The leading cryptocurrency continues its struggle to exceed $49,000 at the time of writing, and it is determined to do so. Moreover, there is a fantastic price catalyst that will feed this optimism in the next 6 hours. Institutions and accredited investors are fervently buying up Spot Bitcoin ETFs.

Why Is Bitcoin Rising?

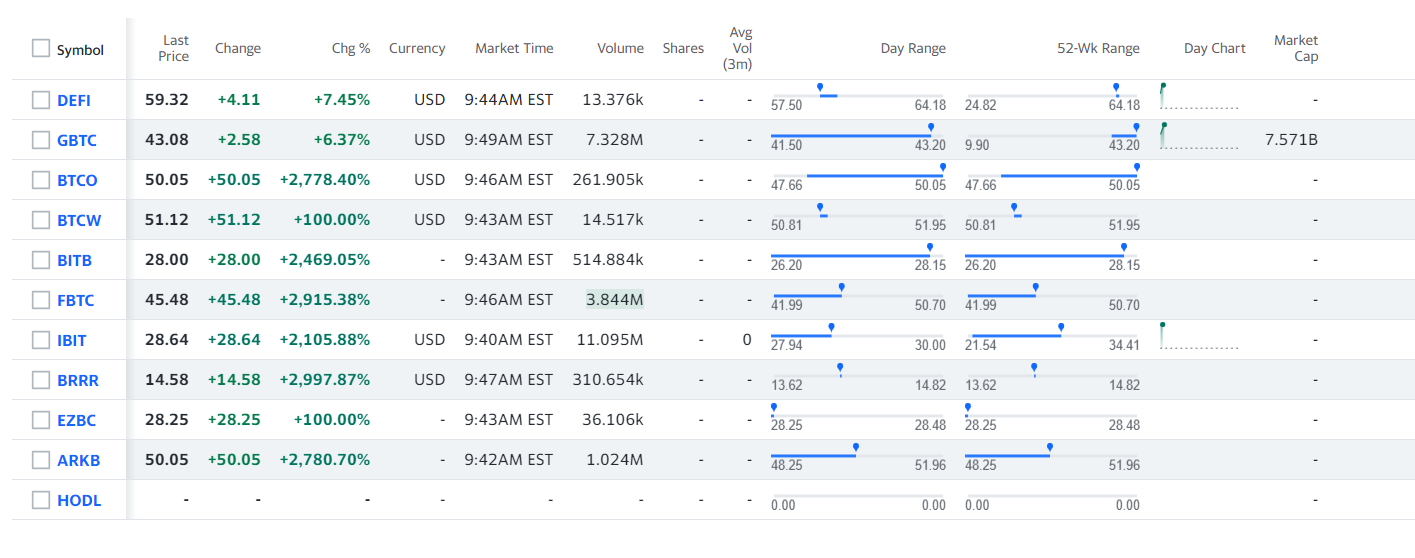

In the first 10 minutes, the cumulative trading volume exceeded $2.3 billion. This unique initial listing volume is one for the history books. We have seen ETFs with daily volumes surpassing $2.1 billion, but the magic of Bitcoin seems set to push this much further within 6 hours. Below you can see the current data of the listed ETFs.

As expected, IBIT, BlackRock’s spot Bitcoin ETF, was the most sought-after asset. The price of Bitcoin exceeded $48,969 a few minutes ago. Meanwhile, altcoins continue to see double-digit growth. As this volume data increases in the coming hours, BTC could reach new highs.

The first-day excitement will likely diminish tomorrow, and during this period, it is expected that BTC will reach its local peak and open up more room for altcoins to rise. Yahoo Finance featured both BlackRock’s IBIT and Grayscale’s GBTC as trending stocks/ETFs. Bloomberg Intelligence analyst Eric Balchunas wrote in a statement on X;

“Although focused on Bitcoin, ETFs continue to demonstrate that they can overcome almost anything.”

Valkyrie’s co-founder and CIO Steven McClurg said they expect investor funds of between $200 million and $400 million to come into Valkyrie’s ETF and that all participants could see an influx of $4 billion to $5 billion within the first few weeks. Bitwise said the market could surpass $70 billion before five years are up. These inflows have the potential to add an extra $1 trillion to BTC’s market value.

Investors should also be prepared for big announcements in the coming days, such as new BTC ETF-backed products like retirement funds. However, no matter how favorable the conditions, the tide can quickly turn in crypto. If MTGOX, Silk Road, and other FUD assets go on sale, everyone’s enthusiasm could be short-lived.