In the past 48 hours, the price of Bitcoin has fallen by 13% from its all-time high of $73,835 to around $60,000 for a short period. This correction is what analysts refer to as a pullback due to overheated market conditions ahead of the Bitcoin halving event expected in about 30 days.

Analysts Highlight Noteworthy Comments

However, a report by CryptoQuant indicates that the Bitcoin bull cycle is not over, considering the relatively low inflow of investments from new investors and price valuation metrics that are still below the levels seen at past market peaks.

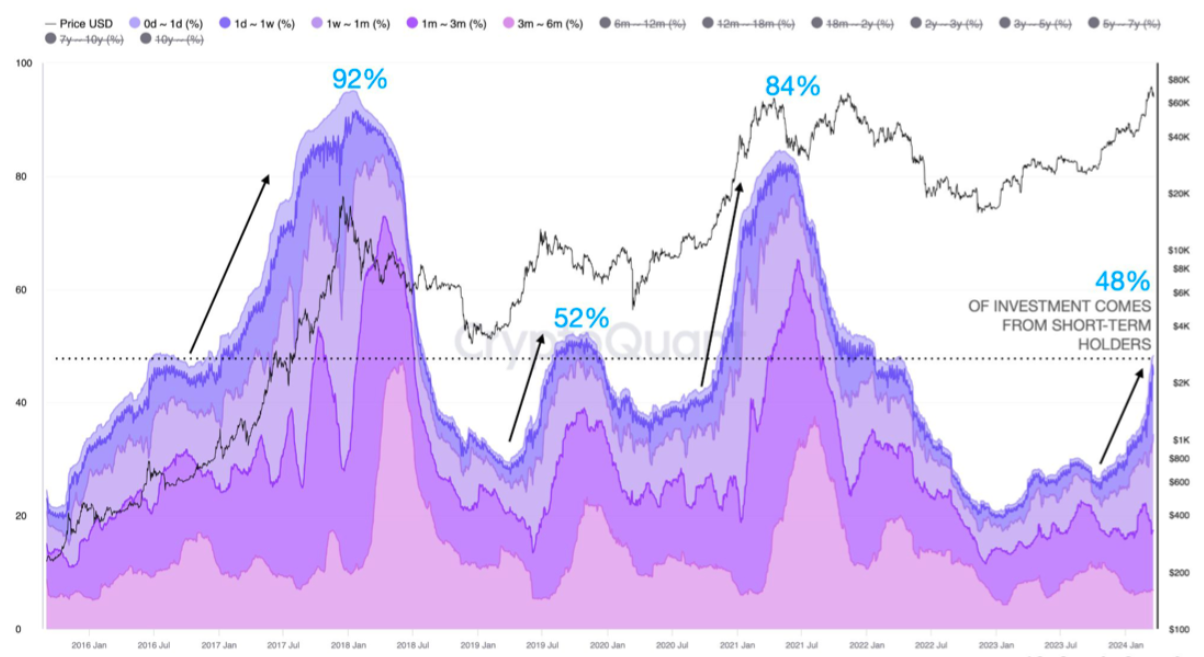

The Weekly Crypto Report by a Blockchain data analysis firm reveals that 48% of Bitcoin investments come from short-term holders. According to CryptoQuant analysts, the bull cycle typically ends with 84-92% of investments coming from these new investors:

“The Bitcoin bull cycle is far from over, as indicated by the relatively low level of new investment inflows.”

The graph above also shows that this metric has reached levels similar to mid-2019, when Bitcoin experienced a significant correction, which is a point of concern for short-term investors. The CryptoQuant report also reveals that valuation data is still below the levels consistent with past market peaks:

“The CryptoQuant P&L Index is still outside the market’s top region (red area) and above the index’s 1-year moving average.”

CryptoQuant’s PnL index consists of three on-chain indicators that show the profitability of Bitcoin. The index had previously indicated that the crypto market would enter a bull cycle in 2024. However, the current level shown in the graph is slightly below the levels observed during the bull runs of 2013, 2017, and 2021.

The Halving Process and Bitcoin Performance

In addition to the data discussed above, the upcoming Bitcoin halving event is an important catalyst expected to support Bitcoin’s price and initiate a parabolic uptrend. According to CoinMarketCap’s halving countdown, there is less than 30 days left until Bitcoin’s next halving event.

With approximately 4,450 blocks remaining, Bitcoin’s fourth halving event is expected to occur on April 20th, reducing miner block rewards by 50% from 6.25 Bitcoins to 3.125 Bitcoins. Historically, the halving of Bitcoin’s supply has been associated with an increase in Bitcoin’s price, with the halving always occurring before a significant bull run in the Bitcoin market.

Standard Chartered Bank made a bold prediction, raising its Bitcoin price forecast for 2024 from $100,000 to $150,000. On Monday, March 18th, Standard Chartered Bank analysts wrote to their clients:

“Considering the sharper price increases to date for 2024, we see the potential for the price to reach the $150,000 level by year-end, which is higher than our previous forecast of $100,000.”

The bank also predicts that Bitcoin’s price will reach a cycle peak of $250,000 before settling around $200,000 in 2025. Although the bank’s analysis is not entirely based on the halving event, it also takes into account the impressive performance of spot Bitcoin ETF funds since they started trading on January 11th and the different dynamics they bring to this halving cycle.

Türkçe

Türkçe Español

Español