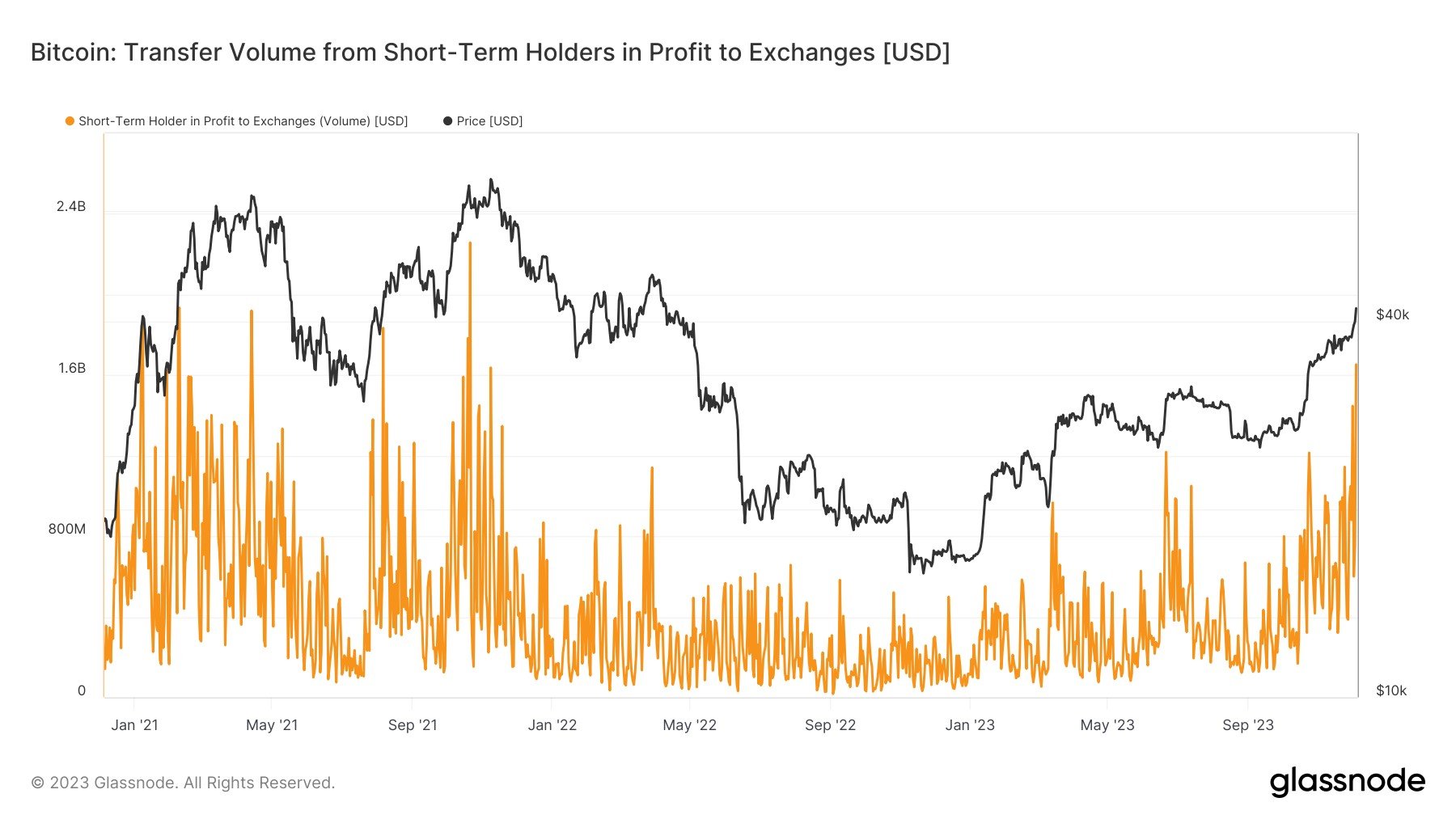

Bitcoin has reached its all-time high of $69,000, triggering a massive profit-taking event. According to the research and data analyst James Van Straten from the crypto analysis firm CryptoSlate, billions of dollars have flowed into exchanges.

Notable Data for Bitcoin

The recent price increases in Bitcoin have delighted investors, as it has reached its highest levels in 19 months. While long-term holders continue to hold their Bitcoin, short-term holders have started to realize their profits.

Short-term holders (STH) refer to investors who hold a certain portion of the asset for 155 days or less. These individuals represent the more speculative part of Bitcoin investors and have provided significant support for BTC prices this year.

