According to the reported data, Bitcoin (BTC) is said to be leading a period of “exhaustion and indifference” among speculators in the market. Glassnode, an analytical company, stated in the latest issue of its weekly newsletter “The Week On-Chain” that Bitcoin has caused a decrease in belief among short-term holders (STH).

Current Data on BTC!

After several months of stagnant BTC price movements, disappointment among market participants has led to deeper downward predictions. Bulls have been unable to break resistance, while sellers are facing multiple support zones in the form of trend lines between the current $29,000 and $25,000.

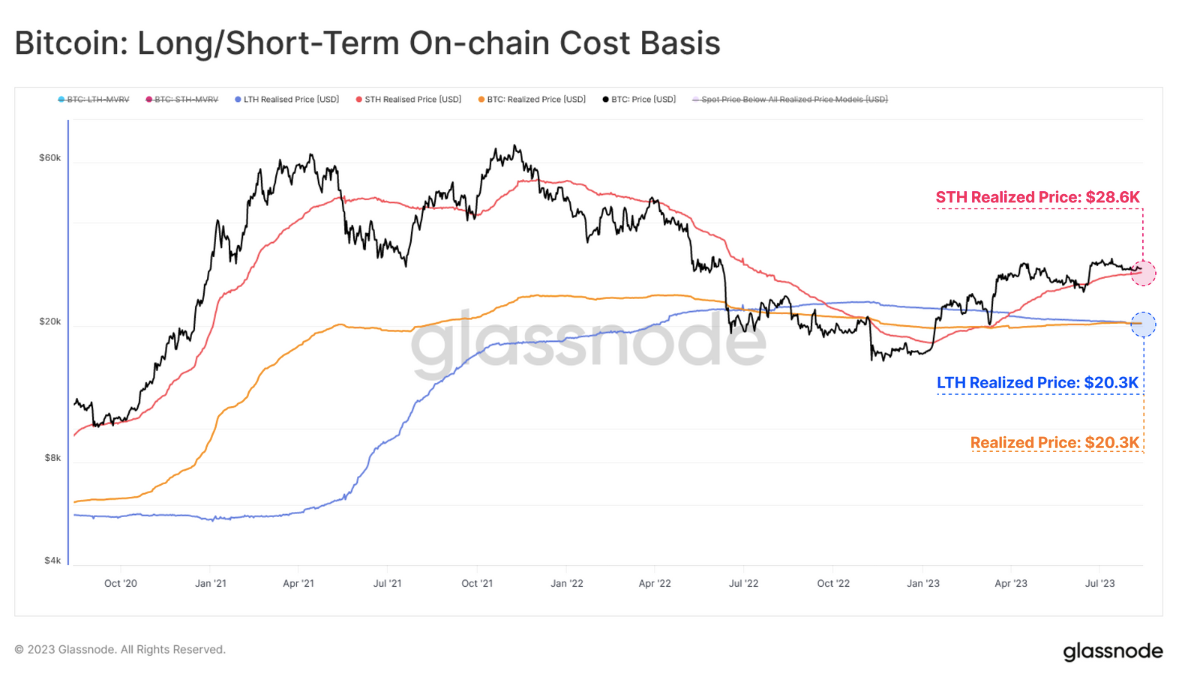

Among these is the cost basis or realized price of STH. STHs are defined by Glassnode as assets held for 155 days or less and may correspond to the more speculative end of the Bitcoin investor spectrum. The STH cost basis has acted as support throughout 2023. However, it is rapidly increasing and currently stands at $28,600.

In contrast, the long-term holder (LTH) cost basis, which reflects the purchase price, is much lower at $20,300. Glassnode stated the following in its comments on the subject:

The distinction between these two cost bases is an indication that many new buyers have a relatively high purchase price.

Will History Repeat Itself in Bitcoin?

Ongoing researchers have described the market as potentially “the heaviest” and even a modest BTC price drop is said to be likely to send the STH data lower. The company stated the following in its announcements:

On a macro scale, this distribution of supply resembles similar periods in past bear market recoveries. However, on a shorter time frame, it can be argued that it is somewhat of a heavy market, with many price-sensitive investors facing the risk of unrealized losses.

Nevertheless, speculators are said to be reassessing market risks. While the portion of BTC supply under the control of STH assets decreases, LTHs now control a larger share than ever before. The following was emphasized on the subject:

Overall, this situation indicates that Bitcoin investors’ belief remains impressively high and very few are willing to liquidate their assets.

The last time there were so few STHs in the market was in October 2021, just before the BTC/USD pair reached its all-time high of $69,000.