The leading cryptocurrency, Bitcoin (BTC), fell from $69,000 to $66,000, indirectly affecting altcoins. The decline in Bitcoin and altcoins also caused a decrease in the total value of cryptocurrency markets. What is the current situation of Ethereum (ETH), which was affected by Bitcoin’s decline?

ETF Expectations for Ethereum

The leading smart contract platform, Ethereum, had shown an increase supported by the rise in Bitcoin’s price. One of the main reasons for the token’s price increase was the expected approval of Ethereum’s spot ETF. However, today’s decline in Bitcoin affected Ethereum. Experts maintain a positive outlook on Ethereum if Bitcoin’s price recovers.

Following the price drop in Ethereum, sales in the cryptocurrency markets reduced the altcoin’s weekly trading volume by approximately 9%. The decline in Ethereum affected experts’ belief in the $4,000 target. The potential approval of spot Ethereum ETFs could trigger institutional and individual interest, supporting a price increase.

Institutional Interest in ETH

Bitcoin previously saw an upward trend in the cryptocurrency markets with the approval of spot ETFs, which could similarly be speculated for Ethereum. As known, the US approved Bitcoin ETFs on January 11. This move in Bitcoin led the cryptocurrency to reach an all-time high of $73,000.

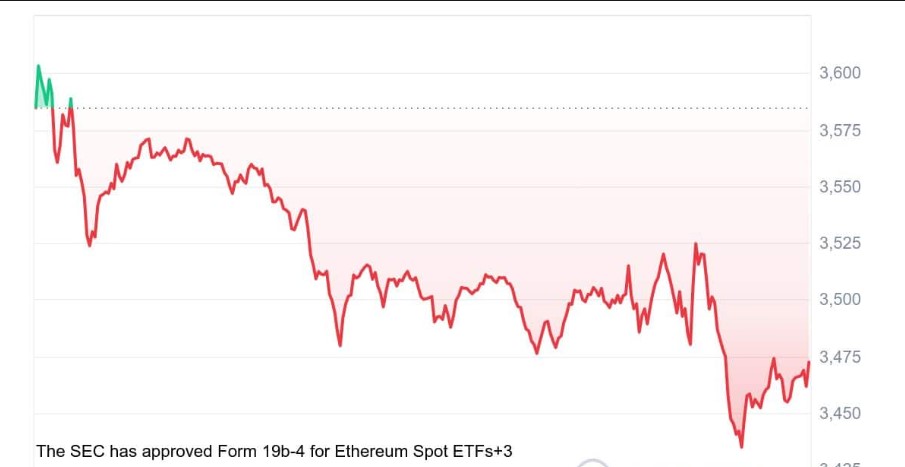

Ethereum’s price rose above $3,700 following the approval of 19b-4 applications. However, the upward momentum later gave way to a decline. This situation could provide an idea of what might happen if multiple ETFs are listed. Additionally, similar entries were observed in other altcoins and meme tokens. This recovery saw a significant rise in entries to institutional products and decentralized protocols. As a result, Bitcoin’s decline negatively affected Ethereum and altcoins. Ethereum’s price dropped, and its weekly trading volume decreased by 9%. Spot ETF approvals could increase Ethereum’s price and trigger institutional interest in the future.