Bitcoin’s price has dipped below $27,600 once more, just minutes shy of the daily closing. The question looming in everyone’s mind is, has the uptrend ended? It might be premature to make definitive statements, but considering recent news and technical analysis data, it’s possible to make some predictions for the remainder of the week. Are cryptocurrency investors on the brink of a significant price movement?

Will Bitcoin’s Rise Continue?

The price of Bitcoin, at the time of writing, sits at $27,581. On the Binance exchange, there are approximately $17 million worth of buy orders close to the $27,400 mark. Conversely, sellers’ orders can extend up to the $28,300 level. Just days ago, we discussed the possibility of a $30 million sale pulling the Bitcoin price down by roughly $1,200. The order book now displays a positive trend, with liquidity heavily favoring buyers.

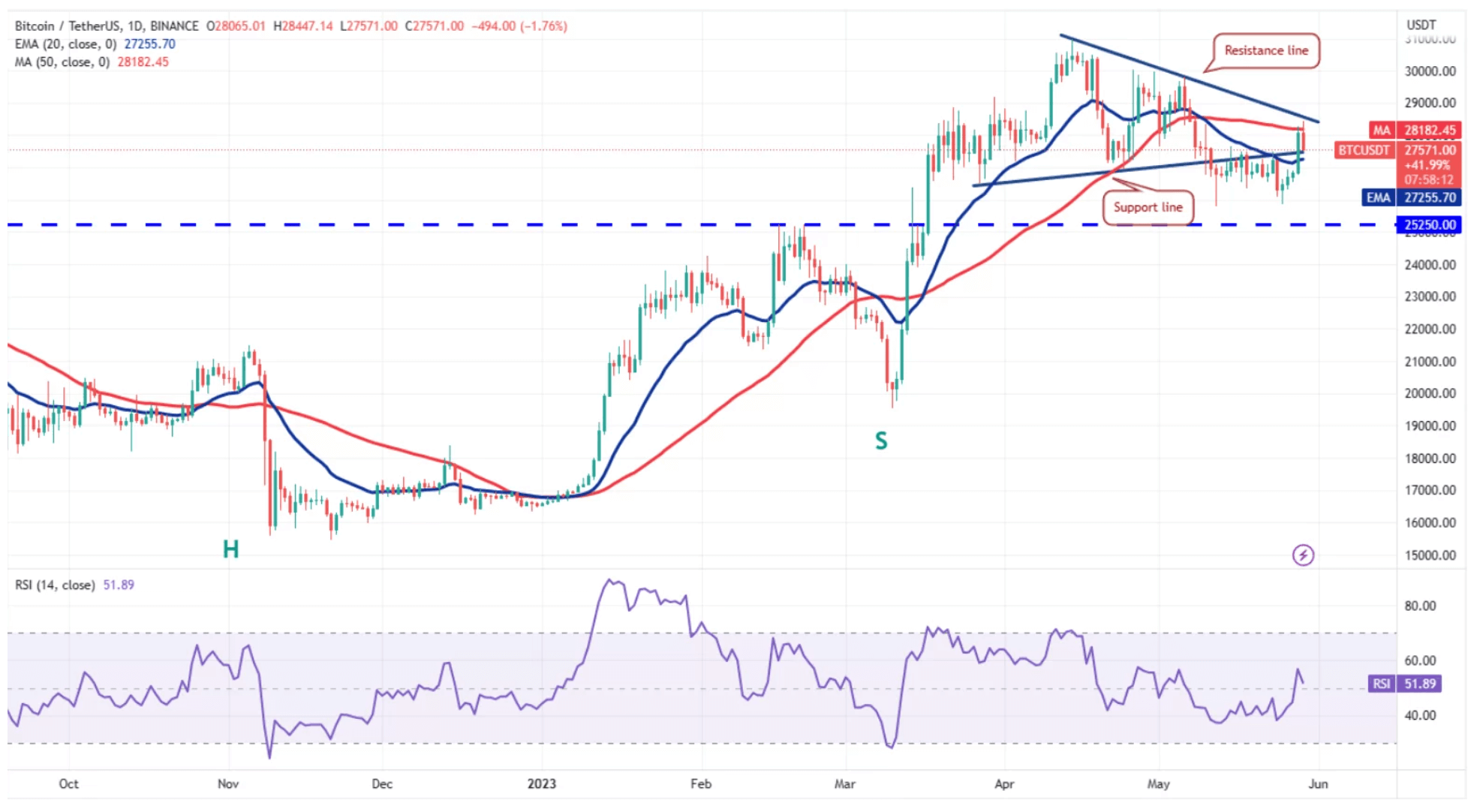

On the daily chart, the RSI is above the 50 level, indicating that buyers haven’t given up. Today may continue on a positive trajectory, with the commencement of legislative approvals for the debt ceiling agreement, especially as Tuesday is expected to be quiet on the macro front. However, the PCE data strengthening the possibility of a Fed rate hike in June is a cause for investor concern. This figure has increased for the first time since October, complicating the Fed’s fight against inflation.

Thus, it’s not surprising that the price, which reached $28,400 on Monday, is experiencing profit-taking. Moreover, the possibility of negative data on wage increases and employment on Thursday and Friday is contributing significantly to these sell-offs. Factoring in the ongoing appetite for risk in short positions, it seems that most investors anticipate that this uptrend won’t persist.

However, Bitcoin’s price doesn’t always move according to pressure expectations. Details such as accumulated short positions in futures and the upcoming move in Hong Kong could trigger a surprising rise towards $30,000.

The rest of the cryptocurrencies could soon start following Bitcoin‘s path.

Bitcoin Technical Analysis Comment

The inability of bears to pull the price below the support level of $25,811 has whetted the bulls’ appetite. They pushed Bitcoin back into the symmetrical triangle pattern on May 28, but higher levels are attracting sell-offs. This is being fueled by the reasons mentioned above. Bears are trying to halt a rebound at the triangle’s resistance line. If bulls prevent the price from falling below the 20-day EMA ($27,255), this will increase the likelihood of a breakout above the resistance line.

According to this, Bitcoin’s price could race towards a new peak at the $30,000 and $31,000 levels. However, a closing below $27,255 could trigger a new wave of selling, towards $25,811 and $25,250 supports.

In summary, while fundamental analysis appears to favor sellers, technical analysis is leaning towards buyers. In this environment, positive crypto data in the coming days could increase the possibility of a peak above $31,000.

Lastly, it’s crucial not to be overly optimistic about an interest rate increase. The Fed has been extremely cautious, and the recent PCE data significantly clarified their stance. The probability of them maintaining interest rates and avoiding excessive market optimism seems quite low.

Of course, nobody can predict the future, and cryptocurrencies are full of surprises.