Bitcoin price’s surge past $70,000 before the halving was predicted by only a few experts, and BTC managed to achieve this. This means that expert predictions do not necessarily translate into future news, and there is no guarantee that Bitcoin will follow the majority’s expected direction. Still, what do the latest indicators, historical data, and expert opinions say about cryptocurrencies?

Will Cryptocurrencies Decline?

The leading cryptocurrency recently reached an all-time high of $72,800. Even as the daily close approaches, it continues to settle above $72,000. What happens after Asian investors wake up in a few hours is a matter of widespread speculation. However, the TD sequential indicator suggests that a price drop may be imminent.

Independent analyst Ali notes that the indicator is signaling a sell due to BTC‘s price trading above $71,700 on a 12-hour chart. Moreover, this sell signal has historically preceded downturns.

“Since the beginning of February, each time this indicator signaled a sell, the BTC price dropped by 1.6% to 3.5%. This trend is something short-term investors should monitor closely.”

In this case, a retracement of BTC’s price towards $70,000 seems likely. While still a high price, a 3.5% correction could have a multiplier effect on altcoins.

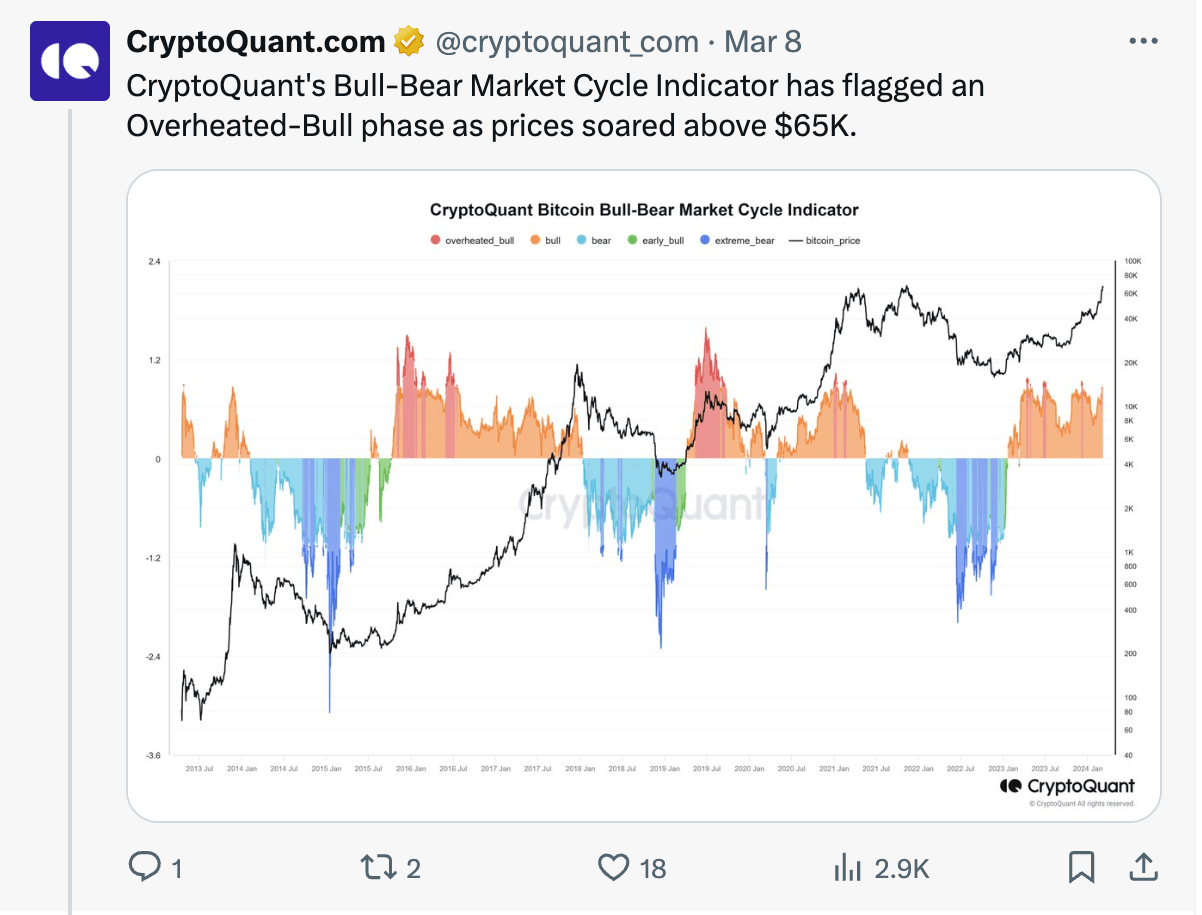

Bitcoin Overheated

Analysts at CryptoQuant have been warning investors about an overheated market since BTC surpassed its all-time high. We used to talk about how BTC’s price could surge massively as traditional finance investors succumbed to FOMO, and now we are witnessing it. I believed in what was to come when I wrote about it back then. And at some point, I believe that excessive sales through the ETF channel could also lead us into a unique downward spiral. This may not have a significant short-term impact, but the onset of the next bear markets will likely be very painful.

CryptoQuant experts also mentioned another metric indicating that miners have been overpaid due to profits reaching their highest levels since December 2023.

“With profitability reaching its highest level since December 2023, miners are now considered to be excessively overpaid.”

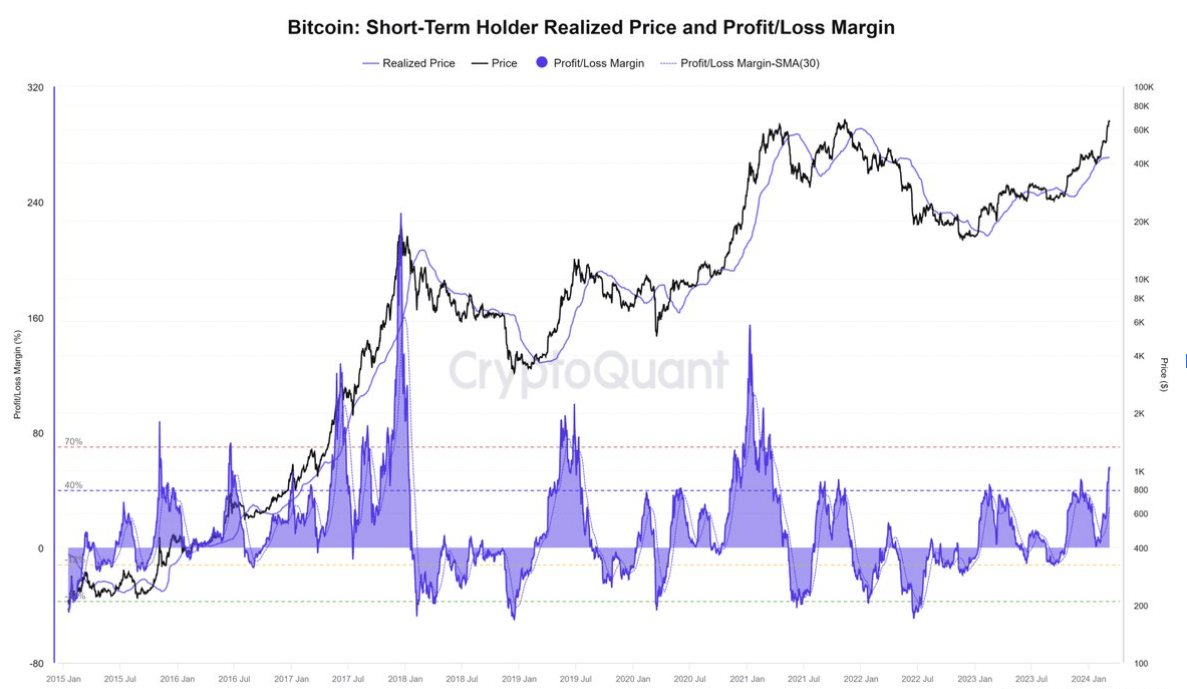

CryptoQuant also notes that unrealized profit margins for investors have reached 57%, historically associated with upcoming corrections.

