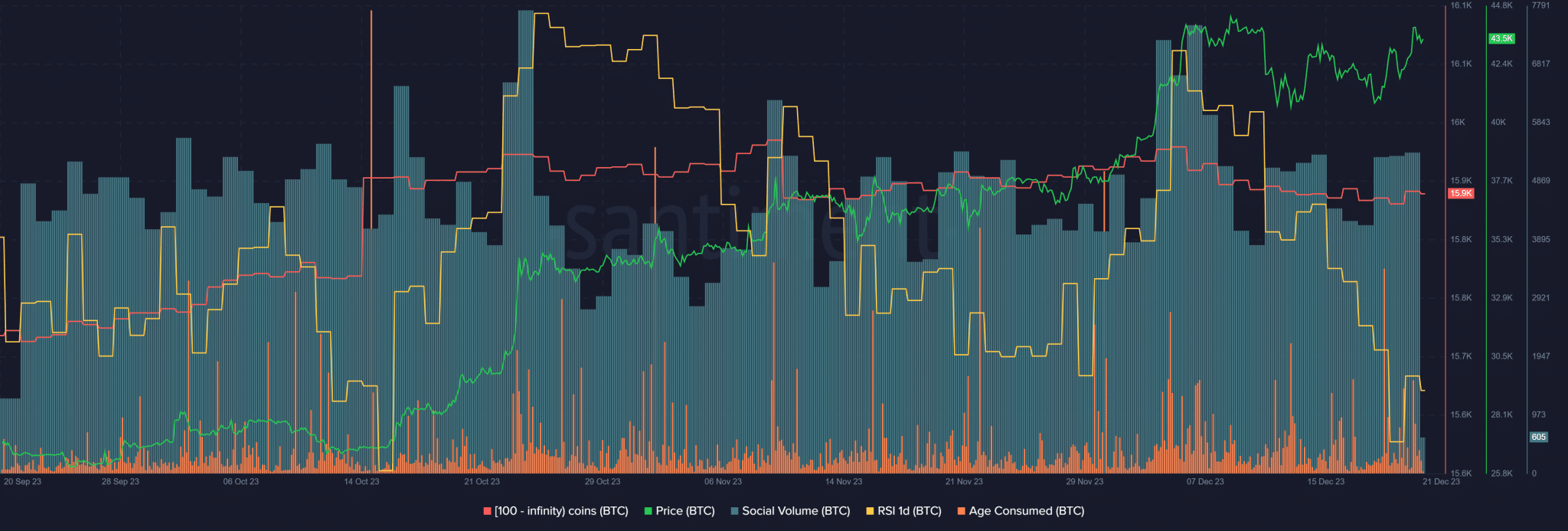

Data analytics company Santiment noted that social volume decreased over the weekend. This was a consistent trend that extended back several months, so it was not a surprise. The number of addresses containing more than 100 BTC increased from 15,941 on December 19th to 15,956 on December 20th. The age consumed metric saw an increase on December 18th, reflecting a possible increase in selling pressure. Since then, there has been no significant volatility. As highlighted in Santiment’s post, the RSI dropped to 42.09 on December 19th, then jumped to 50.38 on December 20th. However, it should be noted that Santiment’s data is calculated slightly differently from the platform TradingView, which is referred to for technical analysis.

On TradingView, the RSI on the one-day chart of the Binance spot BTC market was at 57 on December 19th. It was at 53.8 on December 17th, which was not at all close to the 42.09 value we see on Santiment. Even though the RSI formula is the same, minor differences in rounding can lead to inconsistencies. Differences in time frames can also mean that different daily closings are used.

Santiment Data!

Moreover, Santiment may collect data in a different way; the above graph is based solely on data from Binance. On the TradingView chart, the RSI was at 45 on October 12th but has not reached that level since then. A drop below the 50 level could be an early sign that momentum is starting to shift in favor of sellers. What both charts agree on is that Bitcoin continues to show an upward trend. The Relative Strength Index (RSI) being above the neutral 50 indicated that buyers were still in control at the time of writing, and the technical structure on a one-day chart remained in favor of the bulls.

BTC was already above the $43,000 resistance but struggled to overcome the local resistance of $44.25 thousand. It noted that open positions have been on an upward trend since December 19th. This situation is a sign that sentiment is turning bullish again. Overcoming the local resistance of $44.2 thousand could lead to another inflow of capital into the futures markets and support further gains.

Türkçe

Türkçe Español

Español