Data shows that there has been an almost 15% increase in the BTC/USD pair in the past week, indicating that it is time for investors to reassess their risks. According to Van Straten, the total volume transfer between STHs and exchanges, along with the assets ready for sale, has approached $5 billion since the beginning of December:

“Bitcoin recorded a 7% increase, reaching its peak for the year at $38,800 as of December 1. This milestone has ignited the most significant profit realization from short-term holders seen recently since November 2021.”

Prominent Figure Highlights Resistance Levels

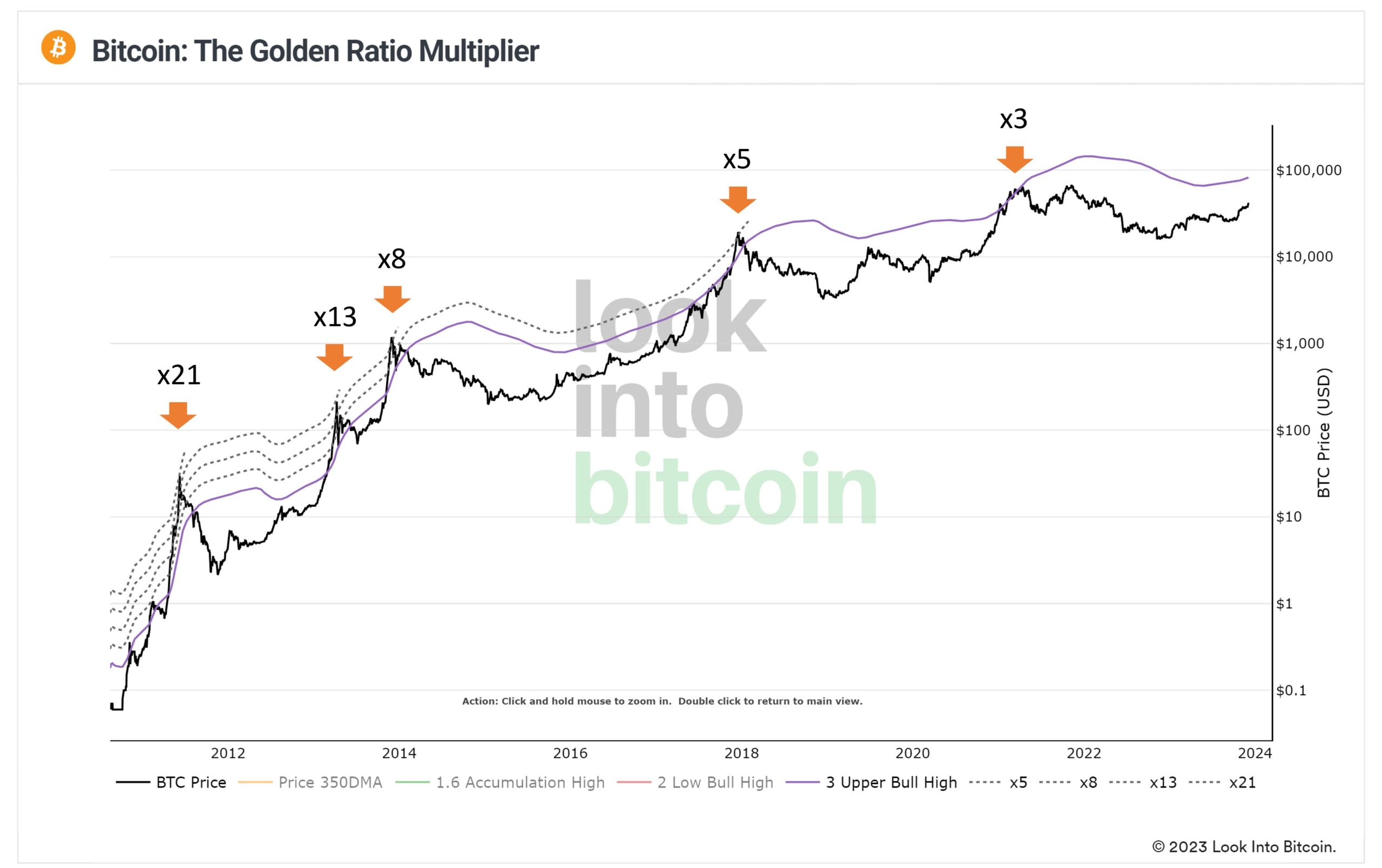

In light of these developments, Philip Swift, the creator of the data statistics platform Look Into Bitcoin, drew attention to the Fibonacci retracement levels that stood out in previous Bitcoin bull markets.

Swift shared his Golden Ratio metric, which he developed in 2019 to track the highest levels of the price cycle, with his followers on social media platform X. In the post, he stated:

“These low fib levels historically acted as resistance in early bull markets. x1.6 (green line) is currently at $43,739 and rising.”