The king of cryptocurrencies has returned to a sideways movement, fluctuating within a narrow range. In the last 52 hours, the $52,000 mark was tested. Despite the price continuing to fluctuate between $50,600 and $52,000, it remained above $51,500 following the opening of the US stock market. Short-term price fluctuations are not very significant for some investors, as they are focused on long-term targets.

Will Bitcoin Hit Half a Million Dollars?

This would roughly mean BTC’s market value reaching $10 trillion. If BTC’s market dominance stays around 50%, we could see a significant portion of altcoins increase by hundreds or even thousands of times in this scenario. So, can BTC, which has not reached a six-figure price for years, really hit half a million dollars?

Bitcoin maximalist Max Keiser believes Bitcoin‘s value will rise above $500,000. His opinion is based on the potential for a stock market crash of unprecedented scale reminiscent of the late 1980s. In other words, the US stock markets will experience a major crash like years ago, and people will buy Bitcoin.

In the second part, we will delve into the details of his prediction, but the current conditions could lead to a crash in the US stock markets, which would also bring the same fate for the crypto environment. Today, even when stock markets fall by 3-4%, BTC also tends to drop, and the likelihood of the opposite happening is very slim. Moreover, a decline in appetite in risk markets is necessary to trigger the stock market crash, and in such a case, crypto, being part of the same risk markets, would also be expected to fall.

Why Might Bitcoin Rise?

According to Keiser, the market is overly ripe for a correction. Keiser refers to data from The Kobeissi Letter, which shows a concentration not seen since the Great Depression. This intense demand for the largest stocks suggests that the market is on the edge of a cliff. So why will BTC rise during this? Keiser believes Bitcoin will be seen as a safe haven.

“Gold will continue to lose value to Bitcoin. BTC ETFs and local BTC miners will be seized by the US government.”

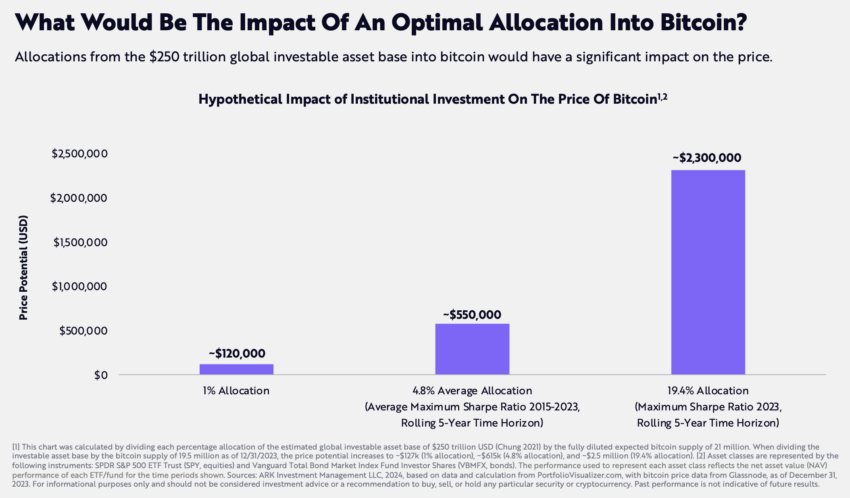

Echoing Keiser, BitMEX co-founder Arthur Hayes points to decreasing liquidity and financial difficulties as harbingers of market downturns. Ark Invest, on the other hand, believes that as BTC finds its place in diversified portfolios, its value will increase parabolically.

Türkçe

Türkçe Español

Español