In the early hours of Monday, March 4th, Bitcoin (BTC) once again left the $64,000 mark behind, but it could not maintain this level and the price fell again. As of the time of writing, it is trading with a 2.75% increase at $63,700 and its market value has risen to $1.253 billion. According to data provided by CoinGlass, total liquidations in Bitcoin amounted to $440,000 in the last 24 hours.

Bitcoin (BTC) Critical Levels

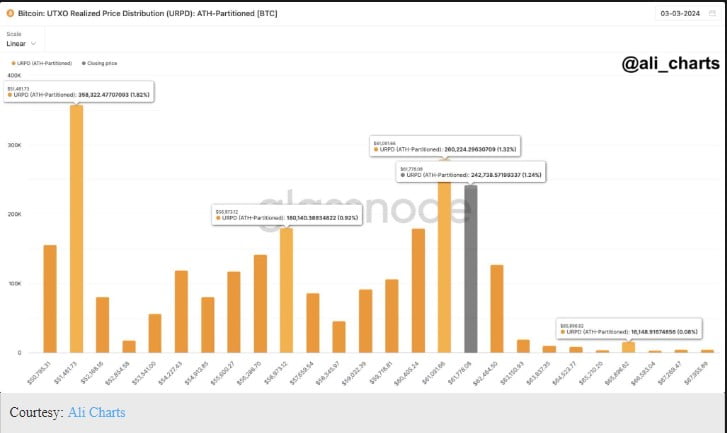

According to statements by the frequently mentioned analyst Ali Martinez, the Bitcoin (BTC) market has witnessed significant price movements between visible levels. Martinez notes that over 500,000 BTC have been traded within the $61,100 to $61,800 range, indicating this level as a crucial support for the cryptocurrency.

Martinez also mentioned that if Bitcoin manages to stay above this support, it could continue its move towards $65,900 and might encounter resistance around this level.

On the other hand, Martinez pointed out the potential for a downward movement for BTC. He mentioned that if the price movement slows down and falls below the determined support level, the price could potentially retreat to $56,970 or even to $51,500.

BTC Price Target

Known for his Bitcoin analyses, Will Woo points to an optimistic outlook for the price of Bitcoin (BTC), suggesting that under certain scenarios, BTC could surpass $125,000 before the end of 2025.

Woo’s analysis draws strength from the assumption that investment giants Blackrock and Fidelity could allocate a relatively small 3% of their clients’ portfolios to Bitcoin.

According to Woo’s calculations, if Blackrock, with total assets of $9.1 trillion, and Fidelity, with assets of $4.2 trillion, allocate 3% to Bitcoin, the resulting investment could have a significant impact on Bitcoin’s price.

Despite this calculation representing only a small fraction of the total global money supply, which is approximately $500 trillion, Woo believes that significant inflows into Bitcoin supported by major asset managers like Blackrock and Fidelity could change the price. Considering Bitcoin’s current price level of $63,700 at the time of writing, Woo’s target would require the price to double.

Türkçe

Türkçe Español

Español