Bitcoin‘s (BTC) price has experienced a significant drop of over 17% from its all-time high of around $73,750, during a period of heightened anticipation for the fourth block reward halving. This decline points to a striking trend in the cryptocurrency market. Analysts have pinpointed various reasons for this downturn, including the historical correction pattern before block reward halving, revisions in expectations for interest rate cuts by the US Federal Reserve (Fed), and information gathered from on-chain data.

Attention to Upcoming US Data

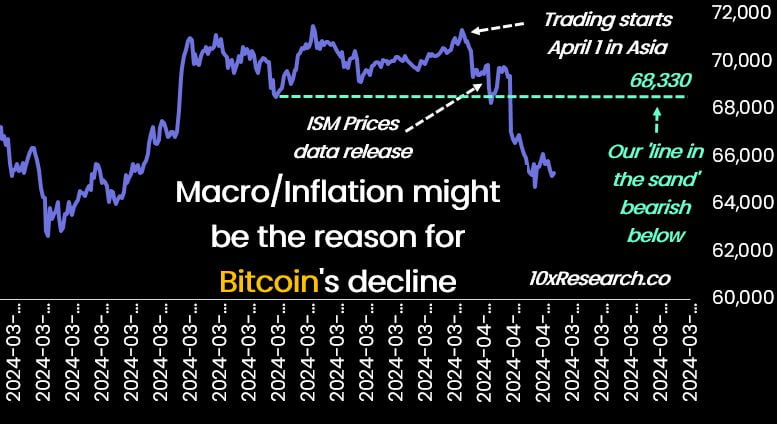

The CEO of crypto research firm 10x Research, Markus Thielen, emphasized the significance of upcoming macroeconomic data on the impact of the Bitcoin block reward halving. Thielen’s analysis highlights the complex relationship between the cyclical patterns of the cryptocurrency market and broader macroeconomic factors.

Although Bitcoin has historically shown a tendency to rally in a four-year cycle, recent developments suggest that macroeconomic conditions could have a more pronounced effect on its price trajectory. Thielen’s previous predictions, such as a bottom forecast for Bitcoin’s price followed by a rise based on inflation trends, underscore the dynamics shaping the largest cryptocurrency and the rest of the market.

Recent economic indicators, including a stronger-than-expected ISM Manufacturing PMI, increases in the US Dollar Index (DXY), and the yield on 10-year Treasury bonds, have contributed to the market’s volatility and the downturn. Given Bitcoin’s inverse correlation with traditional financial measures like the DXY and 10-year Treasury bonds, these macroeconomic changes are becoming increasingly relevant in predicting Bitcoin’s price movements.

Looking ahead, Thielen pointed out that the Consumer Price Index (CPI) data for March will soon be released and underlined its significance for the cryptocurrency market. The CPI data, expected to be published on April 10, will provide critical information on inflation trends that could significantly affect Bitcoin’s price. Thielen suggests that macroeconomic data could have a greater impact on market sentiment and price dynamics than the Bitcoin block reward halving itself.

Bitcoin Expected to Drop to $62,000, Ethereum to $3,100

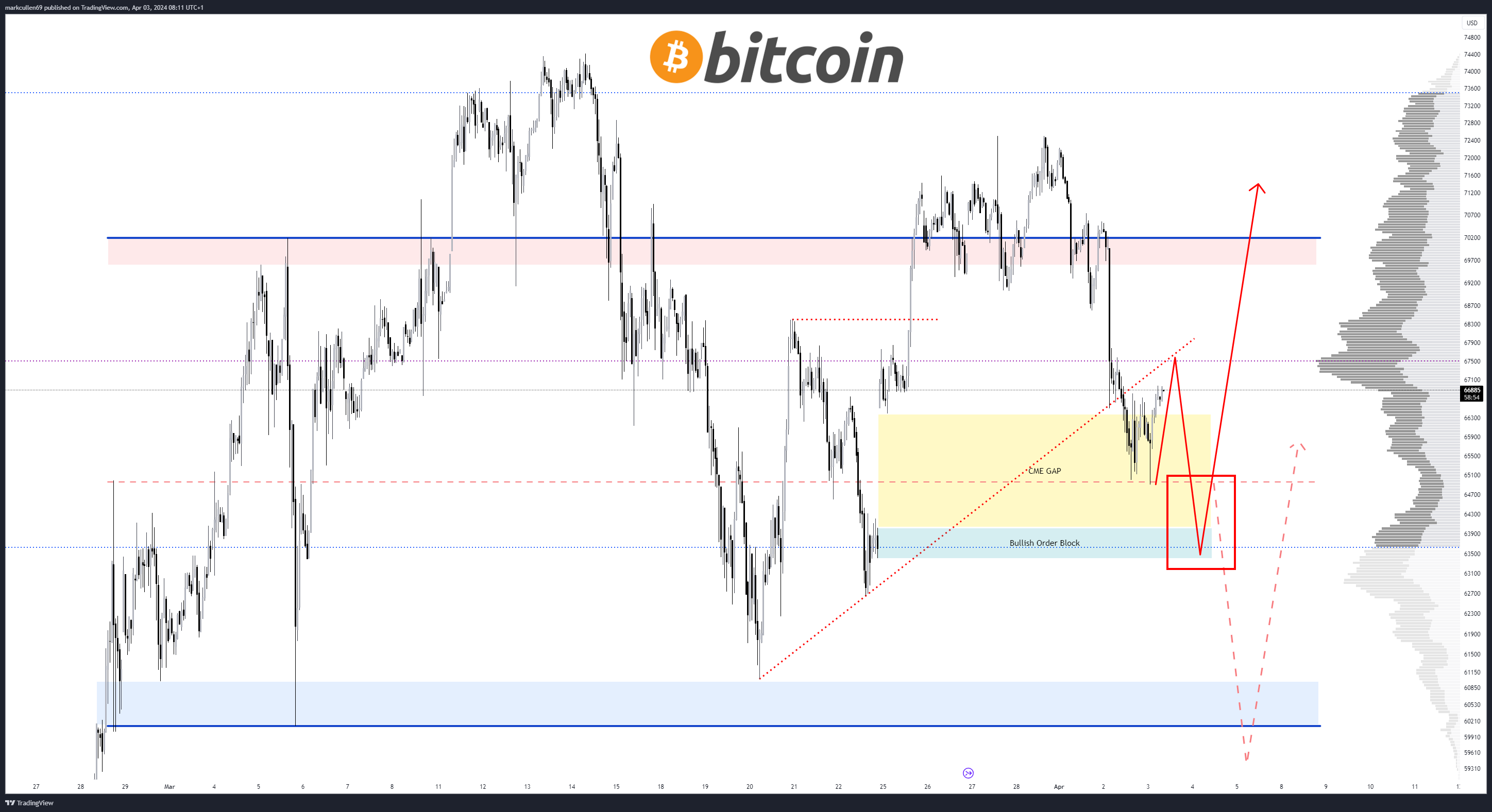

In line with 10x Research’s forecasts, Thielen expects Bitcoin’s price to drop to $62,000 and, correspondingly, Ethereum‘s price to pull back to $3,100. Thielen partially attributes this decline to low transaction volumes.

The analyst noted that $68,330 for BTC and $3,460 for ETH are important support levels on the weekly timeframe and should be closely monitored. According to Thielen, for the bullish trend to find support, Bitcoin needs to fill the CME price gap around $63,500.

Türkçe

Türkçe Español

Español