Bitcoin (BTC) price surged above $70,000 on March 8, reaching a new all-time high. Investors began discussing whether this extraordinary rally could sustain its momentum. Currently, Bitcoin is facing a slight pullback, trading at around $68,500 with a market value of $1.325 trillion.

The Intense Battle Between Buyers and Sellers

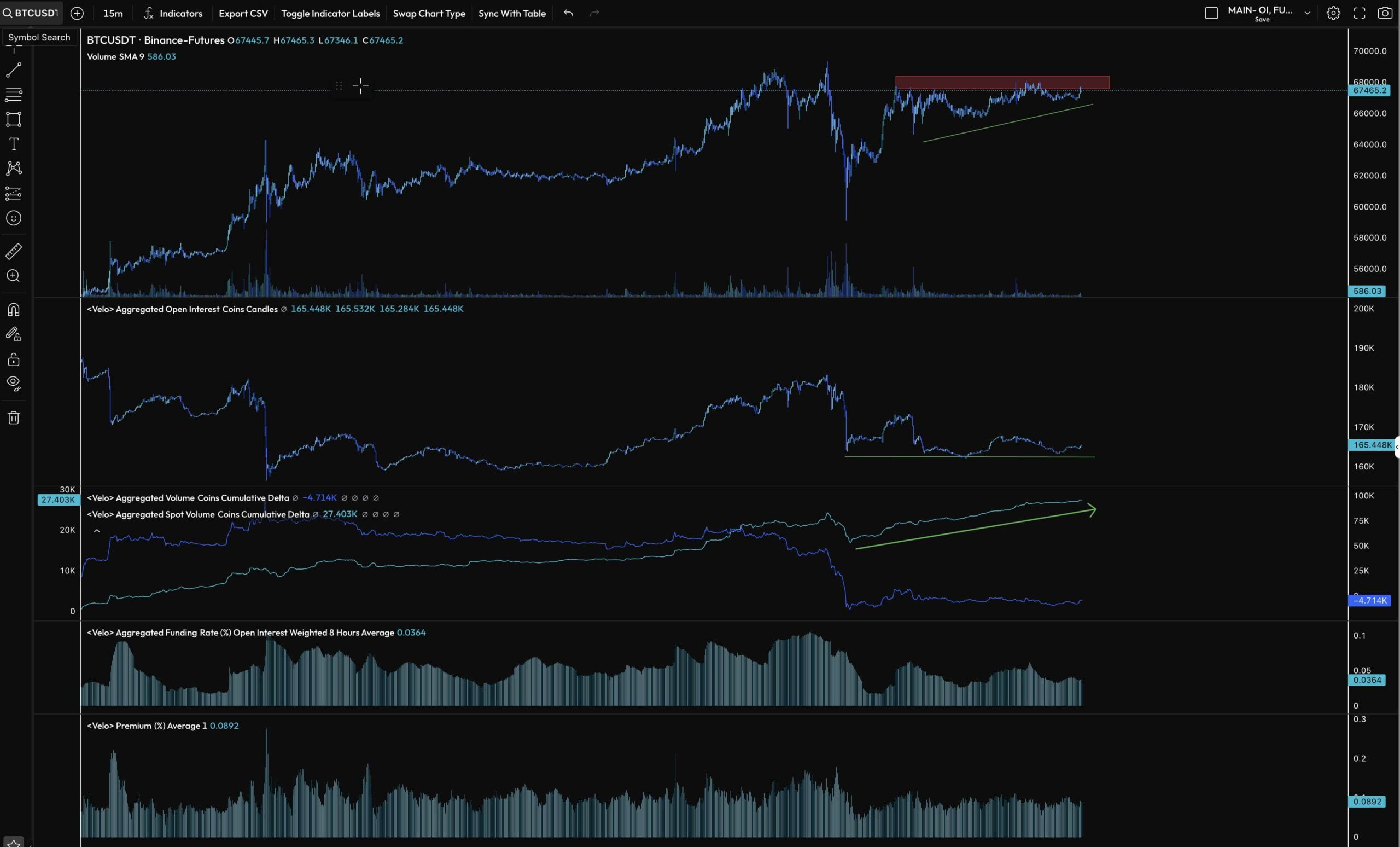

Prominent cryptocurrency analyst CrediBULL Crypto highlighted a significant dynamic in the Bitcoin market, pointing to the ongoing battle between spot buyers and passive sellers. Despite approximately $700 million in significant spot buying within a narrow price range, the largest cryptocurrency struggled to make a substantial upward move, primarily due to price limitations imposed by passive sellers.

CrediBULL Crypto posed a critical question regarding which side would deplete their resources first, asking “Passive sellers or active buyers?” With open interest (OI) remaining stable and funding rates relatively low, the analyst added that if active buying pressure continues and overcomes passive sellers, there is potential for a several thousand dollar upward move. Particularly, Bitcoin ETFs, including BlackRock’s IBIT, continue to show strong buying activity, supporting the upward scenario.

However, if sellers maintain control, any potential downturn in the market is expected to be limited in magnitude. The leverage ratio in the market is low due to the absence of open positions, which indicates that sharp downward movements and large liquidations are less likely to occur.

Current Growth Phase Expected to Last 183 Days

Leading on-chain data platform CryptoQuant shed light on Bitcoin trends using the Adjusted Output Profit Ratio (aSOPR) metric, noting that growth phases typically last between 83 to 387 days.

Based on past cycles, CryptoQuant suggested that the ongoing bullish trend is expected to last 138 days, presenting a potential scenario where the Bitcoin growth cycle could conclude in the next 100-150 days. Some market analysts speculate that after the end of the growth cycle, altcoins may experience a strong rally.