At the beginning of the week, the price of the largest cryptocurrency by market value, Bitcoin (BTC), was around $26,000. This happened despite the asset reaching $28,000 after Grayscale, a cryptocurrency manager, won against the US Securities and Exchange Commission (SEC).

Expectations for Bitcoin Halving!

According to investor and analyst Doctor Profit, the recent rally following Grayscale’s decision should not be taken as a sign that Bitcoin has entered a growth phase. According to his calculations, Bitcoin will enter a positive rally after the 2024 halving. The investor mentioned that until then, US regulators could approve one or more long-awaited Bitcoin exchange-traded funds (ETFs). Grayscale argued that the approval of applications from BlackRock and others could trigger entries into the digital asset market.

It emphasized that September is the worst month of the year for Bitcoin and the crypto market. This time, it argues that the situation will not be different. At the beginning of the month, Doctor Profit expects Bitcoin’s price to follow a sideways movement. After the latest inflation data, which will be announced on September 13, 2023, there will be an increase in Bitcoin volatility.

Possible Effects of the US on Bitcoin Price!

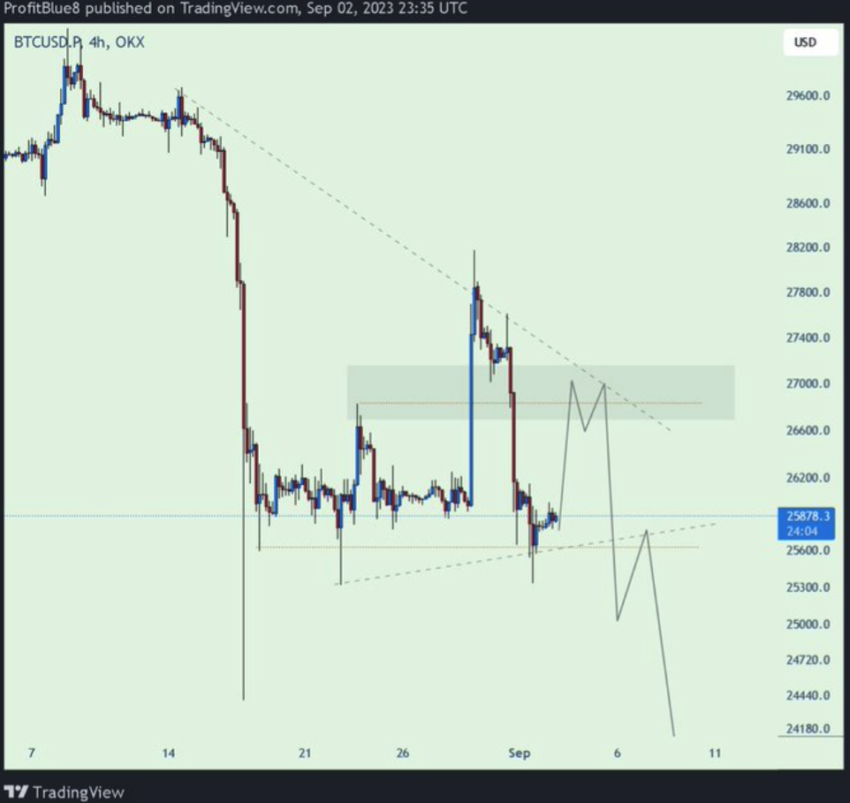

The US Federal Reserve will decide on interest rate hikes or pauses at its meeting in a week. Any future rate increase could harm Bitcoin, which is considered a high-risk asset. Popular crypto analyst Profit Blue also made a similar prediction, forecasting that investors expect Bitcoin to drop to $24,000. Meanwhile, members of the crypto community need to pay attention to positive signs. Bitcoin withdrawal volumes from exchanges have surpassed deposits in the last three months. The data indicates that investors are not ready to leave crypto. Fewer sellers can support the price of the asset.

The relationship between cryptocurrencies and US interest rates is becoming increasingly important. Higher interest rates can attract traditional investors, while low interest rates can increase demand for cryptocurrencies. The crypto market reacts sensitively to interest rate decisions, and this relationship should be monitored more closely in the future.