Bitcoin (BTC), after its incredible rise last month, has once again attracted attention and crowned this situation with an ATH (All-Time High) run. Following this, altcoins also followed this trend, and when the calendars showed April 2, 2024, the price of Bitcoin had fallen by about 7.97% to $64,500. This latest price drop reduced Bitcoin’s market value to $1.28 trillion.

Critical Levels in Bitcoin

Considering the current buying and selling dynamics of Bitcoin, it would not be wrong to say that many opportunities have emerged for investors due to the cryptocurrency’s constant testing of its fundamental support and resistance levels.

During this process, the critical support level for BTC was calculated at $63,119, while on the upside, the $68,858 level continues to be an optimistic resistance level. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

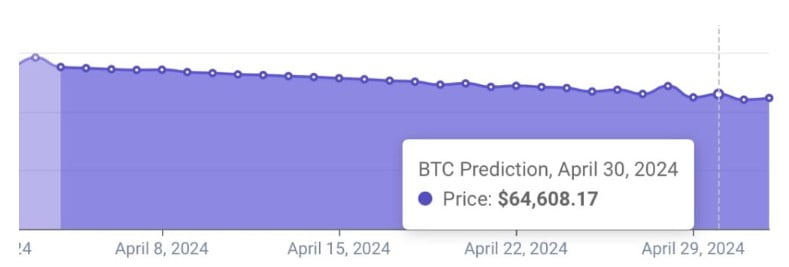

According to the price prediction made by the artificial intelligence machine algorithm, Bitcoin could experience a slight correction to the level of $64,608 by the end of April 2024. This situation could have a negative impact on investors.

Bitcoin and the Economic Outlook

An important factor that emerged specifically in Bitcoin’s recent price movement was the strengthening of the US dollar. Following optimistic US data, the dollar index (DXY), which measures the strength of the dollar against a basket of major fiat currencies, rose above the 105 level and visited a level not seen since mid-November.

This 2.58% increase over a four-week period made dollar-denominated assets like Bitcoin and gold more valuable and potentially less attractive to investors, creating a negative impact on demand.

Moreover, the strengthening of the dollar is expected to trigger global financial tightening and a decrease in the willingness to invest in riskier assets like cryptocurrencies.

Still, some analysts remain optimistic about the issue and suggest that increasing fiscal debts could push the Federal Reserve to lower interest rates. Analysts also state that this could provide significant support to the crypto markets.

Analyst’s BTC Commentary

In addition to the global economic outlook, Bitcoin seems to be dealing with notable events specific to the cryptocurrency field. The halving event, which is expected to occur on April 19 and results in the mining rewards being cut in half every four years, is thought to increase uncertainties over Bitcoin’s price.

Famous analyst Michael van de Poppe, known for his comments on cryptocurrencies, pointed out in a comment that the price could reach a peak before the halving, and a consolidation could occur after a possible ATH.

Türkçe

Türkçe Español

Español