In the midst of an ongoing bull market, Bitcoin (BTC), the world’s largest cryptocurrency by market value, continues to demonstrate strength by holding above the $72,000 level. Bitcoin‘s price consistently sets new records while investor sentiment remains optimistic.

Positive Trends in Bitcoin: $83,000 Target in Sight

Renowned Bitcoin analyst Willy Woo notes that daily capital inflows stored by the Bitcoin network have risen to $2 billion per day, a level comparable to the last significant bull market. Woo predicts further increases in inflows, attributing the notable rise to the recent launch of spot ETFs, which significantly support capital flow into the Bitcoin network.

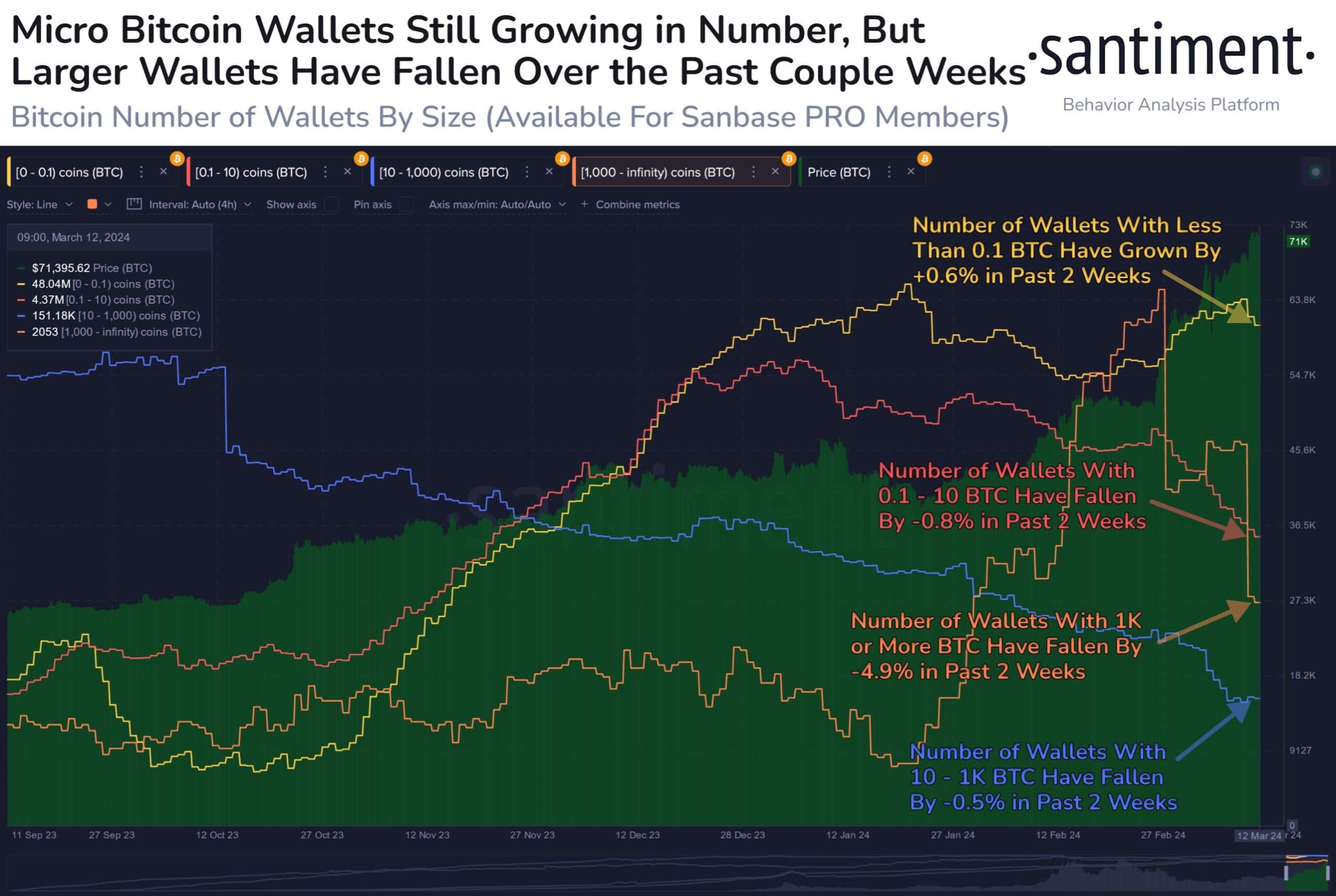

Additionally, on-chain data indicates a significant shift in accumulation patterns. According to the data, small Bitcoin wallets are accumulating, while whale-sized large wallets are selling. On-chain data provider Santiment reports that in the last two weeks, as Bitcoin continued to reach new highs, the number of small wallets holding less than 0.1 BTC increased by 277,000, while the number of wallets holding a thousand or more decreased by 105.

