Even on the worst days of 2022, we continuously talked about the four-year cycles and the eventual arrival of bull markets, albeit late. This year, BTC reached an all-time high level, and after the historic low of $15,500, the excitement was palpable. However, in crypto, prices quickly normalize, and investors always look for more. Will the halving on April 20 give us what we expect?

Predictions for the 2024 Halving

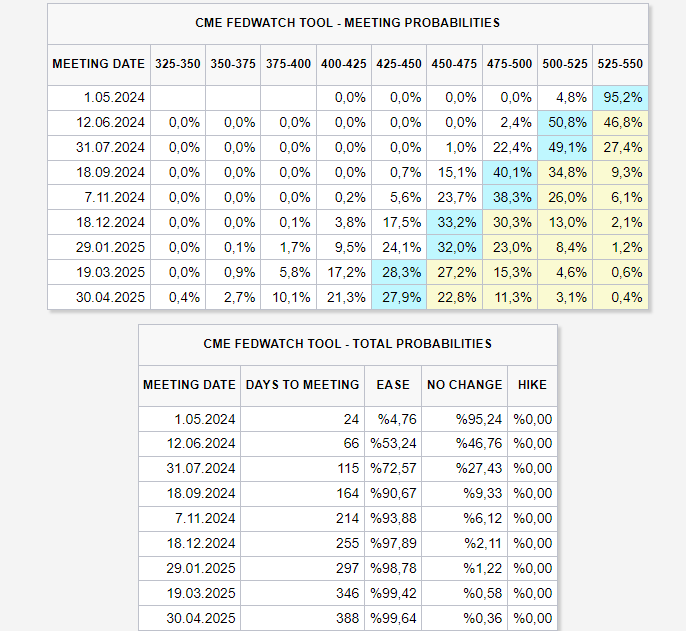

I remember writing dozens of articles in the last 12 months explaining why optimism for 2024 is high. The Halving (April 20), the possibility of ETF approval (approved), interest rate cuts (likely at the June meeting), and many more events helped, and will help, us see new peaks in 2024. However, investors may have already priced in some of these positive developments.

Cryptocurrency exchange Coinbase suggests that many investors may have already digested this event. Moreover, a new narrative is needed for the BTC price to rise further.

“The BTC halving happening on April 20 or 21 could be a catalyst for higher prices, but it will have to contend with typically weak periods of the year for crypto markets and other risk assets.”

Will Cryptocurrencies Rise?

Coinbase’s main focus here is the post-halving period of June-September, which has historically shown weak performance. According to Brave New Coin’s data, Bitcoin has gained an average of 2.7% per month from June to September since 2011.

On the other hand, the “narrative” Coinbase says we need could be a new wave of frenzied demand from institutional and individual investors through the spot Bitcoin ETF channel, combined with the Fed’s interest rate cuts. If the Fed cuts interest rates as expected, the resulting demand in the ETF channel (due to increased appetite in risk markets) could multiply the total inflow of $12 billion and trigger new peaks.

Moreover, the supply scarcity brought by the halving could make BTC even more prominent in risk markets (considering the high return potential). But what if the Fed says, “We will cut interest rates by 25bp instead of 75bp this year because the inflation decline has definitely stopped”? What price will we face when billions of dollars of BTC are sent from Coinbase custody wallets to spot markets for sale, with the same pace of the $12 billion net inflow turning into sales? The nature of crypto, full of surprises, makes both extreme scenarios possible in this exciting world.