Bitcoin is on the rise and altcoins are largely tracking its performance. However, the outlook of the macro economy is significant for a steady increase. After a period of decline due to rapid interest rate hikes, Bitcoin‘s price is now seeing relief as markets anticipate the start of reductions in 2024. So, what did the Fed members recently state?

Fed Statements

Fed’s Collins and Williams were making statements at the time this article was prepared. While the latest data was eagerly awaited to assess the current state of the economy, we saw relatively optimistic remarks. Collins said;

“I need to see more evidence of a continuing disinflationary process before we start carefully normalizing policy. The threat of inflation staying above 2% has diminished. It’s too early to tell if we are getting the right signal from housing inflation data. I expect to see further declines in bank reserves. We anticipate more reductions in reserves and will pay attention to when it might be appropriate to reconsider interest rate cuts. I see a more balanced risk between cutting too early and too late.”

Williams, on the other hand, stated;

“Inflation will reach 2-2.25% this year, and 2% by 2025. I see growth at 1.5% and unemployment around 4% this year. A rate cut by the Fed this year is likely. The post-pandemic effects are still impacting the economy, but I am optimistic about the outlook. Discussions on rate cuts are a sign of progress in reducing inflation. Risks to the Fed’s employment and inflation mandates are moving towards a better balance. There are both upside and downside risks in the outlook. The current unemployment rate of 3.7% is around the long-term level. There is still a way to go to reach the 2% inflation target. I will allow the incoming economic data to determine the path of monetary policy.”

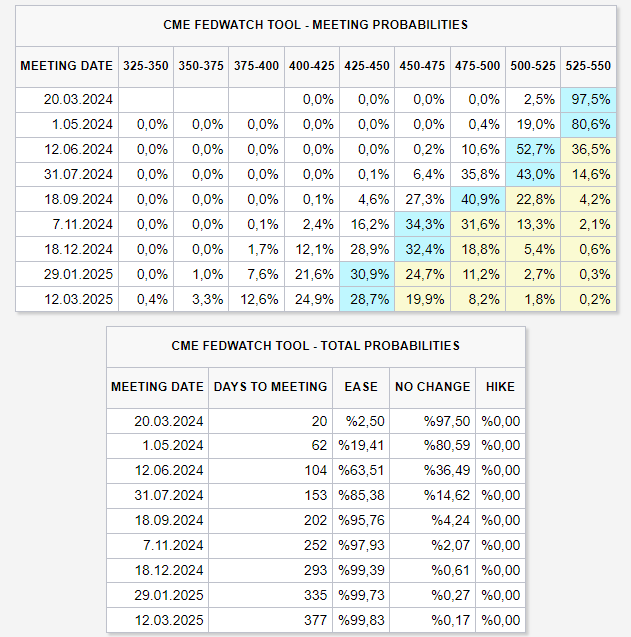

In the table above, you can see the market’s discount expectations according to FedWatch data. While the Fed plans a 75bp reduction, the markets still want more. However, if there are no unexpectedly bad data and the bubble is adjusted, we will likely see a meeting point around July. This will be supportive for the bullish narrative of 2025.

Türkçe

Türkçe Español

Español