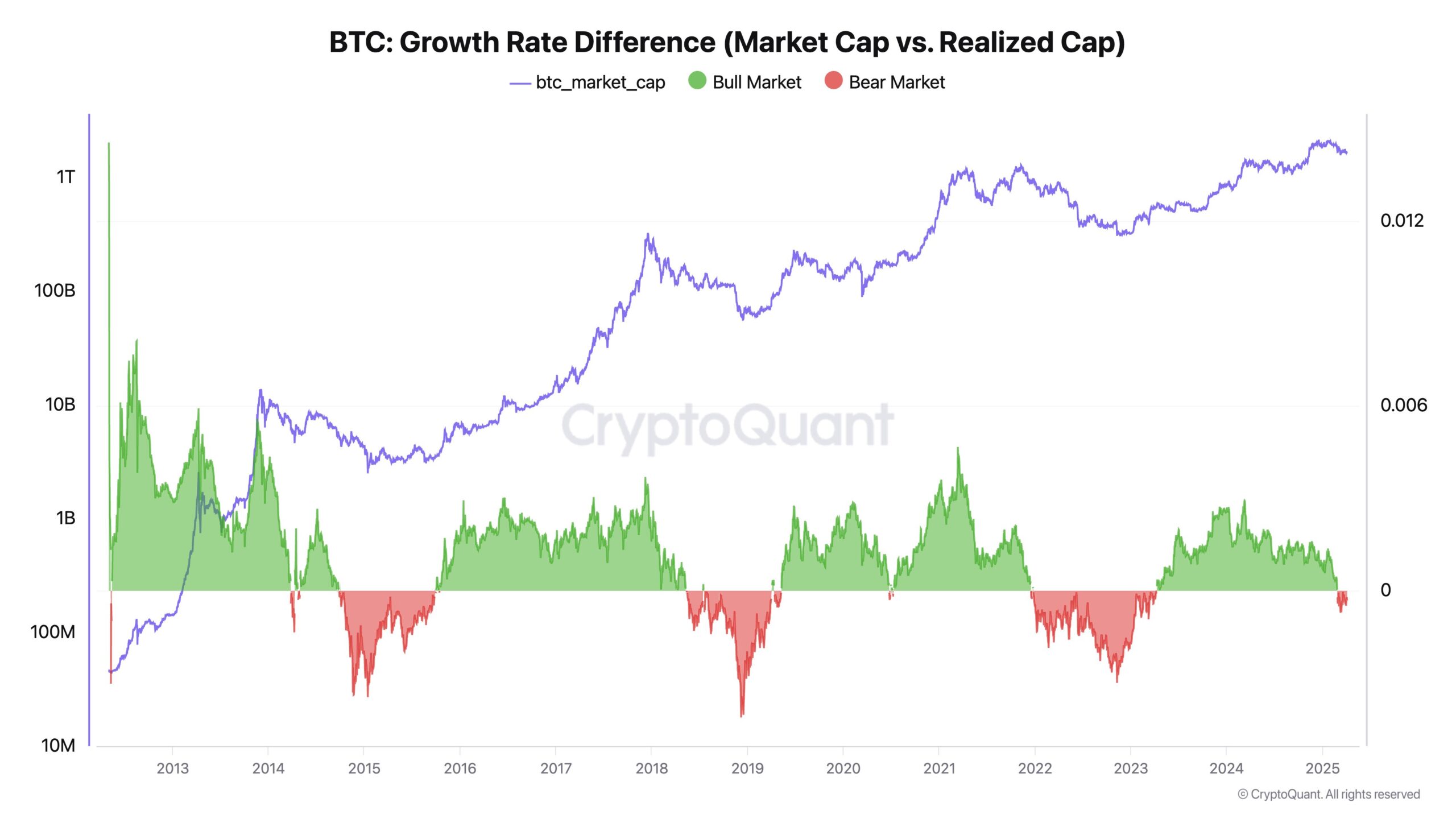

Recent trends in the cryptocurrency market highlight not only price fluctuations but also significant on-chain data. Ki Young Ju, CEO of CryptoQuant, reiterated that the bullish cycle for Bitcoin (BTC)  $104,724 has concluded. His assertion is based on the Realized Cap of Bitcoin, which represents the realized market value measured through on-chain data. While prices remain stagnant, increasing capital inflows signal a pronounced divergence in the market.

$104,724 has concluded. His assertion is based on the Realized Cap of Bitcoin, which represents the realized market value measured through on-chain data. While prices remain stagnant, increasing capital inflows signal a pronounced divergence in the market.

Rising Realized Market Value Amidst Stagnant Prices

According to Ju’s analysis, the Realized Cap of Bitcoin is rising, yet this increase is not reflected in the price. This indicates that while capital is entering the market, buying pressure is insufficient to drive prices higher. Realized Cap, calculated based on on-chain data, considers any BTC that enters a wallet as a “buy” and any that exits as a “sell.” This metric reflects the actual capital entering the market based on the average cost of wallets.

In contrast, traditional Bitcoin Market Cap is determined solely by the latest trading prices on exchanges. Thus, even small purchases can lead to significant increases in market value in a low selling pressure environment, while large purchases cannot influence prices under high selling pressure. The “volume-price divergence” observed when Bitcoin approached $100,000 exemplifies this phenomenon.

Strong Bear Signal: Capital Inflows Not Affecting Prices

To understand market cycles, Ju presents a key criterion: if the Realized Cap is rising while market value remains flat or declines, it signals a strong bear market. This is precisely the current scenario, where capital inflows are occurring without a corresponding price reaction.

Conversely, in bull markets, even small new capital can trigger significant price jumps, creating an environment of high price reactions under low selling pressure. However, current conditions make upward price movement challenging. Ju notes that past cycles indicate that real recoveries following such downtrends typically take at least six months.

Some critics argue that on-chain data does not capture all capital movements; however, Ju counters this by asserting that significant transactions, such as exchange transfers, custody wallets, and ETF-linked trades, can all be distinctly tracked on-chain. Therefore, he emphasizes that Realized Cap remains one of the most reliable indicators for tracking the actual capital entering the market.

Türkçe

Türkçe Español

Español