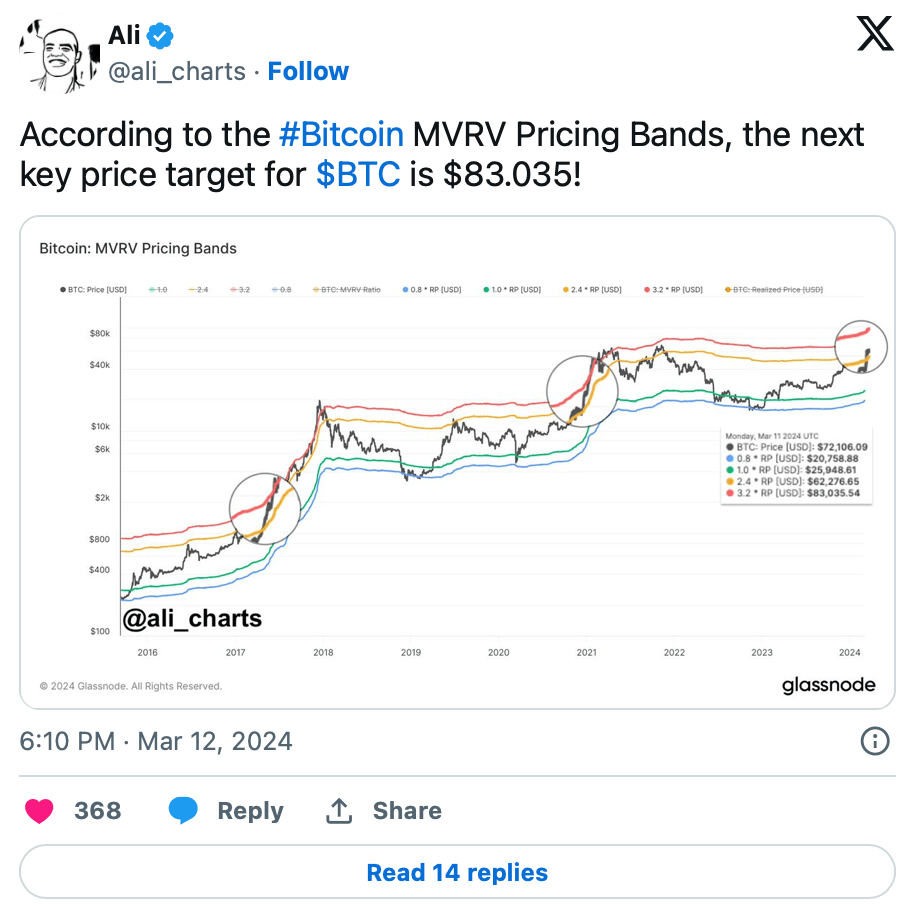

Experienced cryptocurrency analyst Ali Martinez highlights a significant development in the crypto market as approximately $83 billion flows into various cryptocurrencies, with a substantial portion directed towards Bitcoin and Ethereum (ETH). Martinez’s analysis, based on Bitcoin MVRV Pricing Bands, forecasts a significant price target of $83,035 for the largest cryptocurrency.

The inflow of funds into Bitcoin and Ethereum reflects a broader trend of institutional and individual investors eager to enter the cryptocurrency market, anticipating further price rises and adoption.

Rising Since Mid-2023

On the other hand, U.S. stocks also rose, showing resilience despite higher-than-expected inflation figures announced for February. Jurrien Timmer, Director of Global Macro at Fidelity, points out a significant trend in the financial environment, emphasizing that liquidity is reviving regardless of the Fed’s stance.

Timmer notes that overall liquidity, indicated by the Fed’s balance sheet minus reverse repos (RRP) and the Treasury’s cash balance at the Fed (TGA), has been steadily increasing since mid-2023, coinciding with the rise in stock prices.

With liquidity remaining strong, the likelihood of a significant correction in BTC’s price or the overall cryptocurrency market seems remote, signaling continued optimism among investors in the midst of the ongoing bull market.

Türkçe

Türkçe Español

Español