“Additionally, short-term investors have started selling with the highest profit margins since February 2021, potentially signaling increased selling pressure.”

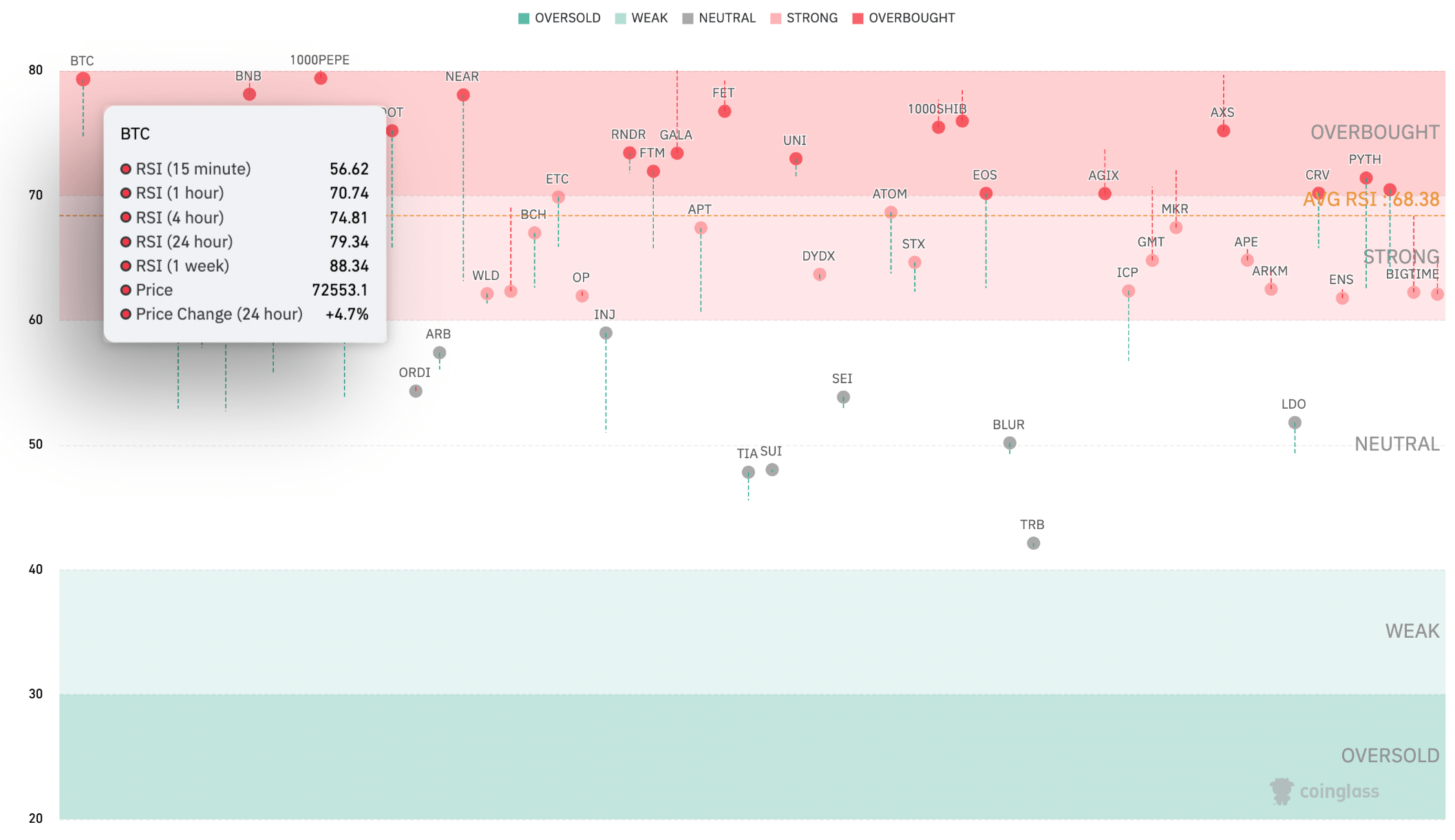

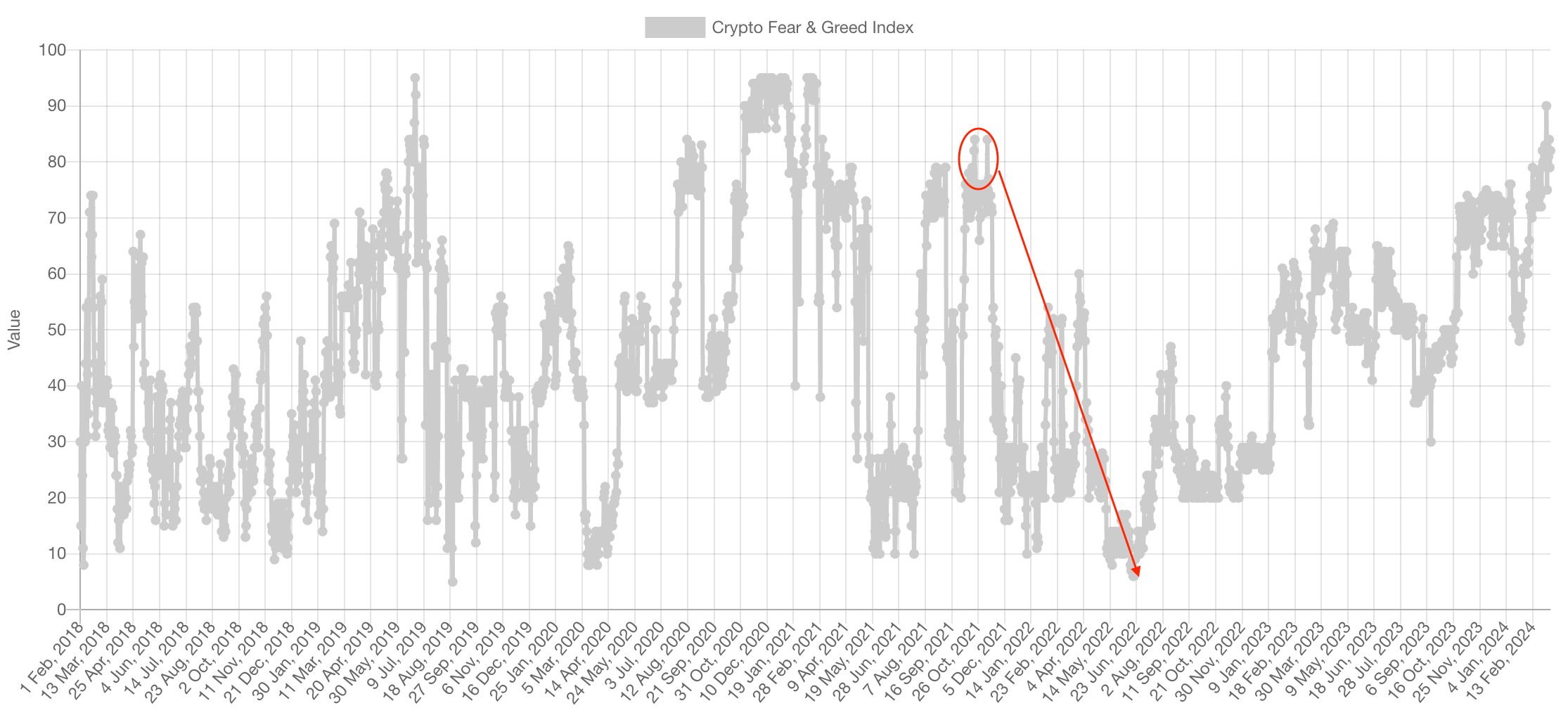

The RSI is in the overbought zone, and the fear and greed index is at 82, indicating extreme greed. All these factors typically suggest a price drop is due, and a deeper interim correction could lead to significant losses in altcoins.

Despite all this, we should not forget that BTC recently found buyers at $38,500 and that major altcoins have not yet strayed too far from their prices on those days.

Türkçe

Türkçe Español

Español