Bitcoin (BTC) had an impressive performance in the last period of the previous year, but experienced a sharp decline following the ETF decision in the early days of the year. After this volatile period, the bulls continue to push for Bitcoin’s price to climb back to its peaks. Particularly, with the recent approval of spot Bitcoin ETFs and the potential key role of the upcoming halving, eyes are turning to the $50,000 level.

The Future of Bitcoin

In light of all these developments, the CEO of the renowned company Bitwise Invest, Hunter Horsley, made a statement suggesting that by 2024, Bitcoin might be ready to reveal its true place and role in the capital markets.

Horsley shared a post on X (formerly known as Twitter) on February 9. In his post, he highlighted that the approval of Bitcoin ETFs has visibly changed the price movement of Bitcoin and allowed for broader market participation, which was previously limited.

Forget what you know about Bitcoin’s price. In 2024, we will discover how the capital markets truly value Bitcoin.

According to the famous CEO, the market has entered a new phase regarding the future price of Bitcoin, in which the value of BTC will be determined by the market.

The approval of spot Bitcoin ETFs has contributed to changing the perspectives of larger groups that were skeptical about cryptocurrencies. Horsley compared the emerging situation to a scarcity and hinted at the potential rise in Bitcoin’s future price.

The Bitcoin Market Is Changing

Horsley’s views were supported by Falcon X’s research director David BitLawant. According to Lawant, the structure of the Bitcoin market already seemed to have changed.

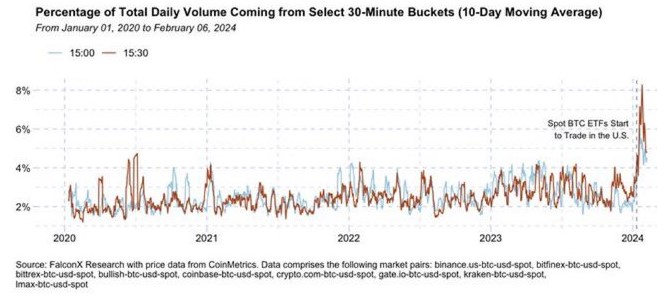

The structure of the Bitcoin market has already begun to change (for the better). For example, volumes around ETF settlement times as a percentage of total daily volumes (for USD pairs) have significantly increased after the launch of spot ETFs.

Lawant believes that the introduction of Bitcoin ETFs has had a positive impact on the market and has reduced the high volatility associated with the cryptocurrency.

Indeed, the recent Bitcoin price predictions by both prominent figures coincide with a potential slowdown in sales at the Grayscale Bitcoin Trust ETF and the positive sentiment this has created among investors.

Contrary to expectations in the market following the approval of spot Bitcoin ETFs, the price of Bitcoin did not rise but experienced price declines due to sales in GBTC. Meanwhile, Bitcoin was finding buyers at the level of $48,200, reflecting only a 0.18% decrease.

Türkçe

Türkçe Español

Español