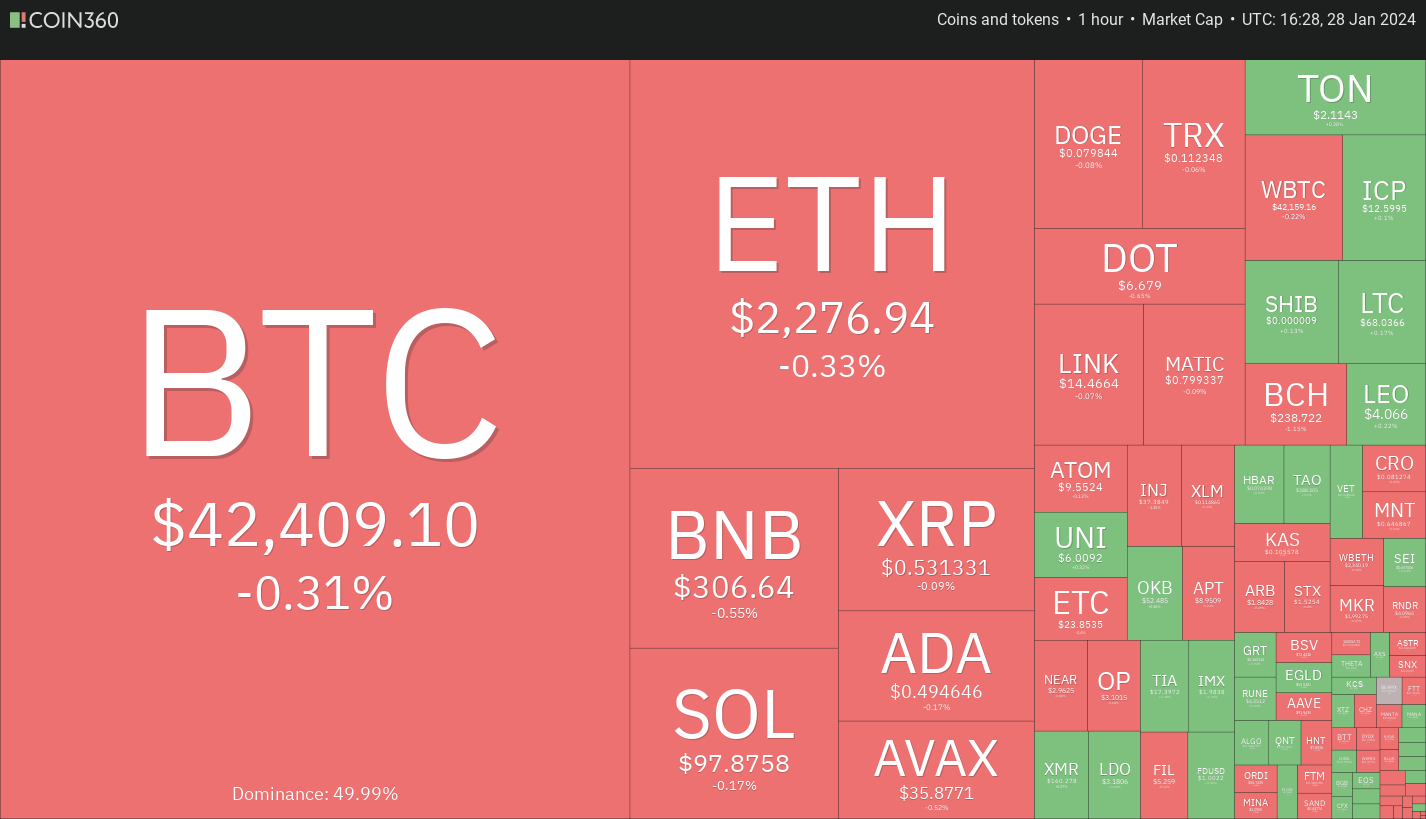

Bitcoin‘s gradual rise over the weekend suggests that the demand from bulls is continuing. Data shared by Bloomberg analyst James Seyffart on January 26th shows that assets under management by BlackRock’s iShares Bitcoin Trust (IBIT) have surpassed the $2 billion mark. Strong buying from lower levels has halted Bitcoin’s decline, but a rapid onset of a new upward momentum seems unlikely.

What’s Happening in the Crypto Market?

While investors focus on the newly launched Bitcoin exchange-traded funds and await the halving event in the Bitcoin ecosystem in April, Bitcoin could solidify its gains. Bitcoin trading within a region is considered a positive sign as it indicates investors are not in a hurry to take profits, expecting the uptrend to continue.

This situation could also be good news for certain altcoin projects that might attract investor interest and sustain their rise. On January 27th, Bitcoin rose above its 20-day exponential moving average of $41,959, indicating a decrease in selling pressure.

Bitcoin Chart Analysis

Both moving averages continue to flatten, and the Relative Strength Index (RSI) is near the midpoint, suggesting a balance between supply and demand. The BTC/USDT pair may oscillate between the levels of $44,700 and $37,980 for some time.

A breakout and close above the $44,700 level would be the first sign of buyers returning to the driver’s seat, potentially driving the price to the local high of $48,970. On the downside, a drop below $37,980 could trigger a deeper correction towards $34,800.

Moving averages have completed a bullish crossover on the 4-hour chart, and the RSI is near the overbought zone, indicating a bullish comeback. The rally could reach $43,500 and then $44,700. On the downside, the moving averages are likely to act as strong support. A drop below the simple 50 moving average could turn the advantage in favor of the bears. The pair could then drop to $39,500 and subsequently to $37,980.

Türkçe

Türkçe Español

Español