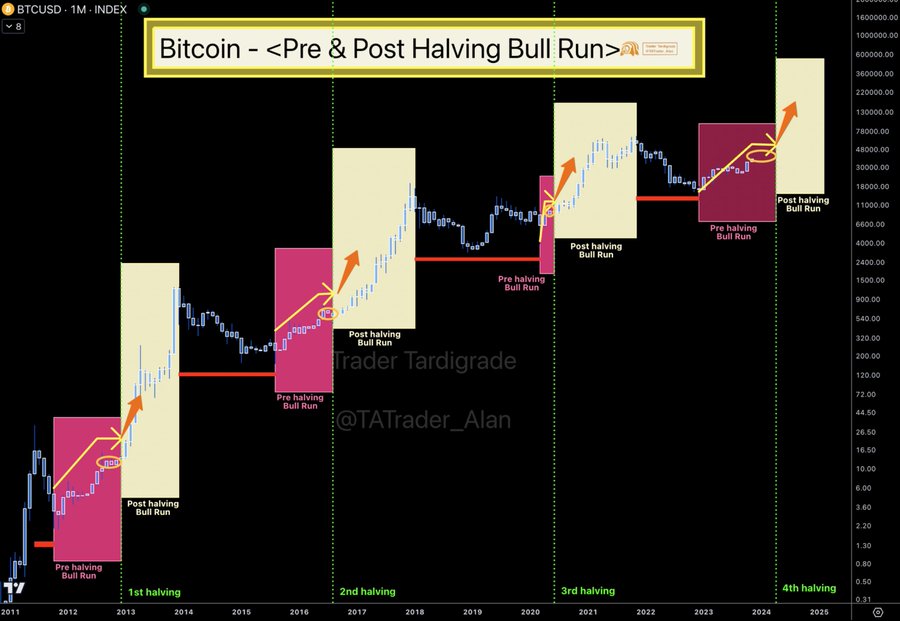

Despite the recent drop in <a href="https://en.coin-turk.com/bitcoin-analyst-dave-the-wave-predicts-potential-424-increase-in-price/”>Bitcoin’s (BTC) price, the largest cryptocurrency managed to surpass the $38,000 barrier several times in the last 24 hours, and the rapidly approaching block reward halving in 2024 is considered an important catalyst that could drive prices upwards. According to a historical analysis by cryptocurrency analyst Trader Tardigrade on November 30th on his personal X (formerly known as Twitter) account, Bitcoin traditionally tends to surge extraordinarily in periods leading up to and following block reward halvings.

“Bitcoin Could Hit $39-40K Within Days”

Experienced cryptocurrency analyst Trader Tardigrade, taking into account the effect of the block reward halving, expressed the view that Bitcoin could rise to $50,000 as the event approaches. According to the analyst, the momentum of the rise will increase after the halving, and the price could head towards $250,000 or beyond.

Another cryptocurrency analyst, Crypto Tony, stated that Bitcoin is currently in a “slow ascending” trend but as long as this uptrend remains unbroken, the target of $39,000 – $40,000 could be reached within the next few days.

Current Status of BTC Price

At the time of this writing, Bitcoin is trading at $37,690. Current data reveals that BTC’s price has fallen by 0.31% in the last 24 hours, but it has increased by 1.61% on the weekly chart and by 9.32% over the last 30 days.

Taking into account the upcoming block reward halving event, as analysts have highlighted, many indicators suggest that Bitcoin has a clear path ahead. Moreover, the potential 90% chance that the U.S. Securities and Exchange Commission (SEC) will approve the country’s first spot Bitcoin exchange-traded fund (ETF) by February 2024 also indicates that the path ahead for the largest cryptocurrency is promising.

- Bitcoin’s price shows resilience ahead of halving.

- Analysts foresee a significant post-halving surge.

- SEC’s ETF decision may further boost Bitcoin.